By Matthew Poterba, CFA, Senior Analyst

Highlights:

Latin America stays our favourite Rising Market area. Sharply accelerating earnings, supportive main indicators, and discount valuations make Brazil and Latin America general appear very enticing. On the different excessive, Chinese language equities (our favourite from 2019 to early 2021) seem very unattractive due to peaking earnings progress, costly valuations, and a weak liquidity backdrop.

- Brazil’s earnings progress is now quicker than China’s! Company earnings progress in Brazil just lately surged previous that in We count on progress to peak for each nations within the second half of the yr, however robust main indicators recommend extra resilient progress in Brazil than in China. Authorities insurance policies in China may also hamper future earnings progress.

- Brazil shares stay a big contrarian play. Brazil shares commerce low cost to historical past whereas China shares are We suspect Brazil shares will reprice increased as traders achieve confidence within the restoration.

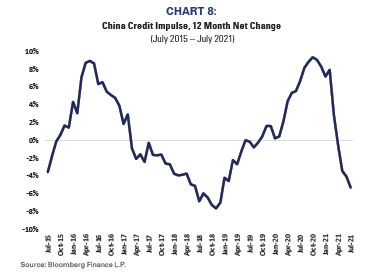

- Liquidity turning unsure. Liquidity inside Brazil and China could possibly be altering and desires shut China’s credit score impulse progress turned detrimental this spring, however current coverage appears extra impartial. Brazil, nonetheless, started to incrementally tighten coverage this yr.

[wce_code id=192]

As the worldwide financial system reopens and as progress matures, traders discover themselves wanting outdoors developed economies for alternatives. One of many challenges, nonetheless, is that though there have been intervals of synchronized progress throughout many Rising Market nations, “EM” consists of 27 totally different nations – every with its personal financial system, set of dangers, and market exposures. As a part of a worldwide fairness allocation, differentiating between Rising Market nations is more and more vital when fundamentals diverge. At present we see alternatives inside Latin America – particularly Brazil – as tailwinds for progress stay supportive and equities nonetheless seem low cost. China, however, is more and more going through headwinds from slowing liquidity and drivers of progress.

Income Development Appears Poised to Diverge in 2H21

Brazilian versus Chinese language earnings progress is only one of a number of areas that spotlight all Rising Market nations aren’t created equal. For instance, Brazilian trailing four-quarter earnings have grown 94% year-on-year and have been accelerating at among the many quickest charges globally, whereas these for Chinese language corporations – nonetheless growing 9% in Q2 – have slowed relative to the remainder of the world. Though it could be simple to dismiss the Brazilian progress dynamic as pushed by 2020 base results, now we have discovered that markets constantly concentrate on the change in earnings progress – “higher” or “worse” – and fewer on whether or not that progress is pushed by simple comparisons.

So, though Chinese language earnings are rising, and we count on their progress charge to peak subsequent quarter within the mid-20%s, the steep declines in 2020 earnings of Brazilian corporations have supercharged 2021 progress charges, which we count on to additional speed up and stay effectively above 100% by way of year-end. Additional, in 1Q22 – by which era the straightforward comparisons from 2020 earnings may have rolled out – analysts count on comparatively stronger earnings progress of Brazilian corporations (43% year-on-year) as in comparison with Chinese language corporations (17% year-on-year).

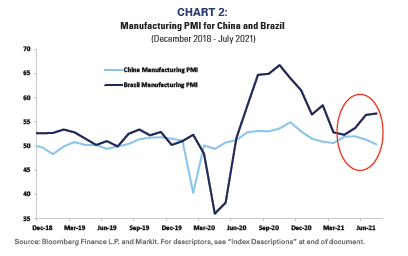

Seeking to the long run, main indicators of earnings seem resilient in Brazil however weakening in China. Most just lately, 6 of the Eight indicators (or 75%) in our Brazil earnings cycle mannequin had been optimistic, whereas 7 of the 11 (or 64%) in our China earnings cycle mannequin had been optimistic. For example, our work exhibits that Buying Supervisor Indices (PMIs) of producing corporations have traditionally supplied perception into the path of future earnings progress (Chart 1). Notice inflections in China’s Manufacturing PMI have traditionally led to inflections in its earnings cycle. Lately, manufacturing PMIs for China have clearly peaked, whereas these for Brazil have just lately reaccelerated (Chart 2), suggesting earnings progress for Chinese language corporations shall be reasonable whereas Brazilian corporations might even see robust progress proceed.

Brazil Shares Stay Out-of-Favor

Along with figuring out revenue outlooks, our analysis has proven that sentiment is usually a key driver of fairness returns as effectively. With Brazilian shares lagging the returns of world equities during the last fifteen months, traders nonetheless seem skeptical of Brazil’s COVID restoration, as proven in Chart 3.

