By Roman Chuyan, CFA, Mannequin Capital

By Roman Chuyan, CFA, Mannequin Capital Administration LLC

- In the present day’s client worth inflation numbers have been staggeringly excessive.

- Excessive inflation will probably be adopted by rising market rates of interest (yields).

- I speculate as soon as once more why I believe this may show to be the proverbial pin to prick this bubble.

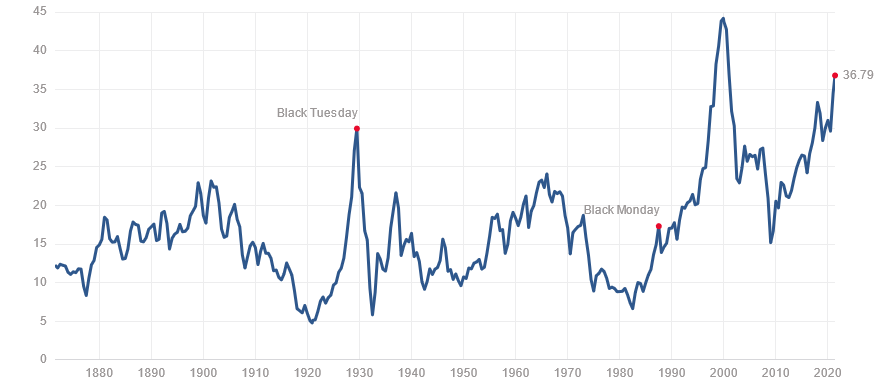

The shares market rally since April-2020 took it to an excessive valuation. It’s a bubble, pure and easy, as I’ve been writing since February. Cause doesn’t apply to bubbles – as an alternative, they’re sustained by crowd mentality. Nonetheless, all bubbles burst – the larger the bubble, the extra extreme the crash. This bubble in shares (and in bonds, actual property, and so on.) may be very large, in no small half because of the Fed’s insurance policies. By most measures, the market valuation is at its highest in not less than 150 years, as I detailed in my current articles (see right here and right here). As soon as once more, the Shiller’s P/E ratio, which controls for earnings cyclicality, is at its highest in not less than 150 years (aside from the dot-com bubble in 1999-2000):

[wce_code id=192]

However, when will the bubble burst? Timing is tough to find out prematurely, and a burst wants a catalyst. We started pointing to rising inflation and market rates of interest (yields) since March as potential catalyst, and it turned clear by early Could that inflation was poised to leap. Lastly, in my Monday’s article I anticipated inflation to leap considerably as quickly as this week (Could 12th).

In in the present day’s replace, I overview the most recent inflation numbers, and speculate as soon as once more why I believe it can show to be the proverbial pin to prick this bubble. It’s nonetheless early to speak about how a lot draw back is anticipated – as soon as it’s clear that the bubble has burst, it is going to be the subject for future articles – keep tuned. I can even largely miss the explanation why we predict inflation is rising.

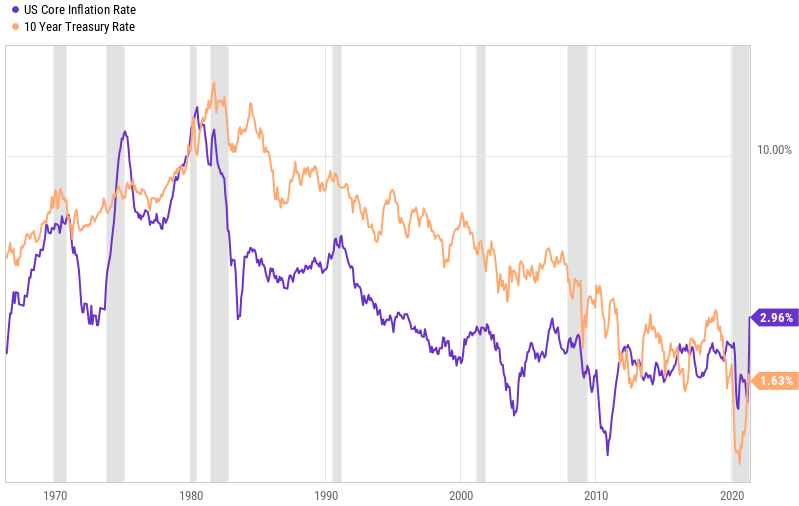

First, allow us to be aware an vital relationship that predicates my argument – one between inflation (and inflation expectations) and market yields (say, the 10-year Treasury yield). Such relationship held, albeit considerably loosely, since Treasury yields have been floated within the early 1960’s. More often than not (however not now), the yield exceeds inflation, to compensate buyers:

Supply: Ycharts, shaded are recessions.

