Within the almost six years since Greg Abbott has been gov

Within the almost six years since Greg Abbott has been governor of Texas, the Lone Star State has been the primary vacation spot for U.S. companies seeking to relocate.

That features California companies. In 2018 and 2019, as many as 660 California-based corporations pulled their stakes up and moved to greener pastures in Texas, the place the price of doing enterprise is roughly 10 p.c under the nationwide common.

Subsequent up is Tesla. The electrical automobile (EV) firm is at the moment within the technique of constructing its fourth manufacturing unit within the Texas capital of Austin, a rising tech hub with a younger, extremely educated inhabitants.

Gov. Greg Abbott on the dimensions of Texas’ economic system in comparison with Russia’s: “We’re greater than Putin.” Picture of Greg Abbott by: Gage Skidmore from Peoria, AZ | Attribution 2.Zero Generic (CC BY 2.0) Picture of Putin by: kremlin.ru | Attribution 4.Zero Worldwide (CC BY 4.0)

A metropolis in Texas can also be named headquarters to TikTok, the favored video-sharing app whose destiny remains to be in limbo after Oracle and Walmart struck a deal to collectively purchase the U.S. service from TikTok’s Chinese language dad or mum firm, ByteDance. This might convey as many as 25,000 high-paying jobs to the Lone Star State, in response to President Donald Trump, who favors Texas because the app’s HQ.

Gov. Abbott touched on jobs, the economic system and extra throughout a Younger Presidents’ Group (YPO) occasion I had the pleasure of attending final week simply exterior San Antonio. He identified that the Texas GDP, at $1.9 trillion, is larger than the economies of Canada, Brazil and Russia.

“We’re greater than Putin,” the governor quipped, eliciting laughter.

Abbott additionally briefly addressed the latest protests throughout the nation, a few of which have sadly turned violent. Texas would all the time help individuals’s First Modification proper to peacefully protest, he harassed, however the second an illustration resorts to rioting and looting, it’s not protected by the Structure.

I just lately shared with you that the multi-city riots between Could and June alone at the moment are estimated to be the costliest civil problems in U.S. historical past, costing the insurance coverage trade between $1 billion and $2 billion in property injury.

This isn’t the primary time I’ve praised our nice house state, and it gained’t be the final. An article I wrote 4 years in the past on why everybody needs to maneuver to Texas ended up being an enormous viral hit on LinkedIn. Two years in the past, Gov. Abbott tweeted one other article I wrote, “6 Motive Why Texas Trumps All Different Economies.”

Gold Correction Is Regular and Wholesome, Says the DNA of Volatility

Gold had its worst week since March, falling some 4.6 p.c from the earlier Friday, because the U.S. greenback staged a rally in opposition to the euro. The worth of bullion closed under $1,900 an oz. final Wednesday for the primary time since July 23 and is now down about 10 p.c from its excessive of $2,075, placing it in correction territory.

I’ve already seen quite a few headlines questioning whether or not that is the tip of the gold rally. Hardly. As I’ve defined many instances earlier than, corrections reminiscent of this are regular and wholesome. They’re part of gold’s DNA of volatility. Throughout the monster rally of the 2000s that culminated in gold hitting its earlier report excessive of $1,900, there have been a number of important pullbacks, a few of them exceeding 20 p.c.

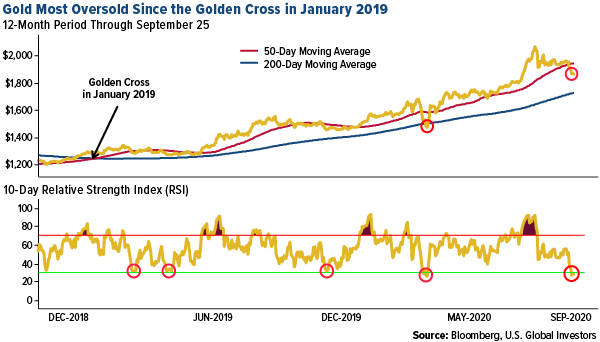

Have a look under. Gold is now extra oversold on the short-term, 10-day relative energy index (RSI) than at some other time for the reason that golden cross came about in January 2019. The final time the dear steel was this oversold, in mid-March, gold fell under not simply its 50-day transferring common but additionally its 200-day common. We’re not fairly there but—gold is buying and selling under its 50-day however nonetheless effectively above the 200-day—however had you purchased the March dip, you’d have seen your place improve 40 p.c over the following 5 months.

