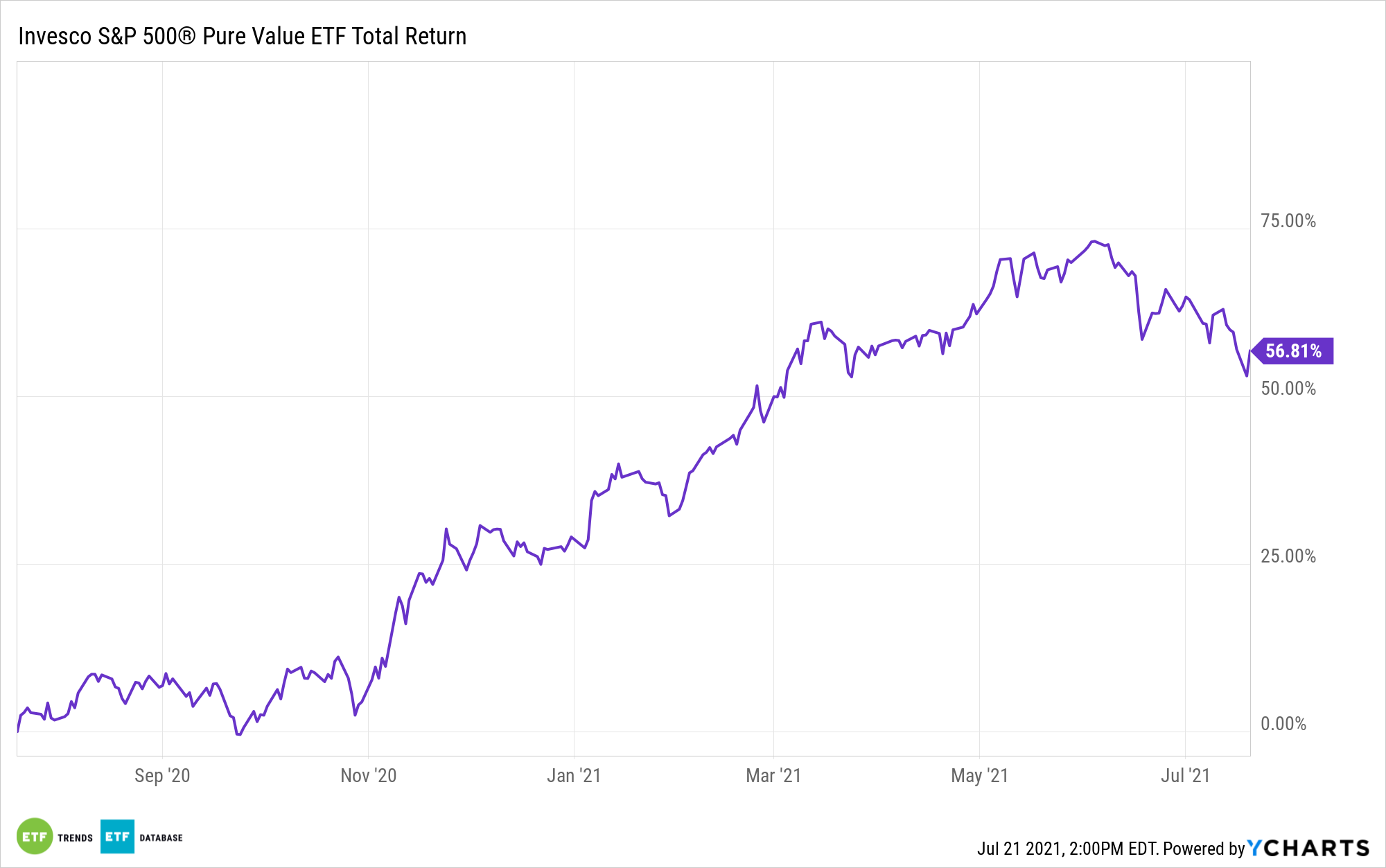

The reflation commerce was one of many apparent catalysts behind the worth rally, one which supported change traded funds just like the Invesco S&P 500® Pure Worth ETF (RPV) by way of a lot of the primary half of the yr.

Nevertheless, similar to another pattern, the reflation rally encountered some headwinds by the hands of declining Treasury yields and discuss that the Federal Reserve may speed up its rate of interest hike timeline. Some market observers consider buyers needn’t fret in regards to the latter and that the reflation commerce might be refreshed sooner fairly than later. That might be an indication to revisit RPV.

“The concept that excessive charges of inflation might drive the Federal Reserve to hike rates of interest prematurely, curbing future progress; the concern that the unfold of the Delta variant may disrupt the worldwide financial restoration; and the priority that coverage modifications and slowing progress momentum may undermine sentiment on China,” stated UBS CIO Mark Haefel.

The strategist recommends buyers do not rush to desert cyclical shares. An correct name right here can be an enormous plus for RPV as a result of the Invesco fund is closely cyclical, as highlighted by a 43.48% allocation to monetary companies shares.

RPV’s Rebound Potential

RPV is down simply 1% over the previous month. A bear market this isn’t, however with buyers pensive about persistent inflation and the emergence of the Delta variant of the coronavirus, some could also be jittery and apprehensive relating to reflation shares. Haefel does not see issues that approach.

“”We don’t suppose near-term inflation will drive policymakers to over tighten, and the Fed’s employment standards are nonetheless unmet,” he stated. “Whereas the Delta variant might imply a extra uneven financial restoration globally – with some rising market economies on a slower path to reopening than the US and Europe – vaccines seem like efficient at lowering healthcare burdens, and we anticipate governments more and more to look by way of rising case numbers.”

Homing in on sector-level reflation concepts, UBS is captivated with power and monetary service names. RPV allocates over half its weight to these two sectors.

Haefele provides the reflation commerce can rebound as a result of S&P 500 earnings progress is forecast to soar this yr. Many customers are additionally in sturdy positions; RPV as a result of devotes virtually 10% of its weight to shopper cyclical shares.

For extra information, data, and technique, go to the ETF Schooling Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.