Real property funding trusts (REITs) ha

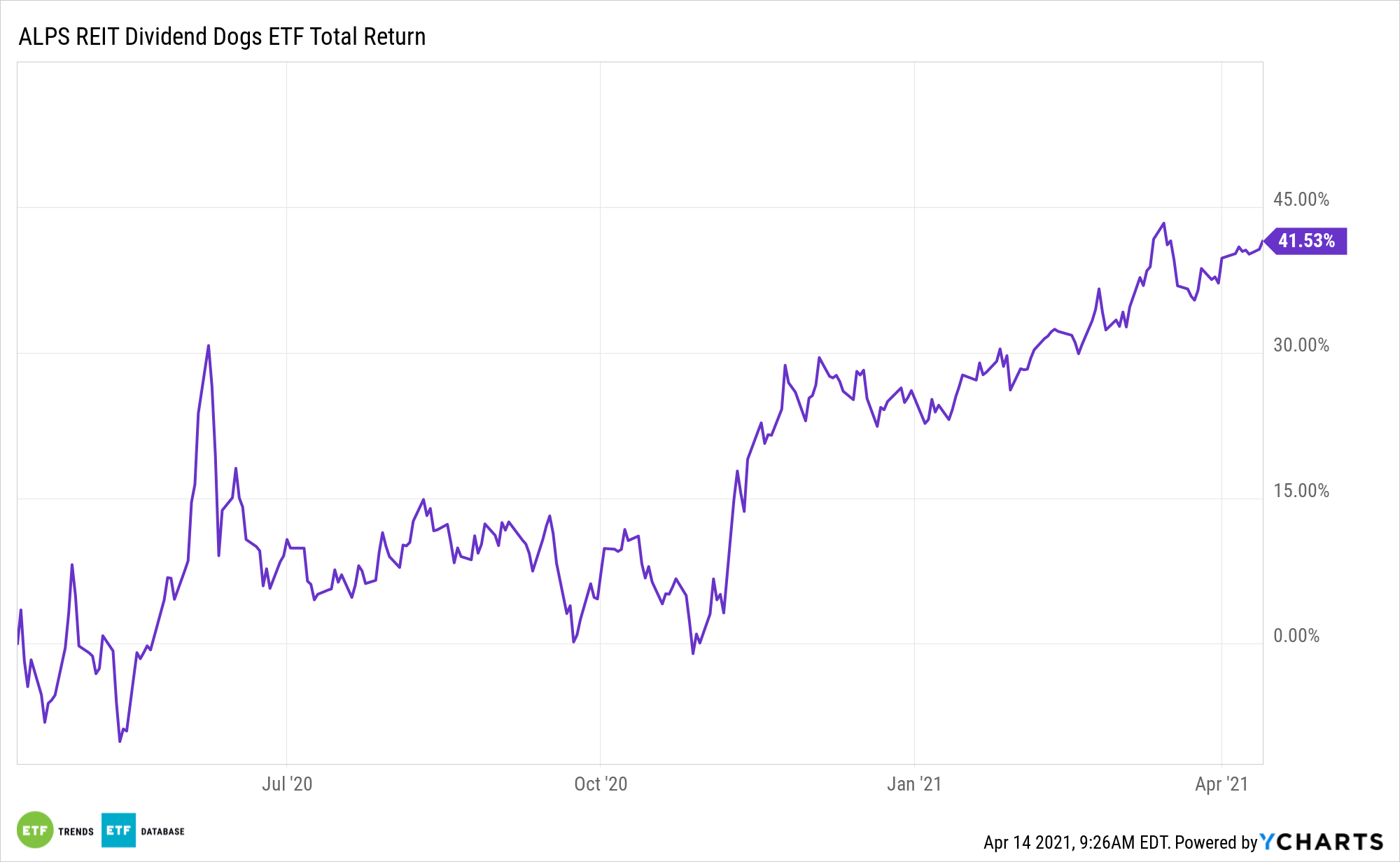

Real property funding trusts (REITs) had been among the many most repudiated belongings on the top of the coronavirus pandemic, however the ALPS REIT Dividend Canine ETF (NYSEArca: RDOG) is on the mend.

RDOG tracks the S-Community REIT Dividend Canine Index, a benchmark that’s much like these discovered on ALPS’ different dividend canine ETFs.

“Investing in actual property securities might be a sexy sector going ahead, not just for the short-term dislocation but in addition as a result of we’re beginning a brand new cycle, lending itself to super alternative,” notes Bernhard Krieg, Portfolio Supervisor, Brookfield Asset Administration. “Actual property extra broadly, but in addition actual property securities, is pushed by lengthy and regular upcycles. We’re seeing rents develop, occupancies enhance, and finally extra provide will degree issues off.”

Rising Themes, Lengthy-Time period Returns, and Extra

Quite a lot of technological themes have gotten more and more related in the true property business. Nonetheless, lots of the conventional trade traded funds addressing this sector lack the mandatory publicity to new developments. For its half, RDOG options sturdy publicity to industrial and expertise REITs, the true property belongings on the middle of disruptive developments reminiscent of 5G and e-commerce.

Traders shouldn’t keep away from RDOG on the premise that its tech ties make it richly valued relative to previous guard REIT ETFs. Actually, RDOG’s industrial REIT publicity is especially significant for long-term buyers.

Low rates of interest additionally help the case for RDOG.

“I don’t foresee threat of inflation. Relatively, we’re more likely to see continued low rates of interest that are very favorable for industrial actual property. As anticipated, the macro fundamentals are enhancing which can additional drive demand over the following 12 months,” stated Calvin Schnure, SVP, Analysis & Financial Evaluation, Nareit.

Actual property funding trusts are nice long-term sources of returns. Publicly listed fairness REITs exhibited a few of the finest common annual internet returns. There are improved diversification advantages as nicely. The sector supplied a terrific supply of diversification in conventional inventory and bond mixes. REITs confirmed a -0.03 correlation to U.S. lengthy bonds and a 0.53 correlation to U.S. massive caps.

So far as improved risk-adjusted returns outdoors of fastened revenue, REITs had the very best Sharpe ratio measuring of 0.44. This displays traditionally excessive returns and simply above-average volatility.

Different REIT ETFs embody the Schwab US REIT ETF (NYSEArca: SCHH) and the Pacer Benchmark Knowledge & Infrastructure Actual Property SCTR ETF (SRVR).

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.