By: BCM Funding Staff

By: BCM Funding Staff

February’s retail gross sales losses had been extra extreme than anticipated—with sectors following a well-recognized sample—however have nonetheless managed to develop year-over-year. Manufacturing additionally felt the consequences of final month’s freezing temperatures and underperformed expectations by over 3%. Housing costs in the meantime proceed to soar in a pattern that appears primed to proceed as provide runs worryingly brief. A $1,400 stimulus verify might not make a lot of a dent in a down cost, however is it doing a lot good in a financial savings account? The 10-year UST yield hit a recent 13-month excessive forward of the Fed choice—which Financial institution of America referred to as “some of the crucial occasions for the Fed in a while”—this week, inching nearer to the two% yield many fund managers consider may spark a 10%+ correction in equities. And what lies forward on the worldwide stage as commodities, EM exports, and new waves of Covid all climb increased?

[wce_code id=192]

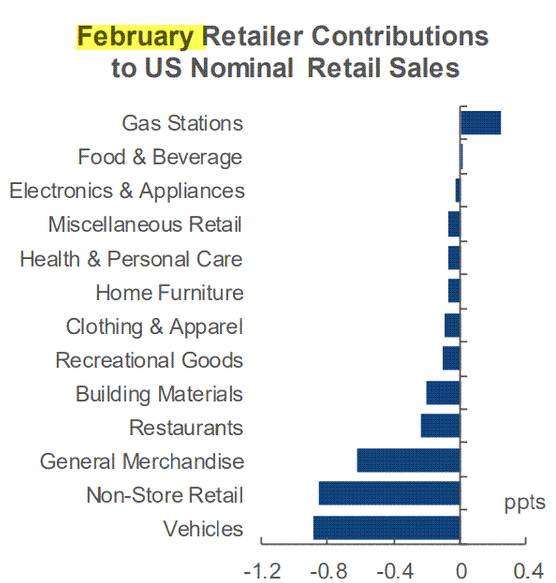

1. February’s deep freeze, along with the Covid hangover, precipitated U.S. retail gross sales to say no by 3% final month. Right here’s the breakout:

Supply: The Day by day Shot, from 3/17/21

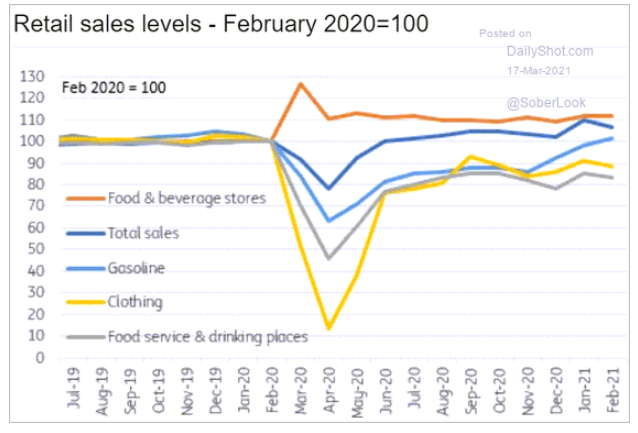

2. However general, retail gross sales are nonetheless increased than in 2020. The Covid issue reveals up once more in clothes and restaurant/bar gross sales:

Supply: The Day by day Shot, from 3/17/21

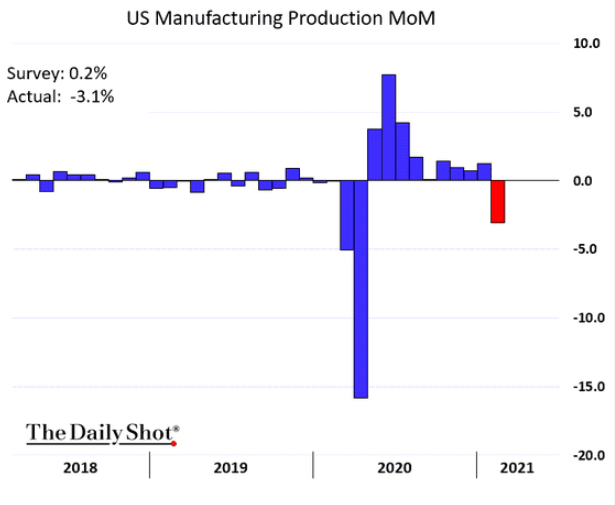

3. The identical climate took its toll on manufacturing as effectively:

Supply: The Day by day Shot, from 3/17/21

4. New houses, after a decade of lackluster housing begins/completions, has precipitated the U.S. to be woefully wanting housing inventory.

