By Stephen McBride We’re simply days away from one of the v

By Stephen McBride

We’re simply days away from one of the vital anticipated elections in historical past. And I’m afraid hundreds of thousands of traders are going to waste money and time attempting to “guess” who’ll win and the way it will impression markets.

The reality is, good traders gained’t waste a second worrying about which celebration will win. In at the moment’s essay, I’ll present you why, and share a few of my high shares to personal proper now.

I might fill the subsequent 5 pages with knowledge factors about how shares carried out below totally different presidents. I’ve even learn theories saying it’s finest to purchase shares on October 1 of the second 12 months of a presidential time period and promote on December 31 of the fourth 12 months.

I’ve executed all of the boring be just right for you. I’ve studied the info again so far as 1897, and one factor is crystal clear: There isn’t some golden, predictable sample in the case of presidents and the inventory market.

Shares have SOARED when each Republicans and Democrats have been in energy. Shares have TANKED when each Republicans and Democrats have been in energy.

The media does a terrific job at highlighting the Grand Canyon-sized variations between either side. You’ll hear how Biden needs to fund the Inexperienced New Deal, and Trump doesn’t. Or that Trump needs to beef up the army, whereas Biden needs to slash protection spending.

That is all simply noise. Ignore it, as a result of it’s a distraction from what actually strikes the needle for shares.

The one factor that issues

Let’s return to 2008 for a second. It was the monetary disaster. Shares have been in the course of their worst 12 months for the reason that Nice Despair. It was additionally an election 12 months which noticed the White Home flip from Republican to Democrat as Obama swept to victory. Obama was considered as probably the most socialist president since FDR, and plenty of good of us predicted his insurance policies would crash markets.

Political pollster Dick Morris predicted: “The inventory market would go loopy if [Obama] was elected.” Former CNBC host Charlie Gasparino stated: “It’s laborious to see how a President Obama can be good for Wall Road. Shares would tank.”

And two months forward of the election, near half of respondents in a Bloomberg survey stated an Obama win can be dangerous for monetary markets. Actually, my buddy who hated Obama’s insurance policies bought each inventory in his portfolio. And he didn’t contact shares once more for years. Huge mistake.

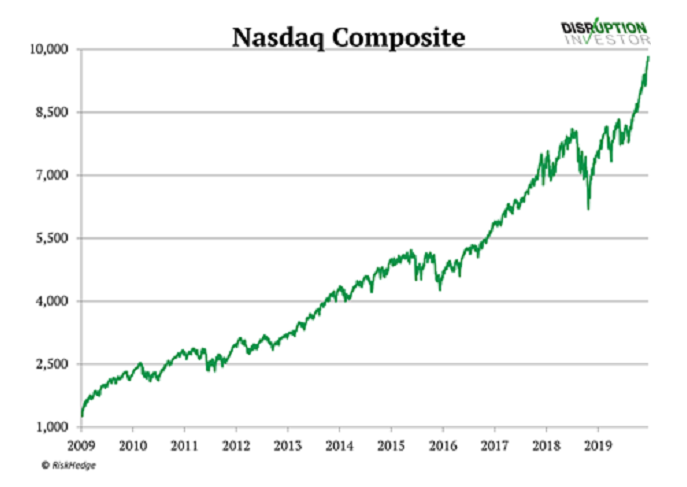

In the meantime, traders who ignored all this political theater obtained the final giggle. From the day Obama took workplace till election day 2016, the Nasdaq climbed 245%. The ‘08 disaster was such a financially traumatic occasion that shares might have simply gone nowhere for years. How might the market rip larger when the world economic system was on the brink?

It’s possible you’ll bear in mind the US authorities pumped $1 trillion of stimulus into the economic system to maintain the wheels turning. America’s central financial institution, the Federal Reserve, “created” one other $1.four trillion, which was funneled into US banks.

On the time, this was completely unprecedented. The US authorities had by no means thrown this amount of cash on the economic system earlier than. Many good folks have been satisfied it might warp the monetary system and switch the US greenback into rest room paper.