It’s believable that the Fed’s new (since 2008) bond-buying behavior forces yields to remain nicely beneath inflation. Nonetheless, it is a double-edged sword as a result of the Fed shopping for bonds quantities to money-creation, which can probably drive inflation even greater. This risk apart, we assume that yields will rise from right here and comply with inflation greater.

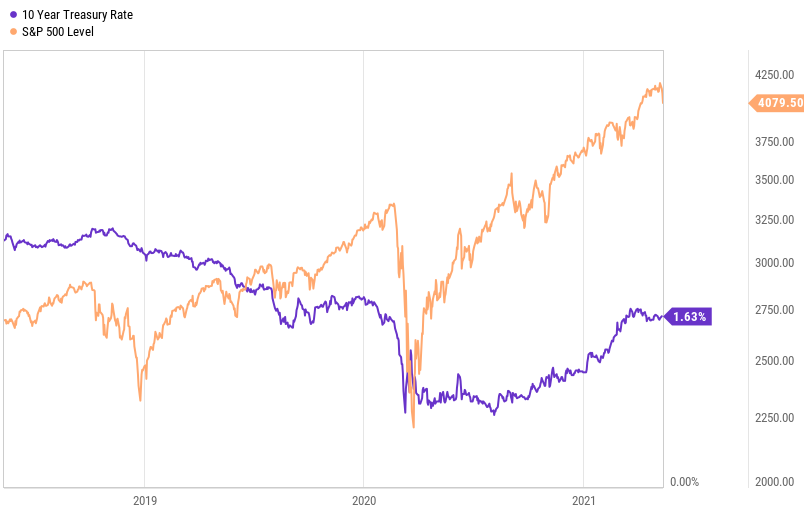

Rising yields would be the proverbial pin. Greater yields have traditionally had a detrimental impact on the inventory market. Market volatility has already elevated this week, and I believe inventory buyers are rightfully involved. Recall that shares started to drop the second the 10-year Treasury yield rose above 3.2% in October of 2018 (see chart beneath). The priority was, and stays, that greater charges would burden the monetary system attributable to monumental debt. This time, the “too-high” yield degree will probably be decrease, as a result of there’s much more debt and we’ve been conditioned by near-zero charges in 2020-21. What’s that vital degree? My guess is pretty much as good as yours, however I’d put on the spherical variety of 2% on the 10-year Treasury. The 10-year is at present buying and selling slightly below 1.7%.

Supply: Ycharts

The patron worth index (CPI) numbers for April reported this morning have been staggeringly excessive within the context of low inflation lately. The CPI price jumped to 4.2% nicely above 3.6% anticipated, and the best price in 12.5 years, since 2008. Core CPI which excludes meals and power jumped to three%, additionally nicely above expectations and its highest since 1996 (24 years):

Supply: Ycharts.com

Needless to say the sooner consensus expectations (3.6% for CPI) already mirrored the “base impact,” or the “transitory” nature of inflation that the Fed officers have lately quoted. So, this leap in inflation was sudden, and non-transitory (everlasting).

I’ll solely briefly point out the explanations for this leap in inflation. At a excessive degree, it’s attributable to lowered provide of products (uncooked supplies, laptop chips, and so on.) coupled with rising demand for them. The federal government’s insurance policies have created each. The present administration’s restrict-and-regulate insurance policies trigger lowered manufacturing. The beneficiant federal stimulus funds prompted a number of million folks to go away the labor power, which created labor shortages and lowered manufacturing. On the demand facet, the trillions in these funds stored demand for items excessive (consider the housing growth, for instance). A end result – self-reinforcing shortages and worth will increase.

