Central banks have been web patrons of

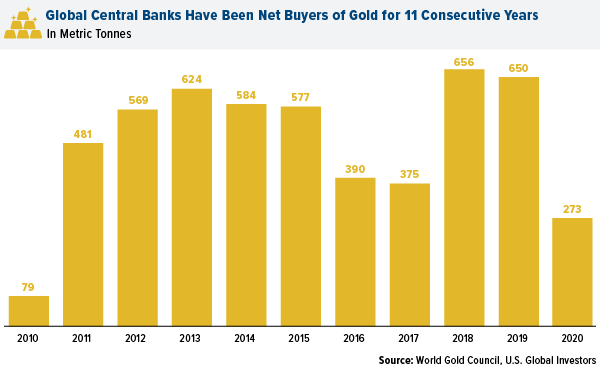

Central banks have been web patrons of gold for 11 consecutive years. In response to World Gold Council (WGC) knowledge, central banks world wide purchased 272.9 tonnes of bullion in 2020.

Purchases final yr had been a whopping 60% decrease than the document 668 tonnes added in 2019. The COVID-19 pandemic was a stronger driver for some central banks to promote reserves and inject liquidity into their economies. Buying was concentrated within the first half of the yr, then turned almost nonexistent within the third quarter and resumed within the final three months of the yr.

click on to enlarge

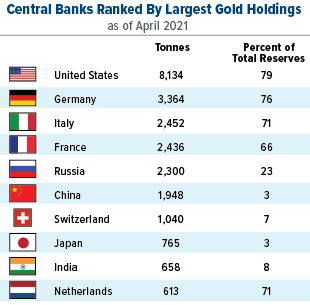

The highest 10 central banks with the most important gold reserves have remained largely unchanged for the previous few years. The USA holds the primary spot with over 8,000 tonnes of gold in its vaults – almost as a lot as the following three nations mixed – and accounting for 79% of whole reserves. The one nations the place gold represents the next % of reserves are Portugal at 80.1% and Venezuela at 82.4%

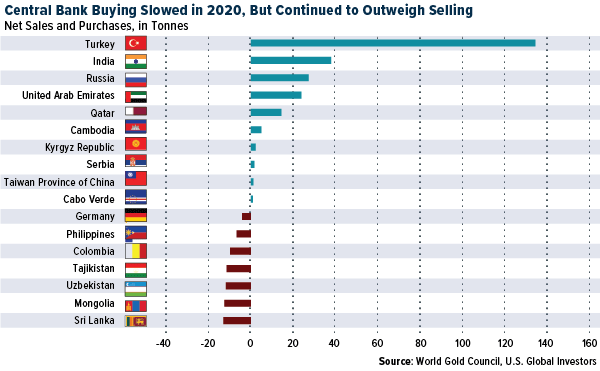

10 central banks made web purchases of 1 tonne or extra in 2020, highlighting the continued demand for the dear metallic. Turkey was the primary purchaser for the second straight yr – including 134.5 tonnes – and was additionally the most important vendor after lowering holdings by 36.Three tonnes. WGC notes gross sales had been concentrated amongst a small variety of central banks that purchase gold from home manufacturing, together with Mongolia and Uzbekistan.

click on to enlarge

Under are the highest 10 nations with the most important gold holdings, with the rankings remaining unchanged from 2019. Figures are as of April 2021 and don’t embrace the Worldwide Financial Fund (IMF) as a rustic, or else it could maintain the quantity three spot with 2,814 tonnes.

10. Netherlands

Tonnes: 612.5

% of overseas reserves: 67.Four %

The Dutch Central Financial institution introduced that it is going to be shifting its gold vaults from Amsterdam to Camp New Amsterdam, about an hour exterior the town, citing burdensome safety measures of its present location. As many others have identified, this appears odd, on condition that the financial institution pretty lately repatriated a considerable amount of its gold from the U.S.

9. India

Tonnes: 687.8

% of overseas reserves: 6.5 %

It’s no shock that the Financial institution of India has one of many largest shops of gold on the planet. The South Asian nation, residence to 1.25 billion individuals, is the second largest client of the dear metallic, and is among the most dependable drivers of world demand. India’s pageant and marriage ceremony season, which runs from October to December, has traditionally been a enormous boon to gold’s Love Commerce.