Supply: Census Bureau, from 3/17/21

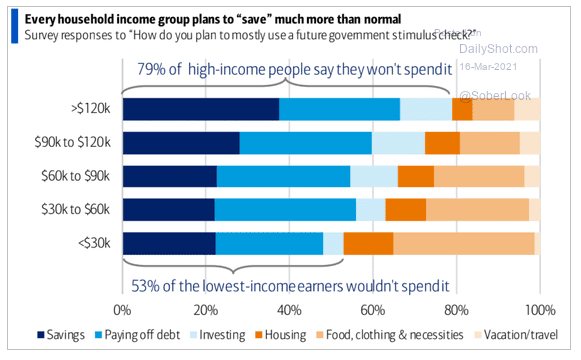

5. Stimu-less? 53-79% of recipients don’t plan to spend their new checks.

Supply: BofA World Analysis, from 3/16/21

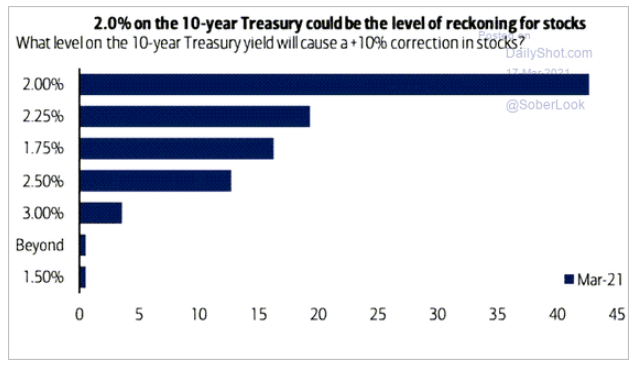

6. A survey of fund managers confirms “Rising yields don’t matter till they do.” With the 10-year UST yield round 1.65%, we’d see who is correct quickly sufficient…