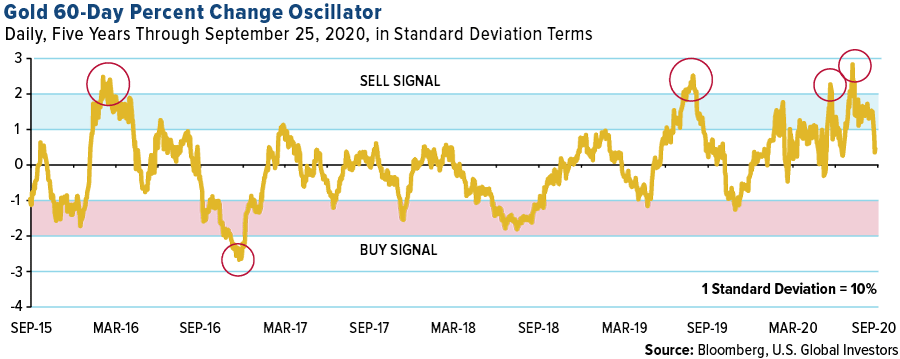

Taking a look at a longer-term interval, gold doesn’t but seem like oversold. The oscillator chart under is predicated on the day by day gold value over a rolling 60-day interval, which is equal to a three-month quarter. As you possibly can see, gold has just lately fallen out of overbought territory and is returning to its five-year imply, or common value. It’s essential to do not forget that for the 60-day interval, a transfer of 1 commonplace deviation is equal to 10 p.c. In different phrases, the value of gold wants to vary by 10 p.c to report a transfer of 1 commonplace deviation.

Greatest One-Day Inflows into Gold-Backed ETFs

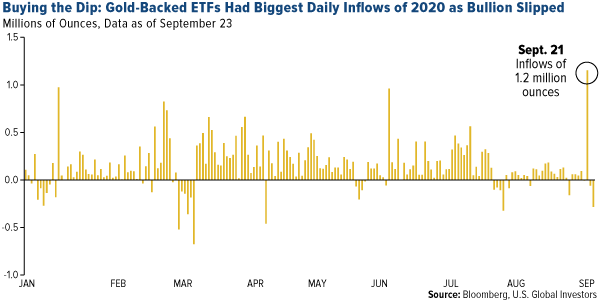

With actual charges nonetheless unfavourable (and prone to stay that manner for a while longer), and unprecedented money-printing threatening to warmth up inflation, I consider it solely is smart to purchase the dips right now.

That’s precisely what many buyers did earlier final week. On Monday, when the yellow steel fell almost 2 p.c, buyers added 1.2 million ounces to ETFs backed by bodily gold. That was probably the most for a single day in 2020.

Randy Smallwood: Treasured Metals in “Golden Instances”

Gold and silver are in “golden instances” proper now, in response to Wheaton Treasured Metals’ president and CEO Randy Smallwood throughout a web-based Denver Gold occasion final week. The “helicopter cash” from governments will proceed to be extremely supported of costs.

Randy can be optimistic on base metals, saying they’re prone to be the majority of streaming deal alternatives going ahead. “It’s good to see cash going to the bottom within the base-metals house,” he commented.

Wheaton Treasured is planning to checklist on the London Inventory Alternate by 12 months finish, which is able to put the $23 billion streaming firm on the radar of United Kingdom buyers who’re in search of to realize fairness publicity to treasured metals. Wheaton at the moment trades in Toronto and New York.

I consider this can be a well-timed resolution on the a part of Randy, who was named the new chair of the World Gold Council (WGC) earlier this month. In accordance with Edison Funding Analysis, treasured steel corporations listed in London “have tended to outperform their friends, with 52 p.c of London-listed corporations outperforming the gold value over the interval of the worst depredations of the coronavirus thus far this 12 months, in contrast with 39 p.c globally.”

Additional, Wheaton Treasured “will present premium-quality, geared publicity to treasured metals costs and fill a void for buyers left by the departure of Randgold Sources in December 2018 after it was acquired by Barrick,” analyst Charles Gibson wrote in a word dated September 22.

As you already know, Wheaton is one in all our favourite mining shares. At current it pays out 30 p.c of its money movement in dividends, however this might rise to between 40 p.c and 50 p.c with increased steel costs, Randy says.

Maverix Metals: A Rising Star within the Streaming Area

One other royalty and streaming firm now we have our eyes on is Maverix Metals, fashioned in 2016 after the corporate acquired a bundle of belongings from Pan American Silver. Final week, Maverix entered right into a binding buy and sale settlement to purchase a portfolio of 11 royalties from Newmont, together with the Camino Rojo gold and silver challenge in Mexico.

