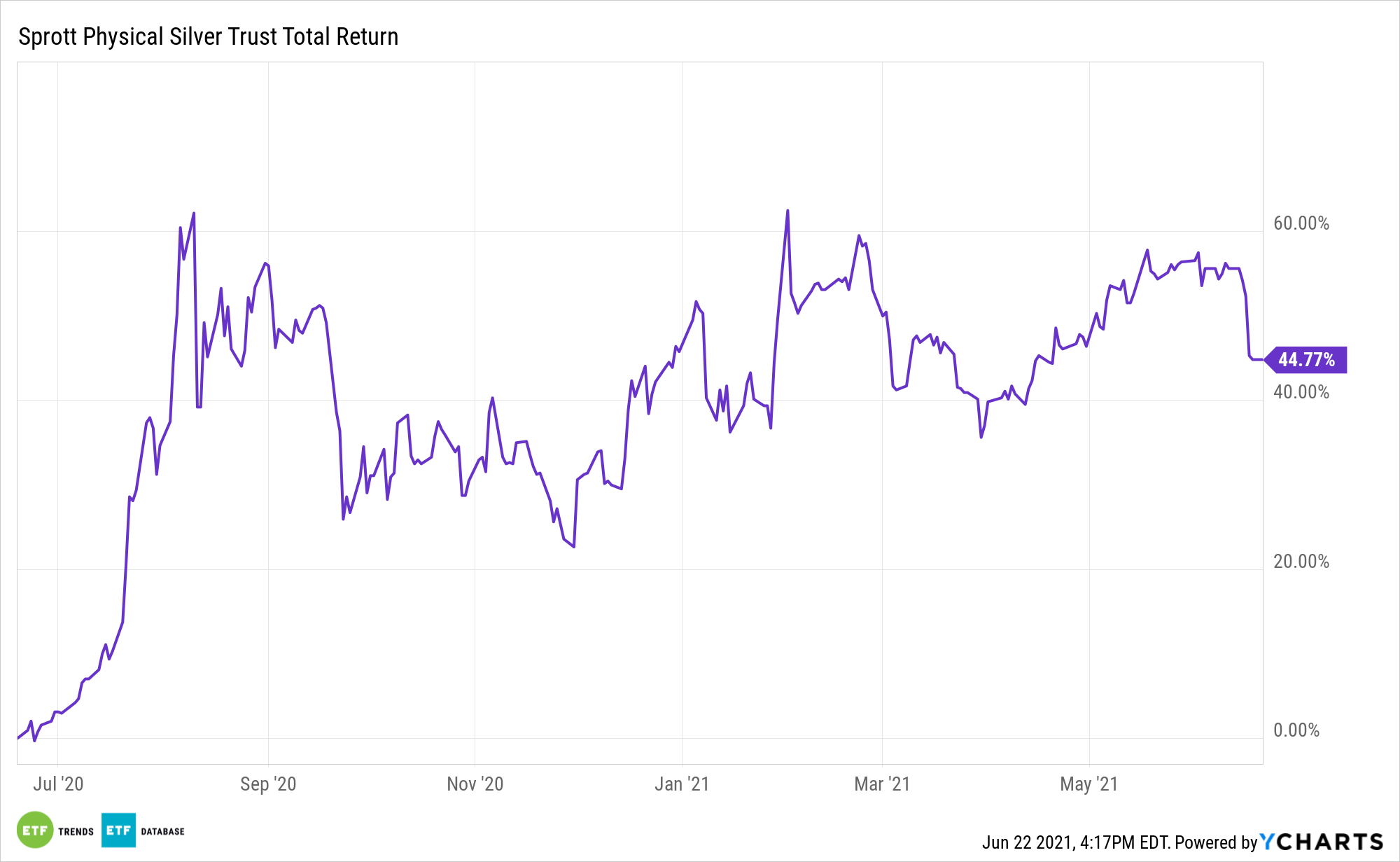

Good efficiency has been good to the Sprott Bodily Silver Belief (PSLV).

Between Might 2020 and Might 2021, PSLV has returned 53%. Over the identical time interval, the fund gained over $2.7 billion in belongings underneath administration—a 199% surge, the quickest progress price as in comparison with different U.S. primarily based silver-focused ETFs.

Why Has Silver Outperformed? It’s Provide & Demand

Whereas treasured metals are well-positioned to thrive within the present surroundings, given inflation fears, silver is uniquely positioned to surge within the period of local weather change.

Silver is a key metallic within the inexperienced revolution. It’s a major part in various climate-friendly applied sciences, reminiscent of photo voltaic panels and hybrid vehicles, and has various shocking makes use of.

Due to the significance environmental applied sciences could have within the coming years, silver is predicted to see rising demand, whilst provide stays constrained. Total manufacturing of silver was down in 2020, as a result of COVID-19 pandemic.

Within the upcoming years, an extra 100 million ounces of silver are estimated to be essential to satisfy this new demand. “I don’t see a whole lot of 10 million-ounce mines coming on-line within the subsequent 5-10 years,” mentioned Sprott Senior Portfolio Supervisor Marina Smirnova in an episode of Sprott Discuss Radio, including she thinks that “an actual scarcity” of provide is probably going over the following few years.

Her colleague Paul Wong mentioned in a current report that “elementary provide and demand are overwhelmingly bullish [for silver] as funding and industrial demand, particularly in clear know-how, far outstrip provide for the foreseeable future.”

The Silver Institute expects silver costs to soar 30% in 2021, and eventually break previous the resistance level of $28/oz. Some even see the valuable metallic hitting $40 by the tip of the 12 months.

About PSLV

PSLV is a closed-end belief that holds unencumbered, fully-allocated London Good Supply bars of silver bullion, saved within the custody of the Royal Canadian Mint.

Shareholders even have the flexibility to redeem their shares for bodily bullion anyplace on the planet (topic to sure minimal circumstances). Such redemptions don’t dilute the belief’s publicity for remaining shareholders.

PSLV’s expense ratio is 0.62%.

For extra information, data, and technique, go to the Gold & Silver Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.