By Jeremy Schwartz, Govt Vice President, World Head of Ana

By Jeremy Schwartz, Govt Vice President, World Head of Analysis, WisdomTree

Growing portfolio high quality is a theme many buyers flock to throughout recessions.

You would possibly fear that rotation and flows to high quality methods push up valuations to premium costs, hurting the prospects of forward-looking returns. However WisdomTree has a possible answer. Now we have a household of high quality dividend progress methods that mix parts of screening for profitability (excessive return on fairness (ROE) and return on property (ROA)) and robust earnings progress expectations.

Due to the profitability focus and the dividend requirement, one of many attention-grabbing elements of our U.S. High quality Dividend Development Fund (DGRW) is that it’s buying and selling at price-to-earnings (P/E) multiples that resemble the traits of “worth” sides of the market, however with considerably increased high quality ratios.

Whereas the S&P 500 Worth Index has a return on fairness of 9.4%—beneath the S&P 500 degree of 13.1%—DGRW has an ROE of greater than 24%.

Please click on right here for standardized and the newest month-end efficiency.

For definitions of phrases within the desk, please go to our glossary.

Let’s take a look at a few of the nuance of this technique.

Dividends Beneath Stress

The broad universe of worth methods and dividend-paying shares has come below strain in 2020 as many corporations have been compelled to cut back or minimize their dividends.

Much less More likely to Reduce Dividends: Whereas 272 corporations, or 13%, of the 1,471 dividend payers within the WisdomTree U.S. Dividend Index both minimize or suspended dividends in 2020, lower than 8% of the 300 corporations within the WisdomTree High quality Dividend Development Index minimize or suspended dividends in 2020.

High quality Extra More likely to Develop Dividends: High quality corporations additionally have a tendency to have the ability to develop dividends sooner over time, they usually have been stress-tested throughout this pandemic. Whereas 54% of the broad universe of 1,471 dividend payers have grown their dividends in 2020, 64% of the High quality Dividend Development Index have.

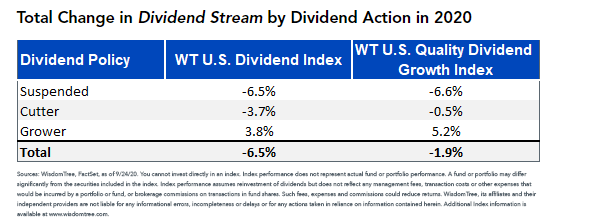

Being much less prone to minimize dividends and extra prone to develop them provides up. The WisdomTree U.S. High quality Dividend Development Index at present solely sees a decline of lower than 2% in its complete Dividend Stream®, whereas the broad index Dividend Stream is down 6.5%.

Whole Change in Dividend Stream by Dividend Motion in 2020

2020 Issue Returns—Low Danger Lags

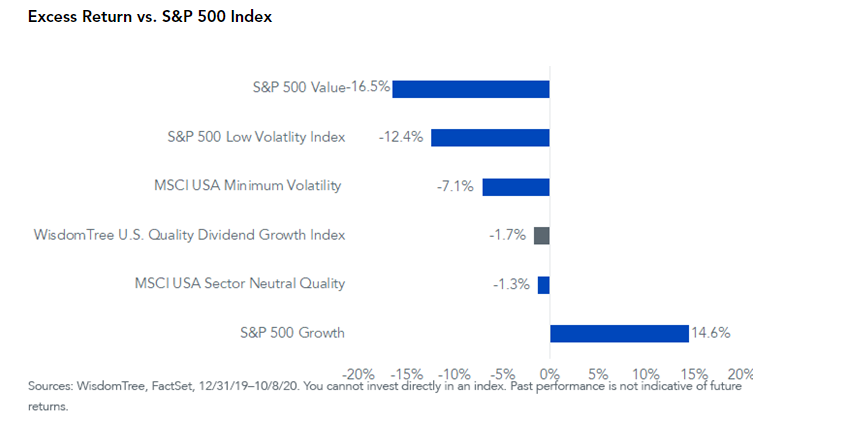

In recent times, buyers have flocked to “low-risk” funds that observe indexes just like the MSCI USA Minimal Volatility and the S&P 500 Low Volatility—including $36.5 billion to such funds between 2017 and 20191.

However these methods haven’t been a ballast in the course of the coronavirus storm. The MSCI USA Minimal Volatility lagged the S&P 500 by 7.1% this 12 months. The S&P Low Volatility has lagged by greater than 12%.

For definitions of phrases within the chart, please go to our glossary.

Development methods, led by expertise shares that benefited from the financial shutdown, have dominated all different elements, with a greater than 3,000 foundation level (bps) unfold between progress and worth.

Remarkably, the WisdomTree U.S. High quality Dividend Development Index solely trailed the S&P 500 by 170 bps this 12 months with out holding 7 of the 10 largest contributors to S&P 500 efficiency—lots of the non-dividend-paying expertise shares.

For buyers involved in regards to the top-heavy, growth-led run within the broad benchmark, our high quality dividend progress technique—which mixes parts of high quality and worth—seems like a pretty different for widespread uncertainty and market volatility.

Initially revealed by WisdomTree, 10/9/20

1Jason Zweig, “Some Buyers Tried to Win by Dropping Much less. They Misplaced Anyway,” Wall Avenue Journal, 9/18/20.

Necessary Dangers Associated to this Article

There are dangers related to investing, together with potential lack of principal. Funds focusing their investments on sure sectors enhance their vulnerability to any single financial or regulatory growth. This may occasionally end in higher share value volatility. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.