Intellia Therapeutics (NTLA) CEO John Leonard believes that gene-editing remedy may come to market “very, very quickly,” in response to an interview on CNBC’s Closing Bell, after information broke that CRISPR-based medication was lately utilized in a systemic supply to a human in a breakthrough trial.

The trial, sponsored by Intellia and Regeneron, a biotech firm, concerned treating a uncommon illness through an IV infusion. Beforehand, CRISPR expertise had been in a position for use by eradicating cells from the physique, genetically manipulating them, after which reintroducing them.

CRISPR is a gene modifying method that includes slicing focused DNA and genes to deal with illnesses. A profit to CRISPR therapy is that as a result of it’s designed to focus on one particular gene, the dangers of unintended effects and adversarial reactions is way smaller.

As with every therapy, it’s “subjected to the usual kinds of scientific trials that any drug or gene remedy can be studied underneath, so we’re within the early phases of that,” defined Leonard.

“CRISPR itself will be broadly utilized, the problem is getting it to the actual genes that trigger illness,” he added.

The expertise may very well be ground-breaking for treating illnesses which might be primarily based off of a singular gene. Illnesses primarily based on a number of genes can be tougher, and can take extra time.

Nonetheless, that is “a serious advance within the gene modifying house,” mentioned Leonard.

Intellia Inventory Soars

With the announcement of the profitable trial with Regeneron, Intellia the inventory worth has risen 90% prior to now week. ETFs holding the inventory have additionally jumped.

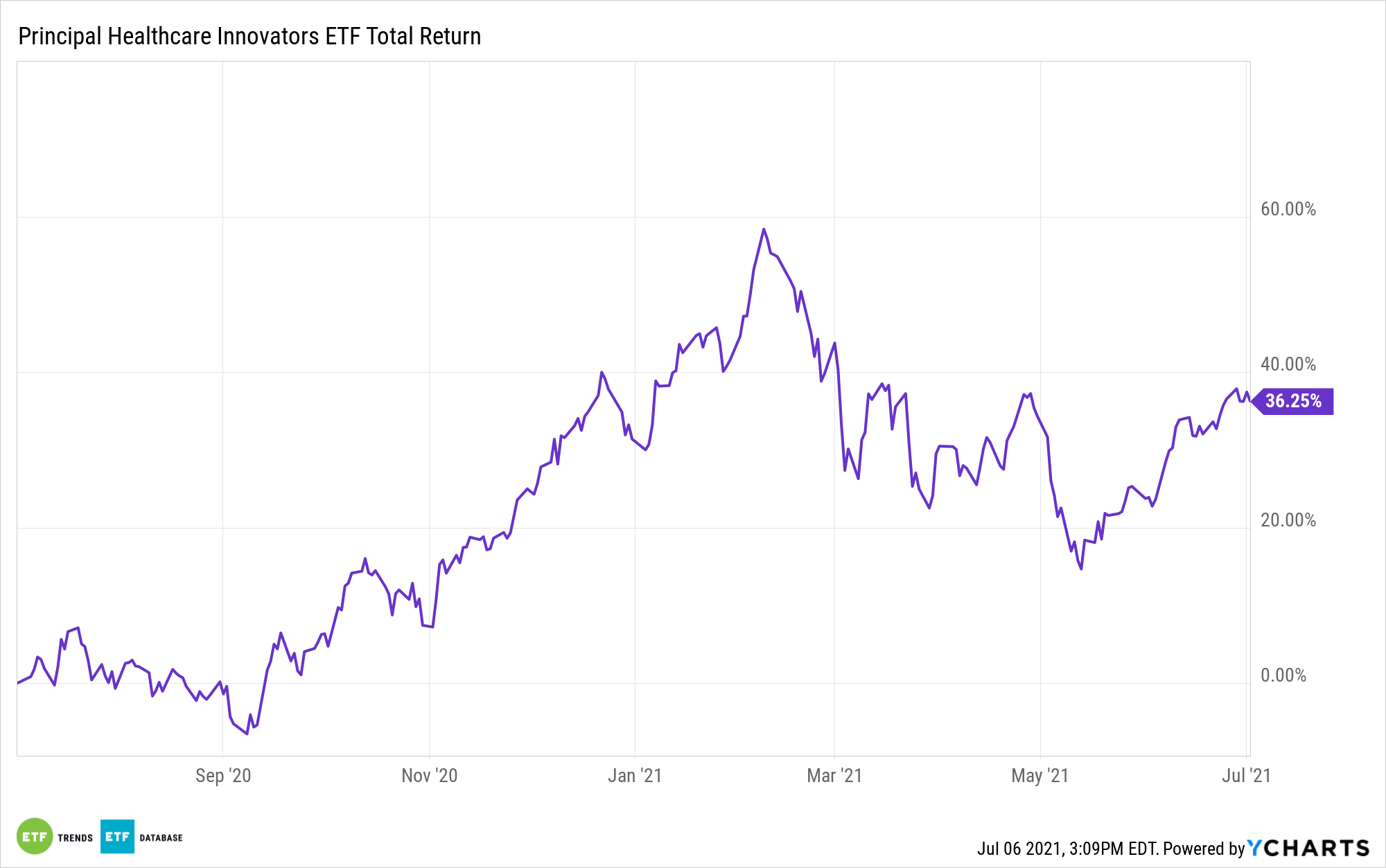

The Principal Healthcare Innovators Index ETF (BTEC), which tracks the Nasdaq Healthcare Innovators Index, holds small- and mid-cap U.S. healthcare corporations.

The fund has 1.53% of its portfolio weighted to Intellia.

BTEC ranks the highest 150-200 corporations by earnings evaluation and rating, then weights every by market cap, as much as a cap of three%.

Different corporations held by the ETF embrace Teledoc Well being Inc (TDOC), a telemedicine and digital healthcare firm, at 2.61%, and Actual Sciences Corp (EXAS), a molecular sciences firm that targets early stage cancers, at 2.71%.

BTEC has web belongings of $178 million and carries an expense ratio of 0.42%.

For extra information, info, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.