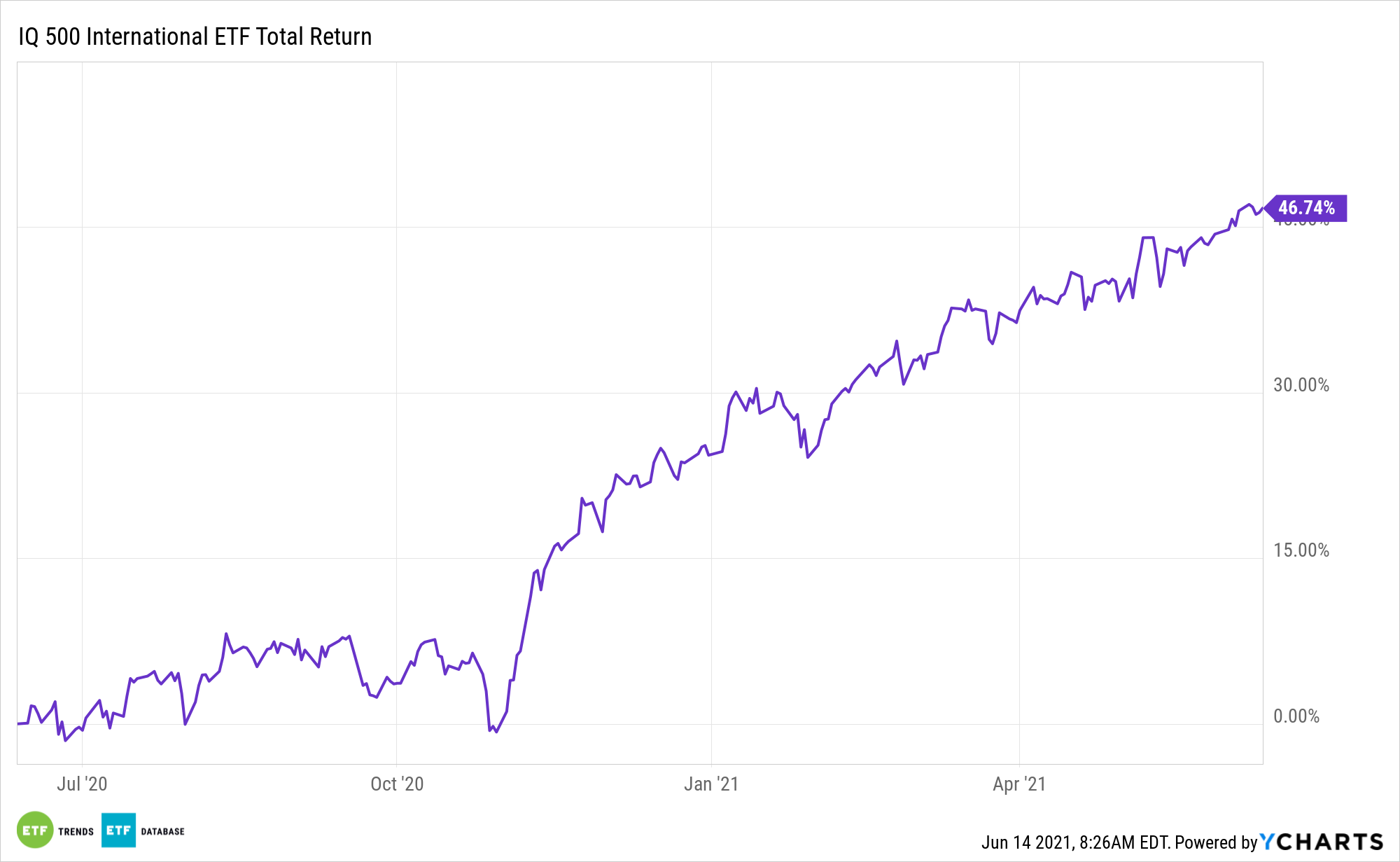

The worldwide re-opening may give worldwide traders renewed publicity to economies overseas for the aim of diversification. One alternate traded fund (ETF) price contemplating is the IQ 500 Worldwide ETF (IQIN).

The fund dips into an unlimited array of worldwide equities to diversify a portfolio and seize upside in different nations across the globe. The fund nearly eliminates focus danger by by no means holding greater than 1.2% of a inventory as a part of its portfolio (502 holdings as of June 9).

Per its normal fund description, IQIN seeks funding outcomes that observe usually to the value and yield efficiency of its underlying index, the IQ 500 Worldwide Index. the value and yield of the IQ 500 Worldwide Index. The IQ 500 Worldwide Index selects and weights securities using a rules-based methodology incorporating three basic components: gross sales, market share, and working margin.

The highest 500 worldwide securities, primarily based on their composite rank, are included within the Index. The fund comes with a low expense ratio of 0.25%, which falls 15 foundation factors beneath the class common. The ETF lends traders:

- A Elementary Mannequin: Gross sales, market share, and working margin weightings have the potential to enhance a portfolio’s risk-return profile over a market-cap-weighted index.

- Enhanced Nation and Sector Diversification: Basically pushed safety choice permits for improved nation diversification and sector weightings over a market-cap-weighted index.

- Core Worldwide Holdings: Developed worldwide fairness ETF with publicity to massive corporations.

Bullish Tendencies for Worldwide Equities

As talked about, the fund’s funding unfold over 21 nations offers IQIN the required diversification to seize upside in a re-opening financial system. Whereas a vaccine deployment continues within the U.S., its results may very well be waning, whereas different components of the globe may starting their very own nascent upswings.

“We’re additionally seeing international financial knowledge pattern within the path we anticipated,” wrote Calamos Investments in a Searching for Alpha article. “There’s little doubt that the U.S. financial system is within the midst of a robust restoration.”

“If we take a look at the Citi Financial Shock Indexes, for instance, we see that knowledge within the U.S. remains to be coming in higher than anticipated, however a lot much less so than final summer season,” the article mentioned additional. “In 2021, there was a small pick-up in late February/early March, however the pattern is decelerating once more. In the meantime, in rising markets and Europe, expectations moved down resulting from lockdowns, however economies have tailored greater than anticipated and knowledge continues to shock to the upside.”

For extra information, data, and technique, go to the Different ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.