Tthis is nonetheless a case for rising markets equities, although that forest is tough to see via the timber of China’s regulatory danger.

There’s additionally nonetheless a case for rising markets dividends. Traders can entry these payouts whereas minimizing publicity to the susceptible Chinese language web and know-how shares with the WisdomTree Rising Markets Excessive Dividend Fund (NYSEArca: DEM).

DEM’s distribution yield of 5.70% clearly stands out, however that is removed from the alternate traded fund’s solely favorable trait. Amongst DEM’s eye-catching traits which can be related in the present day is the fund’s 15% weight to China. That is lower than half of the burden allotted to that nation within the MSCI Rising Markets Index. DEM additionally has some sector-level perks.

“WisdomTree’s excessive dividend Index has under-weight allocations to the businesses—principally within the Data Know-how, Communication Providers and Client Discretionary sectors—which have been the principle targets of China’s regulatory crackdown,” notes WisdomTree analyst Matt Wagner.

DEM can be tethered to rebounding worth shares – a development that unfold to rising markets this yr.

DEM’s underlying index “has additionally been over-weight within the worth sectors like Financials and Supplies which have been beneficiaries of an enhancing world financial system and a rally in commodity costs,” provides Wagner.

These two sectors mix for half the fund’s roster. Other than an nearly 14% tech weight, the majority of which does not contain China, most of DEM’s sector exposures are both cyclical or defensive. Apparently, whereas China is by far the most important creating financial system and its web and know-how shares have been stellar performers till not too long ago, DEM has a longtime historical past of outpacing broader rising markets benchmarks.

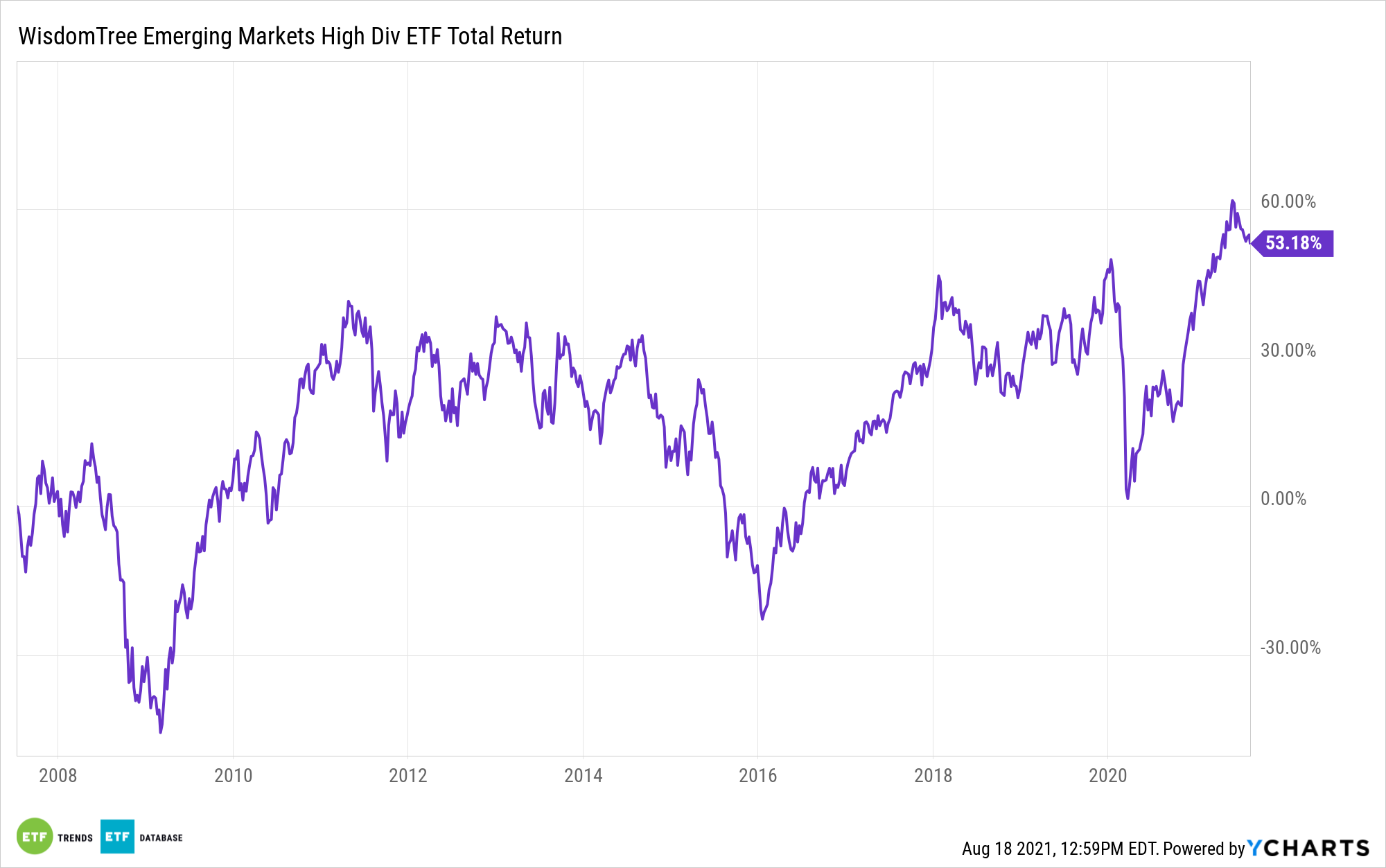

The WisdomTree Rising Markets Excessive Dividend Index, DEM’s underlying benchmark, has topped the MSCI Rising Markets Index courting again to 2007. In different phrases, traders are getting paid to prune China publicity and embrace dividends.

“The outperformance was achieved with much less danger over the total interval, albeit with comparable volatility to the benchmark in newer years,” in accordance with Wagner. “We predict this strategy to concentrating on high quality dividend payers can present an answer for traders concerned about enhancing potential earnings for portfolios, as an energetic administration resolution, and/or to faucet into the next inflation thesis, given its tilts to the Supplies, Financials and Actual Property sectors.”

For extra information, data, and technique, go to the Dividend Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.