Uncooked materials costs skilled an enormous leap previously 12 months: the CRB Commodity Index is up 70%, and the CRB Non-Power index is up 50%. Beneath are some 10-year charts that illustrate the magnitude of the commodity rally. Lumber is probably the most excessive, with its worth now 3-5 occasions the best ranges seen in 40 years of obtainable historical past. Most different commodities – for instance industrial metals (copper, iron) and foodstuffs (soybeans, wheat, pork) – rose sharply previously yr to 10-year or all-time highs.

Supply: Tradingeconomics.com

Supply: Tradingeconomics.com

About Mannequin Capital Administration LLC

Mannequin Capital Administration LLC (“MCM”) is an unbiased SEC-registered funding advisor, and relies in Wellesley, Massachusetts. Using its basic, forward-looking method to asset allocation, MCM offers asset administration providers that assist different advisors implement its dynamic funding methods designed to cut back vital draw back threat. MCM is offered to advisors on AssetMark, Envestnet, SMArtX, and different SMA/UMA platforms, however will not be affiliated with these corporations.

Notices and Disclosures

- This analysis doc and the entire data contained in it (“MCM Analysis”) is the property of MCM. The Data set out on this communication is topic to copyright and will not be reproduced or disseminated, in entire or partially, with out the categorical written permission of MCM. The logos and repair marks contained on this doc are the property of their respective house owners. Third-party knowledge suppliers make no warranties or representations regarding the accuracy, completeness, or timeliness of the information they supply and shall not have legal responsibility for any damages regarding such knowledge.

- MCM doesn’t present individually tailor-made funding recommendation. MCM Analysis has been ready with out regard to the circumstances and aims of those that obtain it. MCM recommends that buyers independently consider specific investments and methods, and encourages buyers to hunt the recommendation of an funding adviser. The appropriateness of an funding or technique will depend upon an investor’s circumstances and aims. The securities, devices, or methods mentioned in MCM Analysis will not be appropriate for all buyers, and sure buyers will not be eligible to buy or take part in some or all of them. The worth of and revenue out of your investments might fluctuate due to adjustments in securities/devices costs, market indexes, or different components. Previous efficiency will not be a assure of future efficiency, and never essentially a information to future efficiency. Estimates of future efficiency are primarily based on assumptions that will not be realized.

- MCM Analysis will not be a suggestion to purchase or promote or the solicitation of a suggestion to purchase or promote any safety/instrument or to take part in any specific buying and selling technique. MCM doesn’t analyze, comply with, analysis or suggest particular person corporations or their securities. Staff of MCM might have investments in securities/devices or derivatives of securities/devices primarily based on broad market indices included in MCM Analysis.

- MCM will not be performing as a municipal advisor and the opinions or views contained in MCM Analysis usually are not supposed to be, and don’t represent, recommendation throughout the which means of Part 975 of the Dodd-Frank Wall Road Reform and Shopper Safety Act.

- MCM Analysis relies on public data. MCM makes each effort to make use of dependable, complete data, however we make no illustration that it’s correct or full. We now have no obligation to let you know when opinions or data in MCM Analysis change.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- “Mannequin Return Forecast” for 6-month S&P 500 return is MCM’s measure of attractiveness of the U.S. fairness market obtained by making use of MCM’s proprietary statistical algorithm and historic knowledge, however will not be promissory, and, by itself, doesn’t represent an funding suggestion. Mannequin Return Forecasts have been calculated and utilized by MCM to its analysis and funding course of in actual time starting from 2012. For durations previous to Jan 2012, the outcomes are “back-tested,” i.e., obtained by retroactively making use of MCM’s algorithm and historic knowledge out there in Jan 2012 or thereafter. Supply for the S&P 500 precise returns: S&P Dow Jones.

- Index returns referenced in MCM Analysis, if any, are gross of any advisory charges, fund administration charges, and buying and selling bills. Fund or ETF returns referenced, if any, are gross of advisory charges and buying and selling bills. Returns will likely be lowered by charges and bills incurred.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.