Despite some worth tumbles over

Despite some worth tumbles over the previous week, traders stay bullish on gold. Inflation stays a priority for a lot of and gold is especially well-positioned to thrive within the present financial situations. The mining sector is benefiting from gold’s ongoing surge, which has made mining ETFs a preferred vacation spot for investor capital.

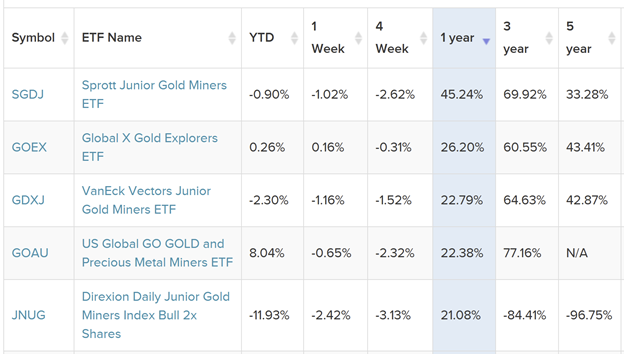

Over the previous twelve months, the mining ETF with the best returns is the Sprott Junior Gold Miners ETF (SGDJ). It’s up 45.24%, simply finest within the subject:

Supply: Etfdb.com

SGDJ tracks small cap gold mining firms, specializing in small firms with robust income progress and worth momentum, two components which have traditionally predicted long-term inventory efficiency.

The portfolio, which holds roughly 30 to 40 shares at any given time, tracks the Solactive Junior Gold Miners Customized Elements Index. It’s rebalanced semi-annually, guaranteeing that it reacts to grab alternatives in a well timed style and retains its holdings optimized.

Though small cap shares are inclined to have extra volatility, additionally they boast bigger upside.

With the potential for high-value discoveries, gold mining is an business that may change in a second. Small- and mid-sized firms are sometimes wolfed up by the bigger gamers, creating loads of alternatives for traders to reap large rewards.

Below SGDJ’s Hood: The High three Holdings

The largest present holding for the Sprott Junior Gold Miners ETF is Nice Bear Sources. Nice Bear Sources made an enormous discovery two years in the past, which continues to herald important income for the agency.

At 4.82%, the next-largest holding in SGDJ is Skeena Sources Restricted, a Canadian firm which accomplished a share consolidation final week. Skeena has a number of websites in Canada’s well-known “Golden Triangle” area. The corporate’s inventory worth has risen significantly over the previous 12 months, buying and selling at $5.40 a 12 months in the past and at $14.38 as we speak.

Centamin PLC is the third-biggest holding in SGDJ, with a stake of 4.38%. The corporate had a tough preliminary go of the pandemic, with its largest web site proving unsafe simply because the COVID disaster worsened.

Nonetheless, the gold mining group appear to be poised to surge as its mines come again on-line and the vaccine rollout continues.

For extra information, info, and technique, go to the Gold & Silver Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.