By Michael Venuto, Co-founder & CIO, Toroso Investments

Final week, ETF Suppose Tank Contributors Michael Gayed and Mike Venuto traveled to their first in individual funding convention for the reason that starting of the pandemic. The Cash Present occasion introduced traders and thought leaders collectively for 3 days of funding schooling and networking. Michael Gayed was there to debate his intermarket evaluation of the Lumber/Gold ratio; a duplicate of his award-winning white paper could be discovered on SSRN. Mike Venuto was additionally addressing gold within the debate with Adrian Day, on “Crypto vs. Gold.” A clip of the dialogue could be discovered right here. In right now’s ETF Suppose Tank analysis word, we’re sharing among the key factors from the “Crypto vs. Gold” debate.

Inherency

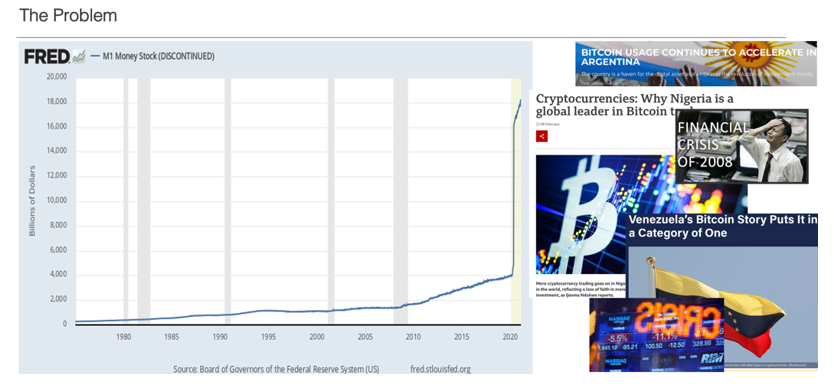

An fascinating issue within the “Crypto vs. Gold” debate is that each search to unravel the same drawback. Nevertheless, few take the time to outline this inherency. Gold was used as an authentic type of foreign money and financial normal, however on account of some deficiencies and the will of governments to print cash, it’s use as medium of change has diminished. Crypto was born out of the monetary disaster of 2008 as a method to separate cash from governments and/or trusted third events. So in the long run, each Crypto and Gold are sought out as options to the same concern of presidency intervention.

[wce_code id=192]

Crypto Attributes

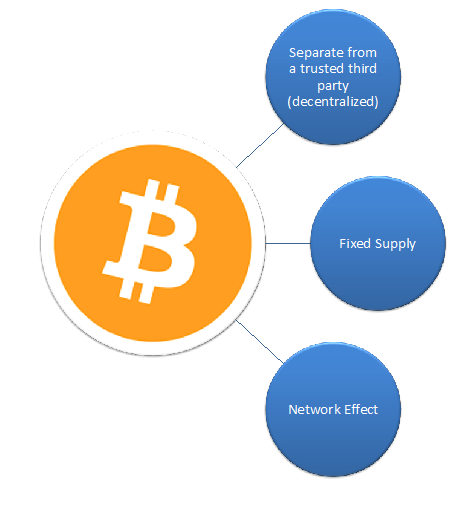

As the primary Crypto-currency, Bitcoin was born in 2009 in response to the monetary disaster. There are three core attributes that help Bitcoin’s adoption as a substitute for fiat cash. The primary two are a part of the code:

- Separate from a trusted third get together (decentralized)

- Mounted Provide

The third attribute is extra of a self-fulfilling paradox, in that the “community impact” has taken maintain. Merely put, the Bitcoin community is now topic to the Lindy Impact:

The Lindy impact is a theorized phenomenon by which the long run life expectancy of some non-perishable issues, like a know-how or an thought, is proportional to their present age. Thus, the Lindy impact proposes the longer a interval one thing has survived to exist or be used within the current, it’s also prone to have an extended remaining life expectancy. Longevity implies a resistance to vary, obsolescence or competitors and better odds of continued existence into the long run.

