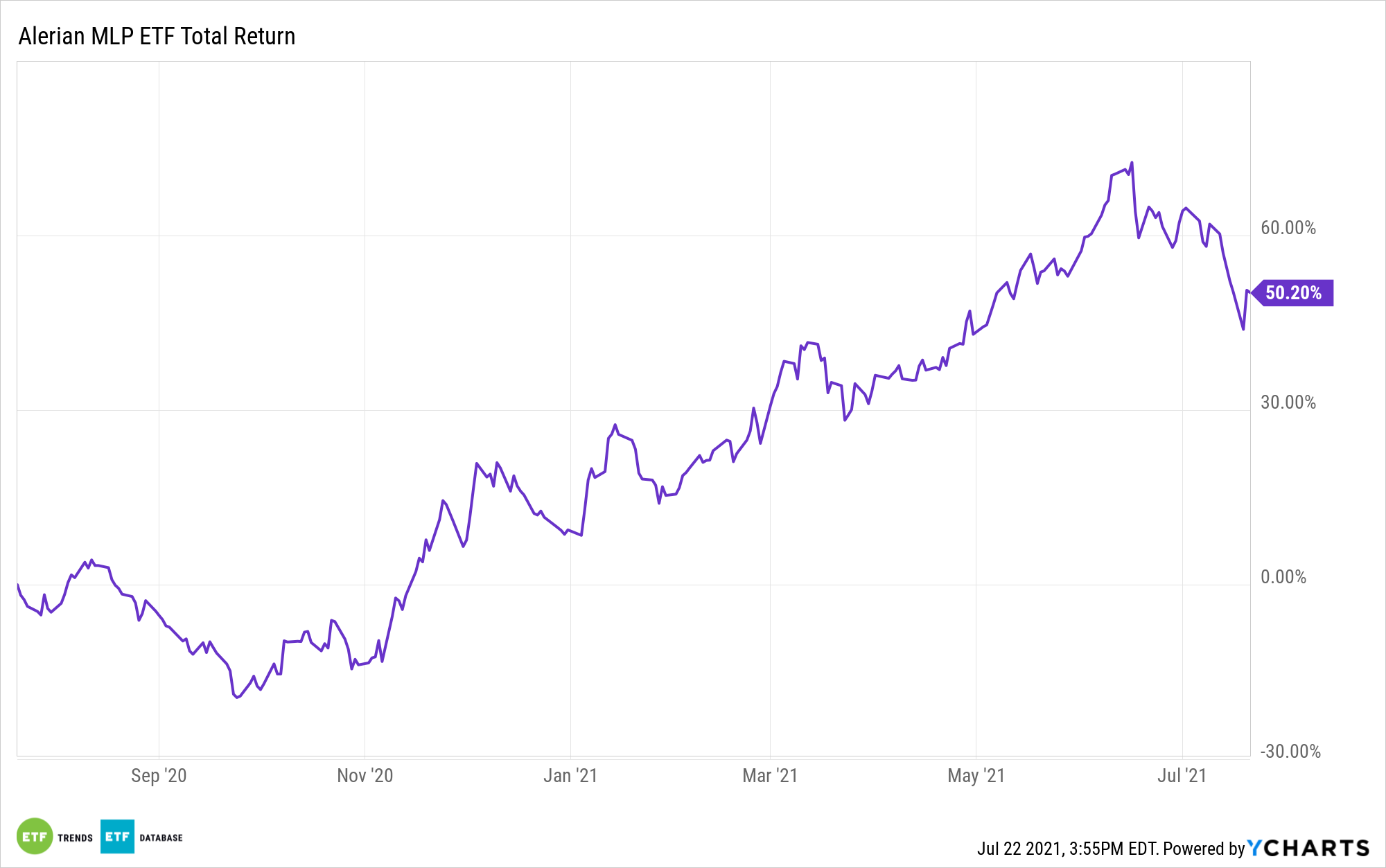

The ALPS Alerian MLP ETF (NYSEArca: AMLP) and its midstream elements are coping with a near-term uptick in volatility as oil costs decline amid the enlargement of the delta variant of the coronavirus pandemic because the Group of Petroleum Exporting International locations (OPEC) strikes to spice up output.

Skilled power buyers know these are respectable headwinds and certain clarify why AMLP is decrease by nearly 3% over the previous week. Nonetheless, the latest malaise could possibly be a chance to contemplate shopping for midstream belongings on the dip.

As Alerian analyst Mauricio Samaniego factors out, midstream power corporations have distinctive skills to endure commodity value fluctuations, particularly when in comparison with exploration and manufacturing shares.

“Whereas uncertainties over renewed lockdowns and its impact on oil demand are nonetheless untimely—and haven’t led to downward revisions in financial development forecasts—midstream stands out amongst the power house for its fee-based enterprise mannequin and contract protections that help money move stability and assist insulate the house from a risky crude oil surroundings,” he says.

Much less Correlation to Oil Costs

AMLP’s underlying index – the Alerian MLP Infrastructure Index – has some favorable historical past on its aspect relating to correlations to grease costs. It is rolling five-year correlation of 0.464 to West Texas Intermediate costs is nicely beneath comparable metrics on the Power Choose Sector Index and the PHLX Oil Providers Index.

Moreover, midstream power names are deriving some help from sturdy pure gasoline demand and the associated export marketplace for that commodity.

“Regardless of volatility inflicted upon the crude oil market, the midstream house continues to learn from resilient pure gasoline demand because the summer season warmth wave, rising liquified pure gasoline (LNG) exports, and tighter provide have saved pure gasoline costs hovering round a two-and-half-year excessive,” provides Samaniego.

On the finish of the day, AMLP gives buyers not solely yield-based benefits, however perks by means of the midstream’s fee-based enterprise mannequin, bettering stability sheets, and rising money move era.

“Price-based enterprise and contract protections equip the midstream house to higher stand up to commodity value volatility whereas delivering engaging earnings and better money move stability relative to its power friends. As well as, huge publicity to pure gasoline assist alleviate the results of oil value fluctuations amid resilient pure gasoline costs and regular demand,” concludes Samaniego.

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.