A raft of constructive financial inform

A raft of constructive financial information was launched final week, pointing to a strong ongoing restoration from the pandemic-triggered downturn and including to the thesis that inflation is ready to speed up.

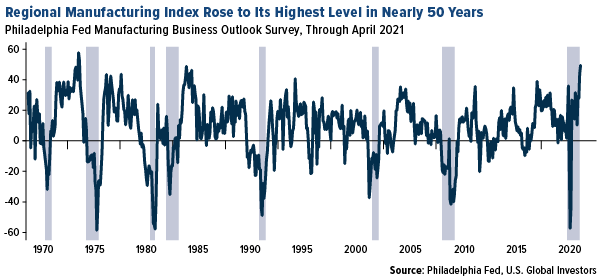

Main manufacturing knowledge from the Federal Reserve Banks of Philadelphia and New York had been extraordinarily constructive for enterprise exercise going ahead. The Philadelphia Fed Index registered a 50.2 this month, which is the very best degree in practically 50 years should you can consider it. Shut to 3 in 4 corporations reported greater enter costs for uncooked supplies in addition to greater costs for their very own manufactured items. Producers in New York reported the identical, with enter costs rising on the quickest tempo since 2008 and promoting costs surging at a record-setting tempo.

click on to enlarge

Certainly, the producer worth index (PPI), issued month-to-month by the Bureau of Labor Statistics (BLS), reveals costs rising at multiyear highs. The index for processed items, for example, moved up 4.0% in March, the largest enhance since August 1974. For the 12-month interval, unprocessed items exploded 41.6%, the strongest such development since July 2008.

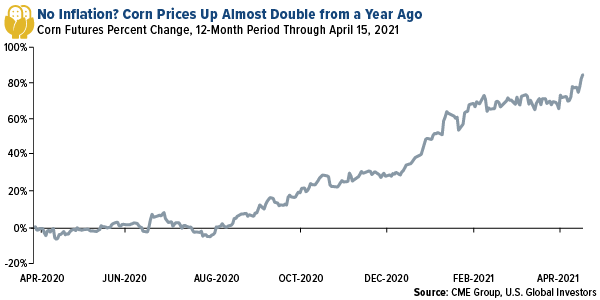

Various commodities have been on a tear currently. Lumber futures are up for the 15th straight day. And simply check out corn costs. Futures for the crop spiked above $6 a bushel for the primary time since June 2013 on tight provide and robust demand from China and South Korea. Corn costs at the moment are up 85% in comparison with the identical time final 12 months and will double earlier than we see a retreat.

click on to enlarge

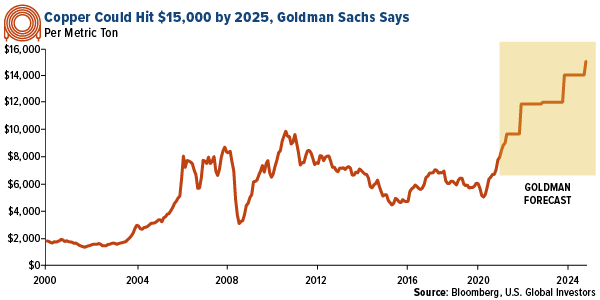

Copper continued its rally final week on a bullish report from Goldman Sachs, which sees the pink steel climbing to an all-time excessive of $15,000 per metric ton by 2025 on an unprecedented supply-demand imbalance introduced on by renewable power. In line with the analyst group, present copper costs of round $9,000 “are too low to forestall a near-term danger of stock depletion.” Solely a worth level of round $15,000 is sufficient to incentivize the event of recent copper initiatives.

click on to enlarge

Our favourite copper play continues to be Ivanhoe Mines, led by billionaire Robert Friedland, who sees the shortage of recent mines as a nationwide safety challenge. Talking on the digital CRU World Copper Convention final week, Robert instructed listeners that markets nonetheless haven’t fairly acknowledged how disruptive the transition to renewable power and electrification-of-everything might be, nor simply how a lot copper might be required.

“It’s all copper, copper, copper, copper, copper, copper,” Robert mentioned.

Ivanhoe Mines additionally introduced it produced a file 400,000 metric tons of ore grading 5.36% copper at its Kakula and Kansoko mines in March.