Wikipedia, Lindy impact, 5/4/21

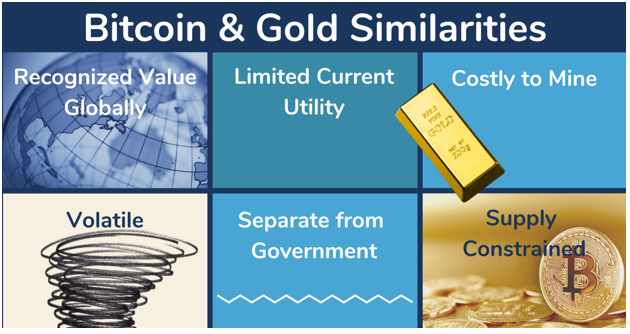

Similarities

As alluded to earlier, Crypto and Gold have some clear similarities, famous within the subsequent chart:

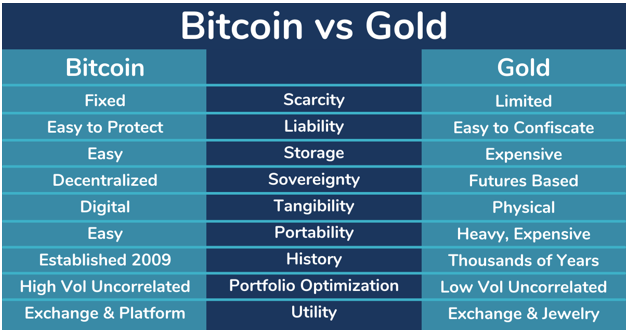

Variations

The variations are fairly stark as nicely. The potential of Crypto far exceeds, in our opinion, the restricted, though traditionally confirmed utility of gold.

Closing Arguments

The true winner of the controversy from allocation stage is that traders ought to contemplate each Gold and Crypto. The fact is that each property are risky and uncorrelated. From a contemporary portfolio concept viewpoint, the return streams of each Gold and Crypto can be utilized to optimize a buy-and-rebalance portfolio. From the viewpoint of a speculator or a futurist, the unknown functions and worth of Crypto and Blockchain know-how far exceed the utility of shiny rocks which can be simply stolen.

Disclosure

The data offered right here is for monetary professionals solely and shouldn’t be thought-about an individualized advice or customized funding recommendation. The funding methods talked about right here will not be appropriate for everybody. Every investor must overview an funding technique for his or her personal explicit state of affairs earlier than making any funding choice.

All expressions of opinion are topic to vary with out discover in response to shifting market situations. Information contained herein from third get together suppliers is obtained from what are thought-about dependable sources. Nevertheless, its accuracy, completeness or reliability can’t be assured.

Examples offered are for illustrative functions solely and never supposed to be reflective of outcomes you possibly can anticipate to realize.

All investments contain danger, together with potential lack of principal.

The worth of investments and the revenue from them can go down in addition to up and traders might not get again the quantities initially invested, and could be affected by adjustments in rates of interest, in change charges, normal market situations, political, social and financial developments and different variable components. Funding entails dangers together with however not restricted to, potential delays in funds and lack of revenue or capital. Neither Toroso nor any of its associates ensures any charge of return or the return of capital invested. This commentary materials is accessible for informational functions solely and nothing herein constitutes a suggestion to promote or a solicitation of a suggestion to purchase any safety and nothing herein needs to be construed as such. All funding methods and investments contain danger of loss, together with the potential lack of all quantities invested, and nothing herein needs to be construed as a assure of any particular end result or revenue. Whereas we’ve gathered the data introduced herein from sources that we imagine to be dependable, we can’t assure the accuracy or completeness of the data introduced and the data introduced shouldn’t be relied upon as such. Any opinions expressed herein are our opinions and are present solely as of the date of distribution, and are topic to vary with out discover. We disclaim any obligation to offer revised opinions within the occasion of modified circumstances.

The data on this materials is confidential and proprietary and will not be used apart from by the supposed consumer. Neither Toroso or its associates or any of their officers or staff of Toroso accepts any legal responsibility in any respect for any loss arising from any use of this materials or its contents. This materials will not be reproduced, distributed or revealed with out prior written permission from Toroso. Distribution of this materials could also be restricted in sure jurisdictions. Any individuals coming into possession of this materials ought to search recommendation for particulars of and observe such restrictions (if any).

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.