This pessimistic outlook could clarify why Brazilian shares proceed to commerce at depressed ahead price-to-earnings multiples relative to broader Rising Markets, and particularly China (Chart 4). Chinese language shares, conversely, are nonetheless wealthy relative to their historic common, even regardless of the current sell-off in Chinese language markets. We suspect that is partly on account of traders extrapolating China’s restoration and their markets behaving as a secure haven in the course of the onset of COVID-19.

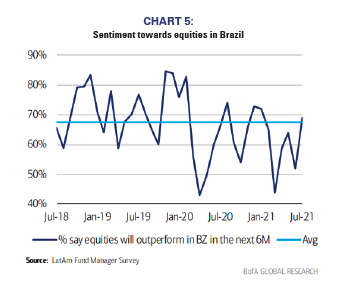

investor sentiment from one other angle, we word that BofA Analysis’s month-to-month Fund Managers’ Survey exhibits traders have largely been much less optimistic on Brazilian shares for the reason that onset of the pandemic. The July survey famous that traders have grow to be incrementally extra constructive on Brazilian shares, however even with that enchancment sentiment remains to be solely simply at common ranges (Chart 5).

We anticipate that as Brazilian corporations ship on robust earnings progress, traders will grow to be more and more constructive on their fairness prospects. China’s rebound, however, seems largely priced in, and any earnings disappointment could trigger traders to reprice these shares.

Altering Currents in Liquidity

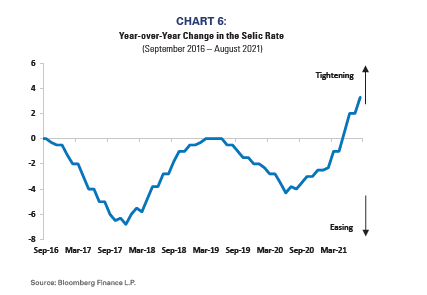

Over the past 18 months Brazil met the pandemic head on with sizeable fiscal stimulus and a dramatic easing of its coverage charge (the Selic), as proven in Chart 6. These coverage strikes helped stabilize, and extra just lately, have supplied a tailwind to progress. China, however, enacted fewer pro-growth insurance policies throughout 2020 and 2021, partly as a result of their home financial system was broken much less by the pandemic. Historical past means that coverage tends to work with lengthy lags, and as such we count on Brazil’s easing a yr in the past to proceed to positively reverberate all through the nation, notably in distinction to China.

Extra just lately, the tempo of Brazil’s easing has slowed, with the Banco Central do Brasil (BCB) starting to boost the Selic in March to fight sharply accelerating inflation and following by way of with three subsequent charge hikes. When the BCB adjusts the Selic charge up or down, it’s successfully altering the price of credit score. Though the BCB has been elevating charges, the present Selic stage stays fairly accommodative relative to historical past. Nonetheless, the BCB’s shift from easing in 2020 to tightening in 2021 could pose a headwind to progress towards year-end and subsequent yr.

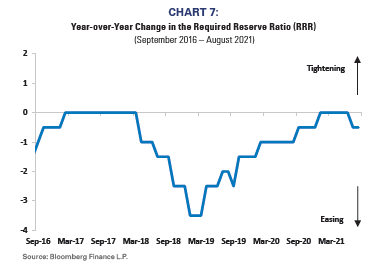

Turning now to China, the newest coverage transfer has been one in every of slight easing reasonably than tightening. Till just lately, the PBOC had left the Required Reserve Ratio (RRR) unchanged, however on July ninth it diminished the speed by 50 foundation factors for all banks (Chart 7)1. Though this variation ought to improve the amount of credit score accessible, historical past would recommend lowering the RRR by this magnitude is unlikely to have a considerable impression on credit score availability and lending.

This coverage transfer additionally comes on the heels of a number of quarters of slowing credit score progress, as evident from China’s slowing and detrimental 12m change in its credit score impulse, which peaked in October 2020 (Chart 8)2. We see the RRR discount as an indication that tighter credit score over the previous few quarters could have stymied the expansion outlook greater than desired. We don’t count on sustained easing by the PBOC within the rapid future as they continue to be targeted on de-risking the monetary sector, and due to this fact, tight credit score possible stays a headwind to accelerating progress within the coming quarters.

After all, we might be remiss if we didn’t additionally point out the current market volatility and coverage information out of China. Inside the final month, a number of corporations in China’s property market are more and more displaying indicators of stress, authorities reforms had been introduced on corporations in China’s tutoring sector, and Chinese language regulators took motion towards a number of high-profile corporations. The path of China’s coverage is a crucial determinant of the outlook for its market, particularly to the extent it positively or negatively impacts the earnings, liquidity, or sentiment backdrop.

Fundamentals Driving Efficiency

The brighter outlook for company earnings progress, cheaper valuations, and a extra constructive credit score backdrop in Brazil over China spotlight that it might be advantageous to be tactical inside Rising Market equities – particularly now and through final yr. As we said beforehand, not all Rising Market nations are created equal – certainly, in 2021 to date, there was over a twelve-percentage-point unfold within the efficiency of Brazil (+3.12%) and China (-9.58%) equities.Three That is all that extra vital in occasions of diverging nation fundamentals.

