China's dominance within the uncommon earth metals trade can carry on fueling the VanEck Vectors Un

China’s dominance within the uncommon earth metals trade can carry on fueling the VanEck Vectors Uncommon Earth/Strategic Metals ETF (REMX). Plenty of the fund’s prime holdings are in China, which additionally provides buyers worldwide publicity.

REMX, which is up over 70% prior to now 12 months alone, seeks to duplicate as carefully as attainable, earlier than charges and bills, the value and yield efficiency of the MVIS® International Uncommon Earth/Strategic Metals Index. The fund usually invests at the very least 80% of its whole belongings in securities that comprise the fund’s benchmark index.

The index consists of firms primarily engaged in quite a lot of actions which can be associated to the manufacturing, refining, and recycling of uncommon earth and strategic metals and minerals.

Talking of momentum, we are able to use technical indicators to substantiate whether or not the uptrend should have legs. With a relative power index (RSI) indicator, REMX is simply above overbought ranges, so momentum is certainly robust.

Nevertheless, a stochastic relative power index (StochRSI) exhibits a degree of 0.349, which is simply above oversold ranges. The 2 opposing indicators might imply REMX nonetheless has room to run, or {that a} drop might happen to check a assist degree of about $73.

What merchants can watch is to see if REMX can breach the excessive of $79.67 made on January 8. If consumers can break that resistance barrier, extra upside could possibly be forward for this uncommon earth metals ETF.

China’s Digital Monopoly

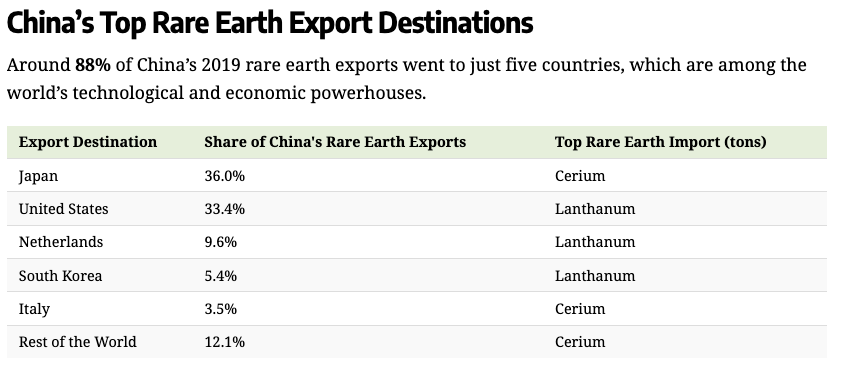

A Visible Capitalist article mentioned China’s sheer dominance within the uncommon earth metals trade. Per the article, “because the world transitions to a cleaner future, the demand for uncommon earth metals is anticipated to just about double by 2030, and nations are in want of a dependable provide chain.”

“China’s digital monopoly in uncommon earth metals not solely provides it a strategic higher hand over closely dependent nations just like the U.S.—which imports 80% of its uncommon earths from China—but in addition makes the provision chain something however dependable,” the article added additional.

For extra information and knowledge, go to the Tactical Allocation Channel.

For extra information and knowledge, go to the Tactical Allocation Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.