As a substitute, that trillion-dollar wall of cash launched the longest inventory bull market of all time. From early 2009 till March 2020, the Nasdaq handed traders 498% income:

That’s the efficiency of the “common” inventory. There are tons of of disruptors that surged 1,000%+ on this interval. In different phrases, regardless of a “socialist” taking the White Home, the monetary disaster, the housing bust, and a limp economic system, shares rocketed to all-time highs. And right here’s the factor: 2008’s unprecedented simple cash insurance policies are small potatoes in comparison with what’s occurring at the moment.

Trump needs to borrow and spend trillions. Biden needs to borrow and spend trillions. Each political events are bent on doing all the things they’ll to spur the economic system larger with limitless spending and financial rocket gasoline. And regardless of who wins this November, they’ll proceed to spend and borrow cash at an unprecedented price. And that’s nice information for the particular “disruptor shares.”

Disruptor shares are “politically insensitive”

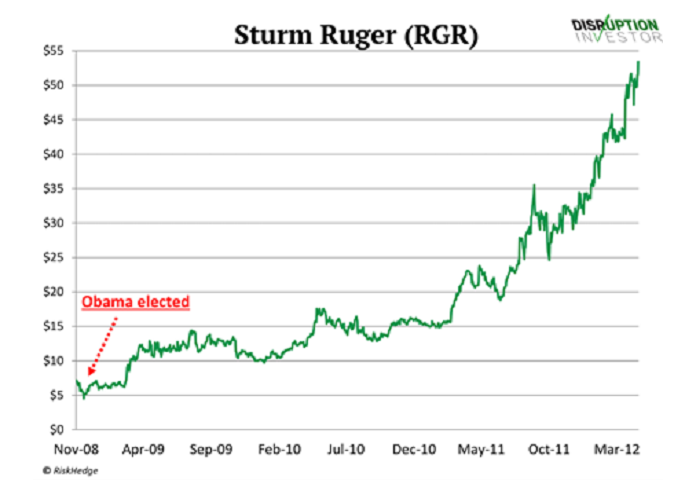

Have you ever ever owned a “politically delicate” inventory? These are corporations that soar or crater primarily based on who sits within the White Home. For instance, do you bear in mind when Obama signed legal guidelines limiting gun gross sales? Seems he was the perfect gun salesman in America for six years working. Firearms firm Sturm Ruger (RGR) surged 1,300% after Obama’s election:

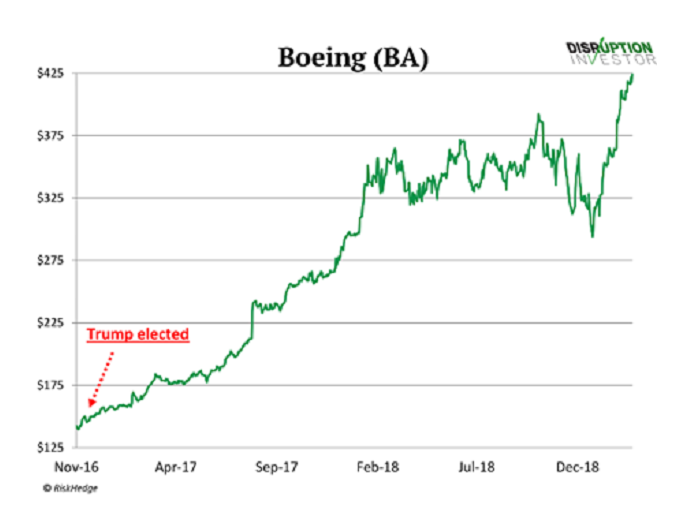

When Trump gained in 2016, he promised to rebuild the US army. That lit a fireplace below the biggest protection contractor, Boeing (BA):

In brief, some corporations dwell and die on election outcomes. Shopping for these kind of shares is like flipping a coin. Wouldn’t you moderately personal corporations that carry out properly regardless of who’s president?

