Rising Treasury yields are pressuring valuable meta

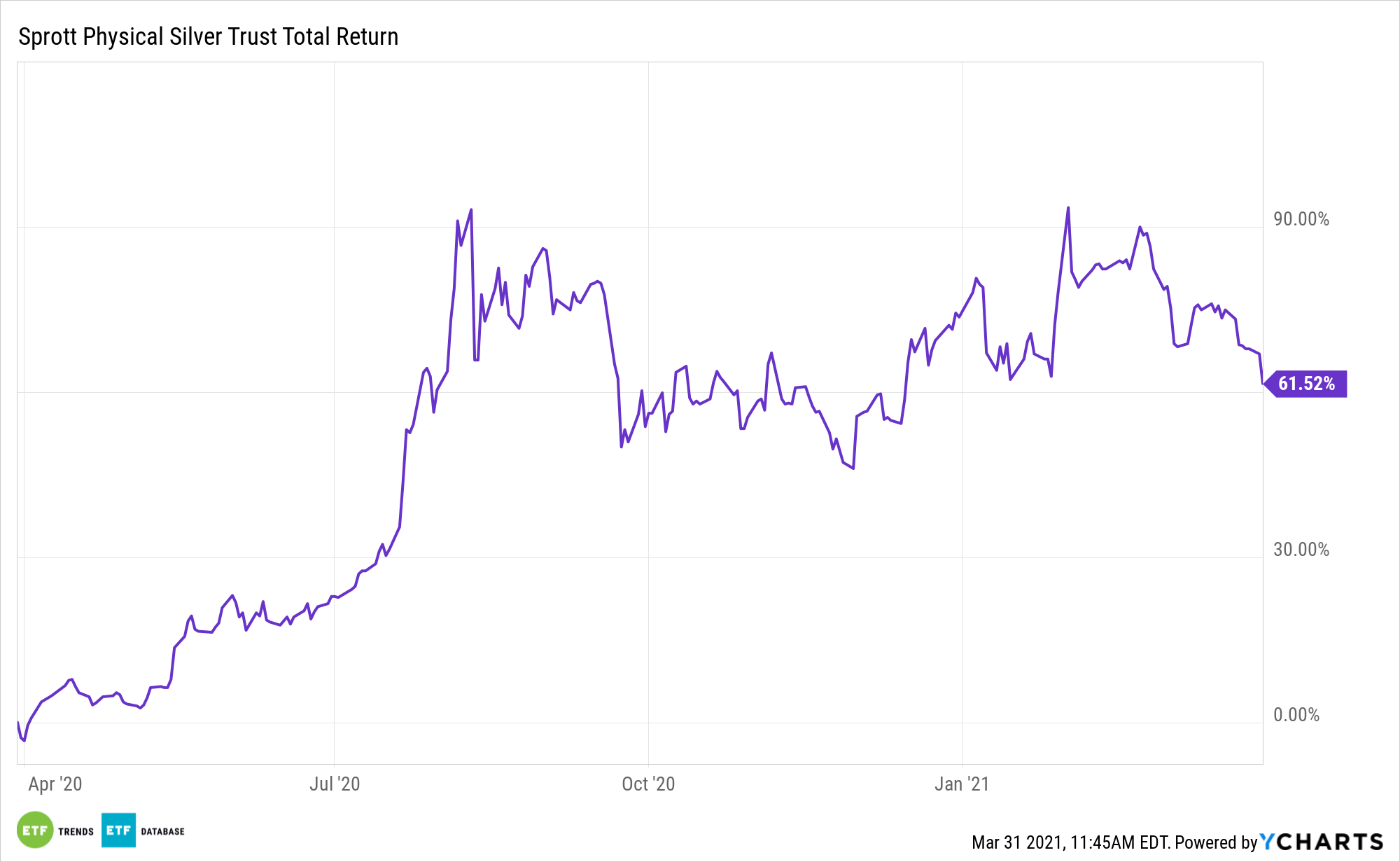

Rising Treasury yields are pressuring valuable metals and belongings such because the Sprott Bodily Silver Belief (NYSEArca: PSLV), however silver can rise anew.

That is the view of some market observers that consider latest weak point within the valuable metallic is a chance to become involved with silver.

“Silver is poised to shine within the coming years as a result of very sturdy basic components. Crucial amongst them is the continuing Inexperienced (eco-friendly) revolution,” in line with In search of Alpha. “These initiatives require big portions of silver, which contrasted with the declining mine manufacturing, signifies that silver will probably be having fun with favorable demand/provide dynamics for a few years.”

See additionally: Is Silver Changing into the Subsequent Goal of Quick Squeezers?

PSLV is a closed-end fund that lets buyers redeem massive blocks of shares in trade for supply of silver bullion.

The Belief usually trades at a premium to internet asset worth (NAV). Closed-end funds can see massive premiums and reductions, whereas trade traded funds have an arbitrage characteristic that tends to maintain costs far more in line. PSLV does possess some distinctive advantages nonetheless, and silver is gaining momentum as long-term thought.

Photo voltaic Adoption Will Regular Silver Demand

Rising photo voltaic adoption will play a job in boosting silver costs and demand.

“Round 100 million silver ounces are used yearly for photovoltaics alone. That represents 10% of annual world provide and that quantity is predicted to develop. Because of the political and social strain, using renewable vitality sources reminiscent of silver-powered photo voltaic panels are going to rise contributing to the regular demand for that metallic,” in line with In search of Alpha.

Not solely is clear vitality consumption rising, however prices are additionally lowering, which in flip bolsters adoption. Moreover, coal manufacturing is slumping, including to the virtuous cycle for different vitality ETFs. Declining photo voltaic prices are anticipated to lure extra company and residential clients into photo voltaic investing.

“Furthermore, given silver’s function within the technological worth chain, it appears probably that eventually, some well-known buyers of the finance or tech world will probably be interested in it (even Warren Buffet owned silver within the 1990s). Whole annual provide of silver is value round 25 billion {dollars} at present costs. That may be a drop within the ocean of liquidity because the Fed alone printed a couple of trillion {dollars} inside final 12 months. A small rotation by one or a couple of massive buyers into silver may trigger costs to skyrocket,” concludes In search of Alpha.

For extra information, info, and technique, go to the Gold & Silver Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.