8. Japan

Tonnes: 765.2

% of overseas reserves: 3.1 %

Japan, the world’s third largest financial system, can also be the eighth largest hoarder of the yellow metallic. Its central financial institution has been one of the aggressive practitioners of quantitative easing—in January 2016, it lowered rates of interest beneath zero—which has helped gas demand for gold world wide.

7. Switzerland

Tonnes: 1,040.0

% of overseas reserves: 5.Four %

In seventh place is Switzerland, which really has the world’s largest reserves of gold per capita. Throughout World Struggle II, the impartial nation turned the middle of the gold commerce in Europe, making transactions with each the Allies and Axis powers. In the present day, a lot of its gold buying and selling is finished with Hong Kong and China.

6. China

Tonnes: 1,948.3

% of overseas reserves: 3.Three %

In the summertime of 2015, the Individuals’s Financial institution of China started sharing its gold buying exercise on a month-to-month foundation for the primary time since 2009. Though China is available in sixth for many gold held, the yellow metallic accounts for under a small share of its total reserves – a mere 3.Three %. As of 2021, China will now enable home and worldwide banks to import massive quantities of the dear metallic into the nation in an effort to assist costs. In response to reporting by Reuters, an estimated 150 metric tons value $8.5 billion can be shipped into China as quickly as April or Might.

5. Russia

Tonnes: 2,295.4

% of overseas reserves: 22.Zero %

The Russian Central Financial institution has been one of many largest patrons of gold for the previous seven years and overtook China in 2018 to have the fifth largest reserves. In 2017, Russia purchased 224 tonnes of bullion in an effort to diversify away from the U.S. greenback, as its relationship with the West has grown chilly because the annexation of the Crimean Peninsula in mid-2014. To boost the money for these purchases, Russia offered an enormous share of its U.S. Treasuries.

4. France

Tonnes: 2,436.0

% of overseas reserves: 64.5 %

France’s central financial institution has offered little of its gold over the previous a number of years. Present reserves include 100 tonnes of gold cash and the remaining in bars weighing round 12.5 kilograms every. The Banque de France vaults in Paris are one of many 4 designated depositories of the Worldwide Financial Fund (IMF).

3. Italy

Tonnes: 2,451.8

% of overseas reserves: 69.Three %

Italy has likewise maintained the scale of its reserves through the years. Mario Draghi, the previous Financial institution of Italy governor and European Central Financial institution governor, when requested by a reporter in 2013 what position gold performs in a central financial institution’s portfolio, answered that the metallic was “a reserve of security,” including, “it offers you a reasonably good safety in opposition to fluctuations in opposition to the greenback.”

2. Germany

Tonnes: 3,362.4

% of overseas reserves: 74.5 %

In 2017 Germany accomplished a four-year repatriation operation to maneuver a complete of 674 tonnes of gold from the Banque de France and the Federal Reserve Financial institution of New York again to its personal vaults. First introduced in 2013, the transfer was anticipated to take till 2020 to finish. Though gold demand fell in 2017 after hitting an all-time excessive in 2016, this European nation has seen gold investing steadily rise because the world monetary disaster.

1. United States

Tonnes: 8,133.5

% of overseas reserves: 77.5 %

With the most important official holdings on the planet, the U.S. lays declare to just about as a lot gold as the following three nations mixed. It additionally has the third highest gold allocation as a share of its overseas reserves. From what we all know, nearly all of U.S. gold is held at Fort Knox in Kentucky, with the rest held on the Philadelphia Mint, Denver Mint, San Francisco Assay Workplace and West Level Bullion Depository. Which state loves gold probably the most? Nicely, the state of Texas went as far as to create its very personal Texas Bullion Depository to safeguard buyers’ gold.

Initially printed by US Funds, 4/29/21

All opinions expressed and knowledge supplied are topic to vary with out discover. A few of these opinions will not be acceptable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. World Traders doesn’t endorse all data equipped by this/these web site(s) and isn’t chargeable for its/their content material.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.