Don’t miss out on future RBA Insights, subscribe right this moment.

To be taught extra about RBA’s disciplined method to macro investing, please contact your native RBA consultant.

INDEX DESCRIPTIONS:

The next descriptions, whereas believed to be correct, are in some instances abbreviated variations of extra detailed or complete definitions accessible from the sponsors or originators of the respective indices. Anybody involved in such additional particulars is free to seek the advice of every such sponsor’s or originator’s web site.

The previous efficiency of an index will not be a assure of future outcomes.

Every index displays an unmanaged universe of securities with none deduction for advisory charges or different bills that would scale back precise returns, in addition to the reinvestment of all earnings and dividends. An precise funding within the securities included within the index would require an investor to incur transaction prices, which might decrease the efficiency outcomes. Indices aren’t actively managed and traders can not make investments immediately within the indices.

Brazil: The MSCI Brazil Index. The MSCI Brazil Index is a free-float-adjusted, market-capitalization-weighted index designed to measure the equity-market efficiency of Brazil.

China: The MSCI Chinal Index. The MSCI China Index is a free-float-adjusted, market-capitalization- weighted index designed to measure the equity-market efficiency of China.

Rising Markets: The MSCI Rising Markets Index. The MSCI Rising Markets Index is a free- float-adjusted, market-capitalization-weighted index designed to measure the equity-market efficiency of Rising Markets.

EM Latin America: The MSCI Rising Markets Latin America Index. The MSCI Rising Markets Latin America Index is a free-float-adjusted, market-capitalization-weighted index designed to measure the equity-market efficiency of EM Latin America.

About Richard Bernstein Advisors

Richard Bernstein Advisors LLC is an funding supervisor specializing in long-only, international fairness and asset allocation funding methods. RBA runs ETF asset allocation SMA portfolios at main wirehouses, unbiased dealer/sellers, TAMPS and on choose RIA platforms. Moreover, RBA companions with a number of corporations together with Eaton Vance Company and First Belief Portfolios LP, and at present has $14.7 billion collectively below administration and advisement as of July 31st, 2021. RBA acts as sub‐advisor for the Eaton Vance Richard Bernstein Fairness Technique Fund, the Eaton Vance Richard Bernstein All‐Asset Technique Fund and in addition affords earnings and distinctive theme‐oriented unit trusts by way of First Belief. RBA can be the index supplier for the First Belief RBA American Industrial Renaissance® ETF. RBA’s funding insights in addition to additional details about the agency and merchandise might be discovered at www.RBAdvisors.com.

Nothing contained herein constitutes tax, authorized, insurance coverage or funding recommendation, or the advice of or a suggestion to promote, or the solicitation of a suggestion to purchase or spend money on any funding product, car, service or instrument. Such a suggestion or solicitation could solely be made by supply to a potential investor of formal providing supplies, together with subscription or account paperwork or varieties, which

embody detailed discussions of the phrases of the respective product, car, service or instrument, together with the principal danger elements which may impression such a purchase order or funding, and which needs to be reviewed fastidiously by any such investor earlier than making the choice

to speculate. RBA data could embody statements regarding monetary market traits and/or particular person shares, and are based mostly on present market circumstances, which can fluctuate and could also be outdated by subsequent market occasions or for different causes. Historic market traits aren’t dependable indicators of precise future market habits or future efficiency of any explicit funding which can differ materially, and shouldn’t be relied upon as such. The funding technique and broad themes mentioned herein could also be inappropriate for traders relying on their particular funding targets and monetary scenario. Info contained within the materials has been obtained from sources believed to be dependable, however not assured. It is best to word that the supplies are supplied “as is” with none categorical or implied warranties. Previous efficiency will not be a assure of future outcomes. All investments contain a level of danger, together with the danger of loss. No a part of RBA’s supplies could also be reproduced in any type, or referred to in another publication, with out categorical written permission from RBA. Hyperlinks to appearances and articles by Richard Bernstein, whether or not within the press, on tv or in any other case, are supplied for informational functions solely and on no account needs to be thought-about a advice of any explicit funding product, car, service or instrument or the rendering of funding recommendation, which should at all times be evaluated by a potential investor in session together with his or her personal monetary adviser and in mild of his or her personal circumstances, together with the investor’s funding horizon, urge for food for danger, and

skill to face up to a possible lack of some or all of an funding’s worth. Investing is topic to market dangers. Buyers acknowledge and

settle for the potential lack of some or all of an funding’s worth. Views represented are topic to vary on the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC doesn’t undertake to advise you of any adjustments within the views expressed herein.

© Copyright 2021 Richard Bernstein Advisors LLC. All rights reserved. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com