Chinese shares have been among the many first to be affected by the onset of the coronavirus pandemic final 12 months, solely to complete 2020 among the many finest performers on this planet.

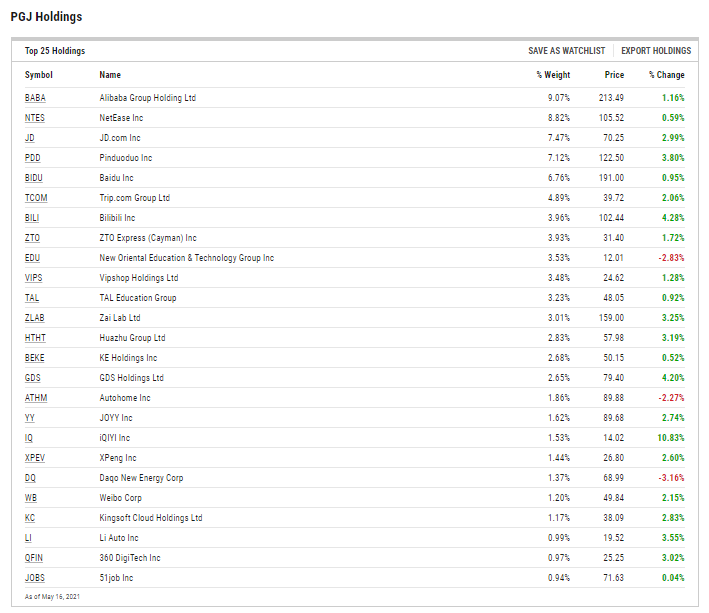

That momentum carried over into 2021, however some trade traded funds, together with the Invesco Golden Dragon China ETF (PGJ), are encountering headwinds as a result of Beijing’s out of the blue heavy-handed strategy to regulating Chinese language tech.

Whereas extra overt regulation might paint an ominous image within the eyes of some buyers, it can’t be ignored that China has huge ambitions to cultivate its tech wants and cut back dependence on imports, which may very well be a longer-ranging catalyst for funds like PGJ.

“Economically, China has an ambition to double GDP by 2035 – surpassing the U.S. and firmly shifting the middle of gravity for international progress to Asia in coming years,” notes BlackRock. “China’s wide-ranging plans contact many flash factors within the U.S.-China relationship, with the Covid pandemic amplifying every nation’s deal with financial resilience. Safe provide chains and self- sufficiency in crucial applied sciences and industries are a strategic precedence and will drive a rewiring of world commerce. Intensifying competitors on key applied sciences, comparable to 5G and semiconductors, is one instance.”

China Additionally Shifting Towards Sustainability

An vital component to the long-term PGJ thesis is China’s strikes to bolster sustainability – objectives some PGJ parts will play roles in serving to the nation attain.

“Sustainability will likely be a robust driver of world returns within the medium time period, in our view, and ever extra central to all funding selections,” provides BlackRock. “There are various points to sustainability – and the burden positioned on every differs throughout buyers. Consequently, the general evaluation of China is investor particular. We think about each the present standing in addition to the path of journey relating to assessing China’s sustainability credentials. We see enchancment on a number of fronts – notably its environmental commitments – however acknowledge there’s additional to go, and commitments have to be realized.”

In truth, PGJ is a reputable play on China’s sustainability ambitions.

“Our obese to Chinese language belongings versus benchmark indexes doesn’t change after taking into consideration the affect on local weather change on anticipated returns. The composition of Chinese language fairness indexes is healthier aligned with the transition to a low-carbon economic system, in our view,” concludes BlackRock.

PGJ allocates simply 6% of its weight to industrial and power shares and has no supplies publicity, steering away from many environmental offenders.

For extra information, info, and technique, go to the ETF Schooling Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.