It’s been a tough go for China’s know-how sector as Beijing ups regulatory scrutiny on Alibaba (NYSE: BABA) and others, however these headwinds might in the end show to be a shopping for alternative for prescient buyers.

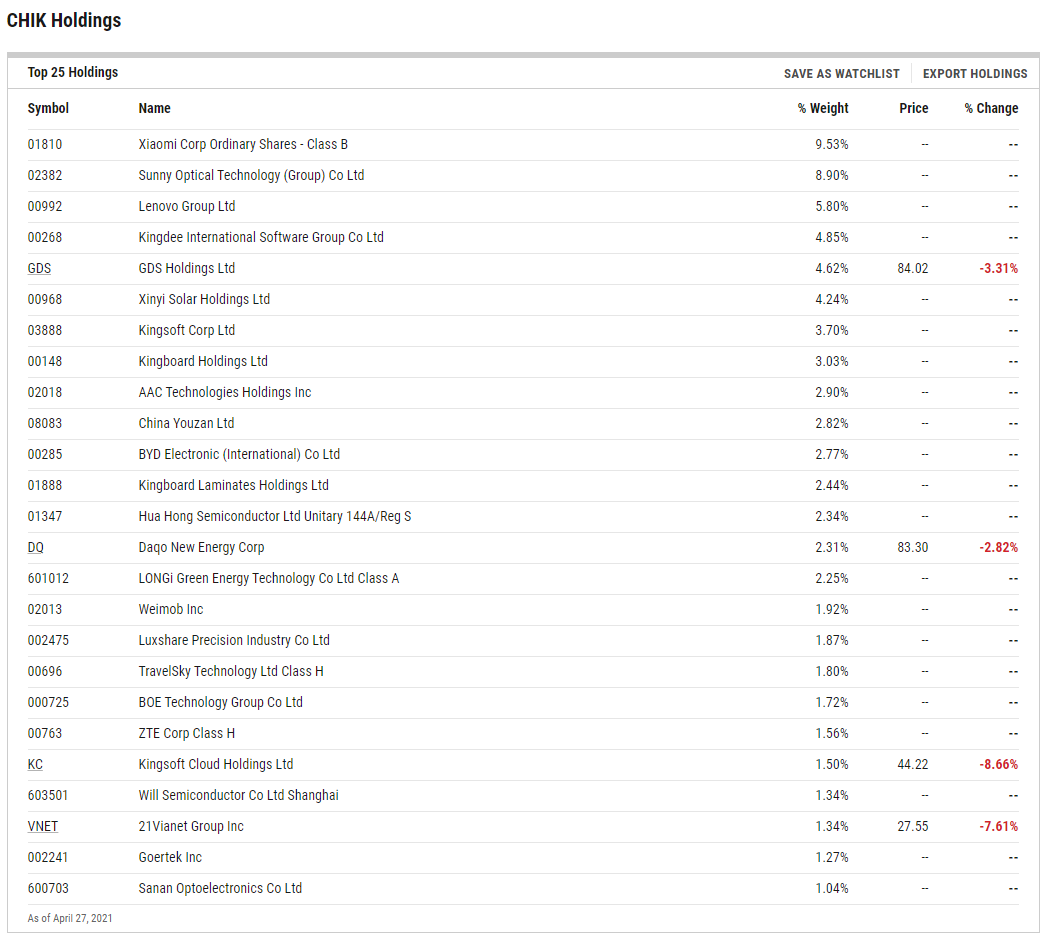

The International X MSCI China Info Know-how ETF (CHIK) is an avenue for taking part in a rebound in Chinese language tech shares.

CHIK tries to replicate the efficiency of the large- and mid-capitalization segments of the MSCI China Index which are categorised within the Info Know-how Sector as per the International Trade Classification System. CHIQ’s underlying index “incorporates all eligible securities as per MSCI’s International Investable Market Index Methodology, together with China A, B, and H shares, Pink chips, P chips, and international listings, amongst others,” in keeping with International X.

For buyers, it is value remembering that most of the names Beijing is zeroing in on are web/shopper discretionary fare, whereas many CHIK elements are business-to-business companies.

“Financial output from Telecommunications, Software program and Info Know-how in 2020 was $587.4bn, in keeping with the Chinese language Ministry of Statistics,” notes International X analyst Chelsea Rodstrom. “Worth added by the sector grew by a formidable 16.9% final yr even though COVID-19 led to low or destructive progress charges for a number of different sectors. Previous to the pandemic, progress was 18.7% in 2019, only one.8% larger than 2020’s figures, exhibiting the resilience of this sector amid a tough world financial setting.”

Second Half Concerns in China

There are industry-level variations between CHIK and rival U.S.-focused funds. Moreover, CHIK seizes upon some vital disruptive progress themes.

“In response to rising demand from rising applied sciences like 5G and electrical autos, in February 2021 the Ministry of Trade and Info Know-how introduced a plan to attain $322.35bn in complete digital elements gross sales and develop 15 digital element firms with income over the $1.5bn mark by 2023,” notes Rodstrom.

That is a technique of claiming CHIK is likely one of the extra viable performs on Beijing’s efforts to wean China off dependence on know-how imports – a significant coverage initiative on the earth’s second-largest financial system.

Rising web penetration is one other longer-ranging catalyst for CHIK, as a result of as that share will increase, so does demand for communications gear, information facilities, and extra.

“China is rapidly adopting applied sciences each previous and new. China’s web protection fee rose from 38.3% in 2011 to 59.6% in 2018,” provides Rodstrom. “Though this quantity remains to be low in comparison with developed nations, a few of which have web penetration charges above 90%, China’s huge inhabitants signifies that it has Three instances as many web customers and three.75 instances as many cell phone customers because the US.”

For extra on disruptive applied sciences, go to our Disruptive Know-how Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.