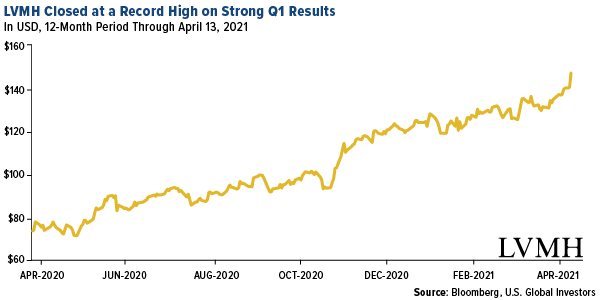

Luxurious Large LVMH Returns to Development

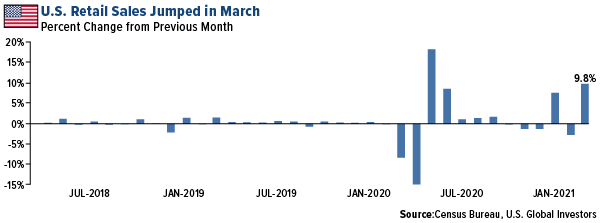

In March, retail gross sales jumped a whopping 9.8% from the earlier month, the second largest surge on file, as shoppers made good use of their stimmy checks. As I shared with you latterly, gross sales of automobiles and lightweight vehicles had been up an unbelievable 58% in March in comparison with final 12 months, with many luxurious carmakers setting new month-to-month and quarterly gross sales data.

click on to enlarge

The French luxurious big LVMH Moet Hennessy Louis Vuitton introduced final week that it had returned to development following the pandemic, reporting first-quarter income of 14 billion euros, or $16.75 billion. Style and leather-based items had a wonderful begin to the 12 months, producing file income that was 52% greater than the identical interval in 2020 and a rise of 37% from 2019. The conglomerate was helped by its current acquisition of U.S. jeweler Tiffany, bringing the variety of corporations it owns to over 75.

click on to enlarge

I’m more than happy with how LVMH has carried out over the course of the pandemic, throughout which the fortunes of rich shoppers have expanded. With a market cap of practically 320 billion euro ($383 billion), LVHM is Europe’s most useful firm. First-quarter gross sales had been pushed by Asia, significantly China, and the U.S., which have performed a a lot better job of combating COVID-19 than Europe. The rising site visitors at U.S. seaports is a transparent signal that demand is robust proper now. Following its record-setting February, the Port of Los Angeles processed 957,599 twenty-foot equal models (TEUs) in March, representing the busiest March within the port’s 114-year historical past. All mixed, it was additionally the busiest first quarter ever for the seaport. To see the highest 10 international locations with the most important transport fleets, click on right here.

Coinbase Goes Public, Opening the Crypto Floodgates

On a closing word, digital currencies stormed Wall Road in a giant means final week. Crypto alternate Coinbase went public in a direct itemizing, opening the floodgates for plenty of different crypto-related corporations.

This transfer brings us one step nearer to mass acceptance of cryptocurrencies.

Prior to now, traders searching for to take part had a number of choices apart from to carry the underlying belongings. The obvious amongst these is to personal shares of the crypto miners, together with HIVE Blockchain Applied sciences, the one publicly traded agency to mine each Bitcoin and Ether utilizing inexperienced power. There are additionally futures contracts by way of CME Group, and plenty of issuers have filed for a Bitcoin ETF.

With Coinbase, ticker COIN, traders get publicity to your complete $2.2 trillion crypto ecosystem, together with not simply Bitcoin and Ether but additionally smaller but fast-growing cash like Dogecoin. All cryptos talked about hit recent new highs final week following Coinbase’s debut.

The inventory traded a staggering $29 billion in quantity on its first day, which might be an all-time excessive, in line with Bloomberg’s Eric Balchunas.

A number of commentators identified that Coinbase ended decrease than it opened at. As I instructed Cointelegraph final week, I’ve seen this story play out many instances over my 30 years in managing cash. Typically when an organization is up 300% in a 12 months and goes public, it will probably simply dump 30%. I don’t consider traders needs to be too nervous about Coinbase’s volatility. I’m extremely bullish.

That’s to not say the trade isn’t risky. It stays extraordinarily risky. A tweet by Documenting Ether on Friday, showing above, reveals simply how a lot your funding could be at this time had you used the April 2020 stimulus verify to purchase Bitcoin, Ether or Dogecoin. It’s onerous to take a look at these figures and never kick your self.

Initially revealed by US Funds, 4/19/21

All opinions expressed and knowledge offered are topic to alter with out discover. A few of these opinions might not be applicable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. World Traders doesn’t endorse all data provided by this/these web site(s) and isn’t accountable for its/their content material. Beta is a measure of the volatility, or systematic danger, of a safety or portfolio compared to the market as an entire.

The Philadelphia Federal Index (or Philly Fed Index) is a regional federal-reserve-bank index measuring adjustments in enterprise development protecting the Pennsylvania, New Jersey, and Delaware area. A producer worth index is a worth index that measures the typical adjustments in costs acquired by home producers for his or her output. Frank Holmes has been appointed non-executive chairman of the Board of Administrators of HIVE Blockchain Applied sciences. Mr. Holmes owns shares of HIVE whereas U.S. World Traders owns convertible securities. Efficient 8/31/2018, Frank Holmes serves because the interim govt chairman of HIVE.

Holdings could change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. World Traders as of (3/31/2020): Ivanhoe Mines Ltd., LVMH Moet Hennessy Louis Vuitton SA.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.