The transaction, in response to a word by Raymond James, “gives Maverix with potential near-term gold equal ounce (GEO) and money movement progress from 5 growth belongings within the Americas, whereas including longer-term optionality by way of the six exploration properties.”

Raymond James has given the inventory an Outperform ranking, with a value goal of C$7.50.

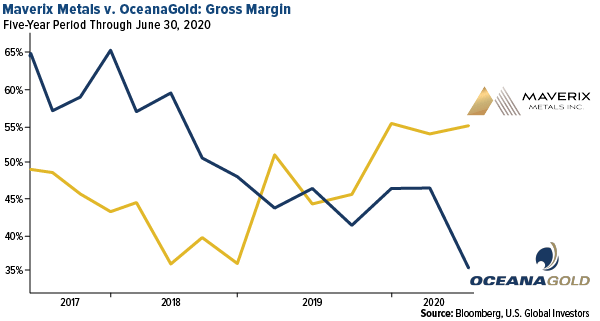

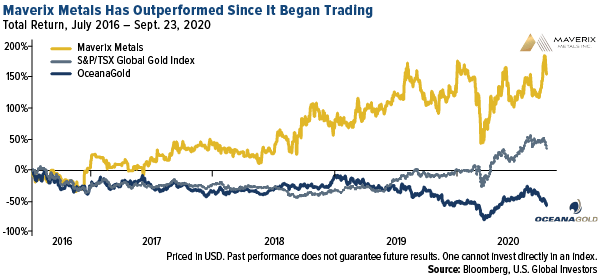

We just like the inventory and, primarily based on our quantamental stock-picking mannequin, have just lately added it our portfolio. This changed Australia-based producer OceanaGold. Maverix’ gross margin overtook OceanaGold’s in 2019 and has solely continued to extend, which is why we made the rotation.

Because it started buying and selling in July 2016, Maverix has outperformed OceanaGold and different international gold shares.

JPMorgan to Pay Document $1 Billion Spoofing Penalty

On a remaining word, a few of you could have heard that JPMorgan & Chase, one of many world’s largest gold and treasured steel merchants, is about to pay near $1 billion to resolve market manipulation investigations by U.S. authorities which have been ongoing for months now. The settlement would permit JPMorgan to proceed regular operations with out being indicted.

Two former JPMorgan merchants are being alleged of “spoofing,” or inserting false orders with no intent to execute them to trick others into transferring costs in a desired path.

Sadly, market manipulation within the international gold market is actual, however there are those that are preventing to reveal it. For those who recall from Could of final 12 months, I interviewed Chris Powell, secretary/treasurer at Gold Anti-Belief Motion Committee (GATA).

We briefly mentioned the JPMorgan spoofing scandal, throughout which Chris shared an attention-grabbing thought on John Edmonds, one of many merchants: “He was allegedly doing it with the data and counsel of his superiors, and if it had been completed on behalf of the federal government, presumably it’s authorized underneath the Gold Reserve Act… [But] I can’t think about the Justice Division could be prosecuting him if his buying and selling was being performed on behalf of the U.S. authorities.”

Have you learnt the world’s prime 10 gold producing international locations? To seek out out, click on right here!

All opinions expressed and knowledge supplied are topic to vary with out discover. A few of these opinions might not be acceptable to each investor. By clicking the hyperlink(s) above, you’ll be directed to a third-party web site(s). U.S. World Traders doesn’t endorse all data equipped by this/these web site(s) and isn’t answerable for its/their content material.

There isn’t a assure that the issuers of any securities will declare dividends sooner or later or that, if declared, will stay at present ranges or improve over time.

The relative energy index (RSI) is a momentum indicator utilized in technical evaluation that measures the magnitude of latest value adjustments to guage overbought or oversold circumstances within the value of a inventory or different asset. Commonplace deviation is a measure of the dispersion of a set of knowledge from its imply. The extra unfold aside the info, the upper the deviation. Commonplace deviation is also called historic volatility. The money movement progress fee for a inventory is a measure of how the inventory’s money movement per share (CFPS) has grown during the last three to 5 years. Gross margin is an organization’s internet gross sales income minus its price of products offered (COGS). In different phrases, it’s the gross sales income an organization retains after incurring the direct prices related to producing the products it sells, and the providers it gives.

Holdings might change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. World Traders as of (06/30/2020): Tesla Inc., Wheaton Treasured Metals Corp., Maverix Metals Inc., OceanaGold Corp., Barrick Gold Corp., Newmont Corp.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.