Video sport equities and trade

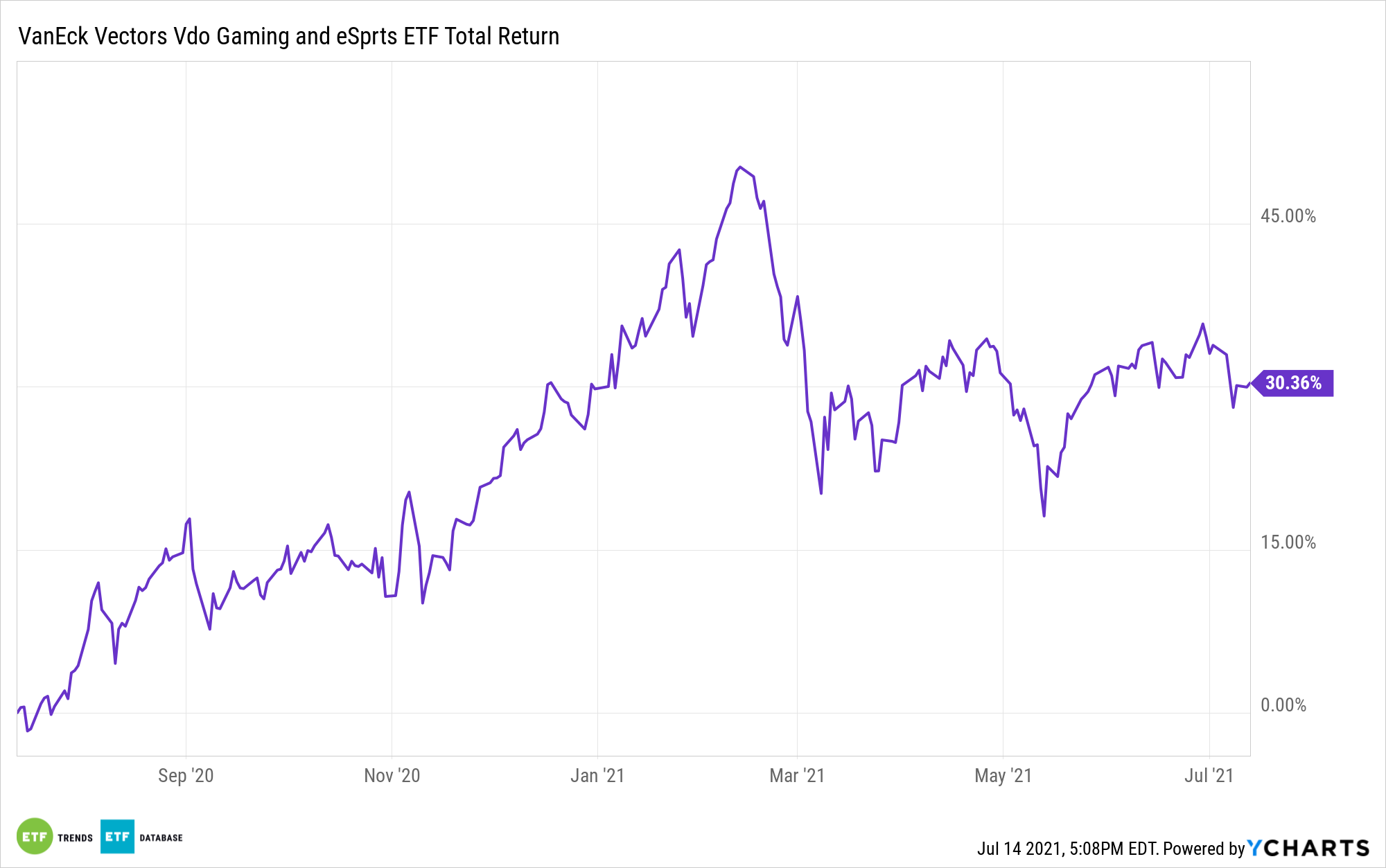

Video sport equities and trade traded funds just like the VanEck Vectors Video Gaming and eSports ETF (NASDAQ: ESPO) have been among the many prime beneficiaries of worldwide lockdowns, however that outlook could also be altering.

That is not essentially the case. In actual fact, the outlook for the online game business is as brilliant because it’s ever been, however traders ought to take into account selectivity within the house.

“Numerous lockdown orders from governments all over the world triggered by the Covid-19 pandemic have proved a boon to videogame corporations, as individuals caught with little else to do turned to interactive leisure. However as restrictions ease within the U.S., some publishers, reminiscent of Digital Arts (ticker: EA), could fare higher than others, reminiscent of Roblox (RBLX), in line with analysts,” stories Max Cherney for Barron’s.

These shares mix for six.4% of the ESPO lineup.

Evaluating ESPO Alternatives

EA, one of many largest online game publishers on the planet, publishes a few of the business’s most venerable franchises, together with FIFA, Madden, the Stars Wars collection of video games, and Apex Legends. A lot of these and different EA franchises characteristic common, extremely anticipated installments, a few of that are coming later this 12 months. Even with that, the inventory remains to be cheap relative to friends.

BMO Capital Markets analyst Gerrick Johnson says EA “trades at a reduction to its friends—Activision, Take-Two, and others—fetching 18 occasions fiscal 2023 per-share earnings, in contrast with the remainder of the group, which trades at 23 occasions ahead earnings,” in line with Barron’s.

ESPO has one other benefit: it allocates over 17% of its weight to semiconductor makers NVIDIA (NASDAQ: NVDA) and Superior Micro Units (NASDAQ: AMD). These are sensible exposures for a online game ETF as a result of NVIDIA and AMD are two of the most important producers of chips for gaming customers and graphics processing items (GPUs) for gaming computer systems.

Nonetheless, these exposures additionally lever ESPO to the worldwide chip scarcity, which is sending semiconductor shares larger this 12 months, in addition to two shares Wall Avenue is generally bullish on. Final week, Oppenheimer raised its worth goal on NVIDIA whereas Goldman Sachs lifted its forecast on AMD. NVIDIA, ESPO’s largest holding, is up 55.11% year-to-date.

For extra information and data, go to the Past Fundamental Beta Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.