Supply: BofA World Enjoyable Supervisor Survey, from 3/17/21

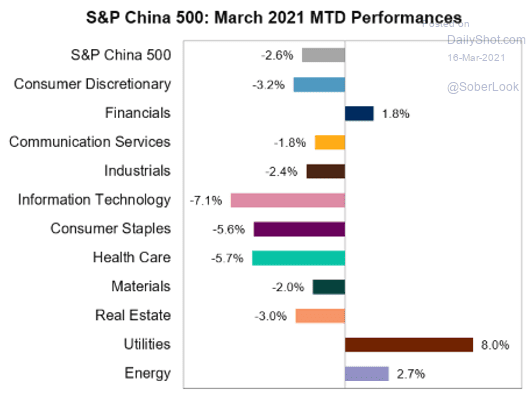

7. To this point in March, China’s inventory market can be taking a look at a potential management change:

Supply: S&P Dow Jones Indices, as of three/12/21

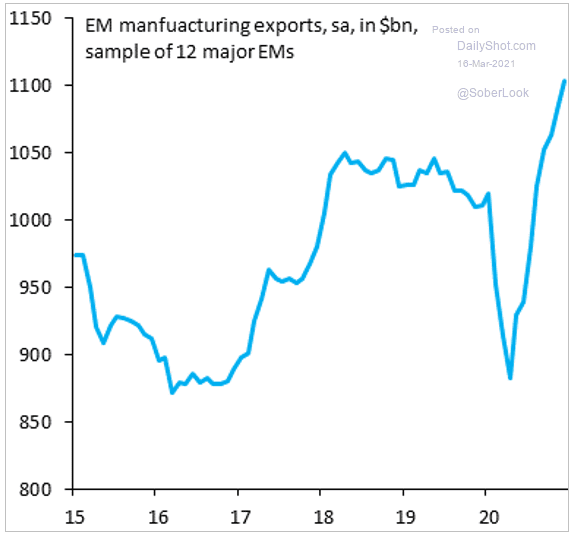

8. Boosted by rising commodity costs, EM exports are hovering:

Supply: The Day by day Shot, from 3/16/21

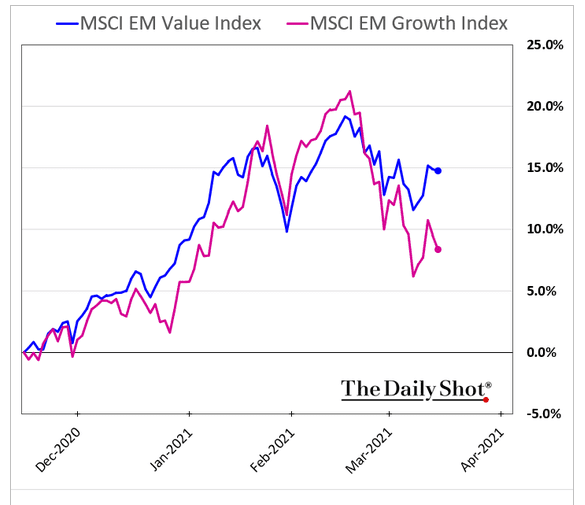

9. But EM inventory costs aren’t following swimsuit. Alternative forward?

Supply: The Day by day Shot, from 3/16/21

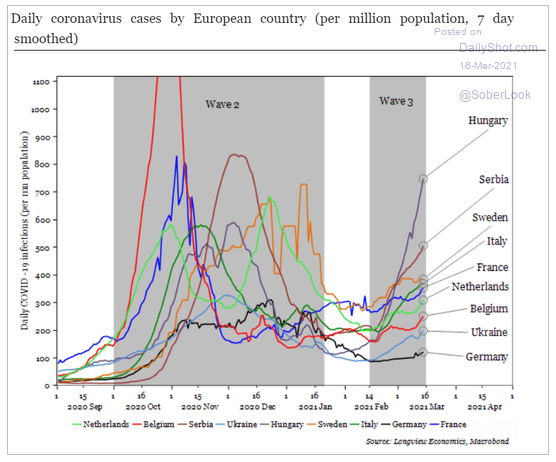

10. Europeans, who usually are method behind in vaccinations, are getting hit with a 3rd wave of Covid. Will this delay their restoration additional? It actually gained’t assist journey…

Supply: The Day by day Shot, from 3/16/21

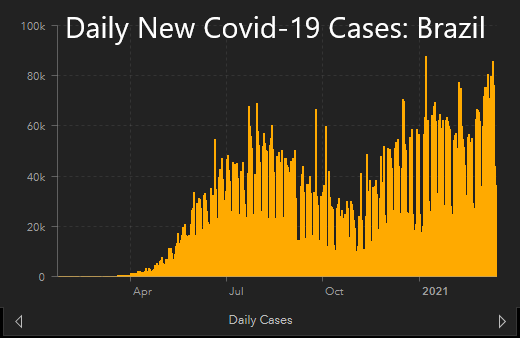

11. Brazil can be in a fierce battle with Covid as their second wave reveals no indicators of waning:

Supply: JHU CSSE , from 3/16/21

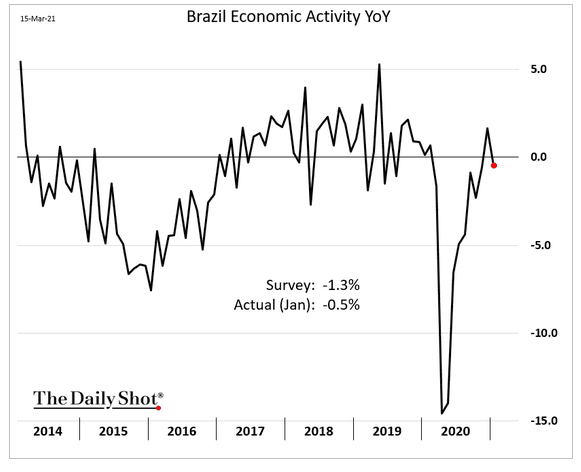

12. Whereas higher than anticipated, their economic system felt the consequences:

Supply: The Day by day Shot, from 3/16/21

This text was contributed by Beaumont Capital Administration Funding Staff, a participant within the ETF Strategist Channel.

For extra insights like these, go to BCM’s weblog at weblog.investbcm.com.

Disclosure: The charts and info-graphics contained on this weblog are usually primarily based on information obtained from third events and are believed to be correct. The commentary included is the opinion of the creator and topic to vary at any time. Any reference to particular securities or investments are for illustrative functions solely and should not supposed as funding recommendation nor are they a suggestion to take any motion. Particular person securities talked about could also be held in shopper accounts. Previous efficiency isn’t any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.