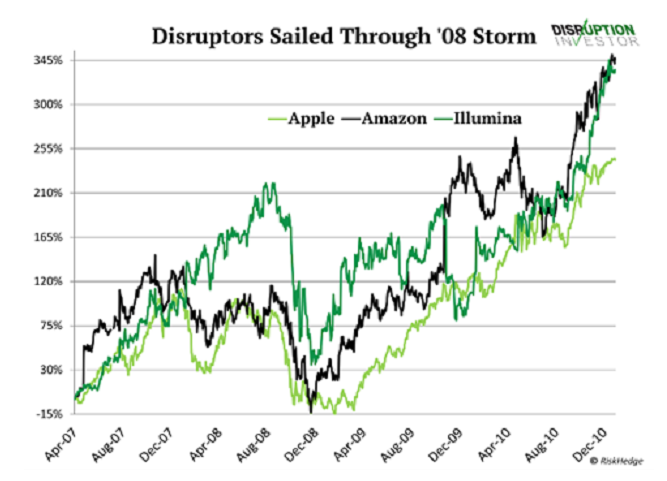

The world’s finest disruptors are completely impervious to elections and the economic system. Check out how Amazon, Apple, and DNA mapper Illumina sped by means of the 2008 election and monetary disaster:

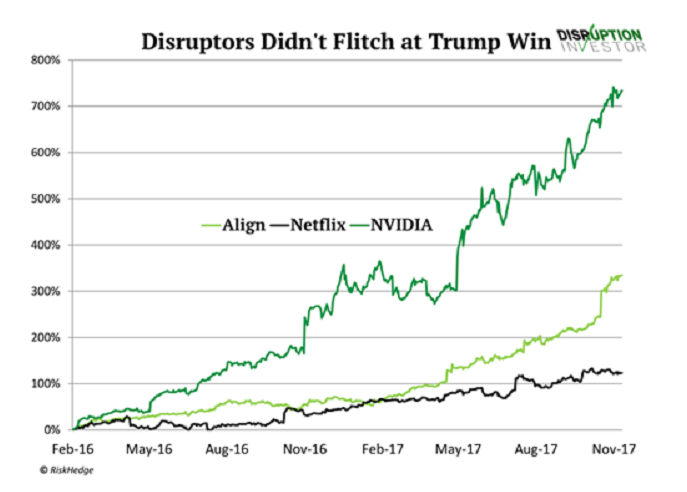

In 2016, Netflix, NVIDIA, and dental disruptor Align didn’t flinch at Trump’s election.

Right here Are the Shares I Suggest Right this moment

This election gained’t make an iota of distinction for cost disruptors PayPal (PYPL), Mastercard (MC), and Visa (V).

The usage of “soiled” money is falling off a cliff proper now. As a substitute, of us are whipping out their Credit cards and Visa playing cards on the checkout. PayPal and its Venmo “app” proceed to eat the lunch of stodgy outdated banks.

In simply the previous three months, Individuals despatched $37 billion to 1 one other, without spending a dime, by means of Venmo. Actually, 60 million+ of us use Venmo to ship and obtain cash at the least as soon as a month. That’s 60 million individuals who aren’t paying for financial institution wires anymore. Do you suppose these disruptions will reverse relying on who wins on November 3? Not an opportunity.

Pc imaginative and prescient can also be untouched by politics. Dozens of disruptors are utilizing NVIDIA (NVDA)’s highly effective chips to show computer systems to “see.” World-class scientists and engineers are inventing groundbreaking disruptions like self-driving automobiles and superhuman medical doctors. Do you suppose they’ll cease fixing these tough issues due to the US election? Not an opportunity.

Whether or not the Republicans or Democrats are in energy, these creators will nonetheless change the world. In case you haven’t but, contemplating including PYPL, MC, V, and NVDA to your portfolio at the moment. They need to thrive regardless of who’s within the White Home for the subsequent 4 years.

The Nice Disruptors: Three Breakthrough Shares Set to Double Your Cash”

Get my newest report the place I reveal my three favourite shares that can hand you 100% features as they disrupt complete industries. Get your free copy right here.

Initially printed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.