Silver costs are poised to surge 30% this 12 months as world demand for the metallic will increase, in response to a brand new report from The Silver Institute.

Demand suffered final 12 months, however a late value surge put silver at $20.55/oz, a 27% enhance over 2019’s annual common and the best silver has been priced since 2013. The report’s authors venture a mean annual silver value this 12 months of $27.30/oz, although the metallic may doubtlessly go even larger, as much as $32/oz.

In 2020, silver benefited from its standing as a protected haven for traders apprehensive in regards to the pandemic’s results available on the market. However with the economic system beginning to gear up, it’s silver’s utility as an industrial metallic that has offered help for its rising value.

Final March, the gold to silver ratio was 127:1, which many consultants noticed as an indication that it was considerably undervalued.

Regardless of this, nevertheless, general silver demand declined by 10% final 12 months, right down to 896.1 million ounces. Industrial demand fell 5%, although robust demand for silver bars and cash helped bodily demand strike a four-year excessive of 200.5 million ounces.

India’s market was a notable exception. Demand from the nation, which has traditionally been one of many largest customers of gold and silver, utterly collapsed final 12 months, going from 57 million ounces in 2019 to simply 9 million.

Rebounding Silver Demand

The World Silver Survey expects silver demand to extend this 12 months by 15% globally, as much as 1.03 billion ounces.

“Final 12 months was distinctive,” Phillip Newman, managing director of Metals Focus in London, advised MarketWatch. He went on to say that this 12 months “will simply stay a robust 12 months,” with the 150 million ounces in ETP funding development “nonetheless fairly sizable.”

A technique traders can entry bodily silver and benefit from potential value will increase is thru the Sprott Bodily Silver Belief (PSLV), which holds London Good Supply bars custodied on the Royal Canadian Mint. Every share of the fund represents a fraction of possession in these bars.

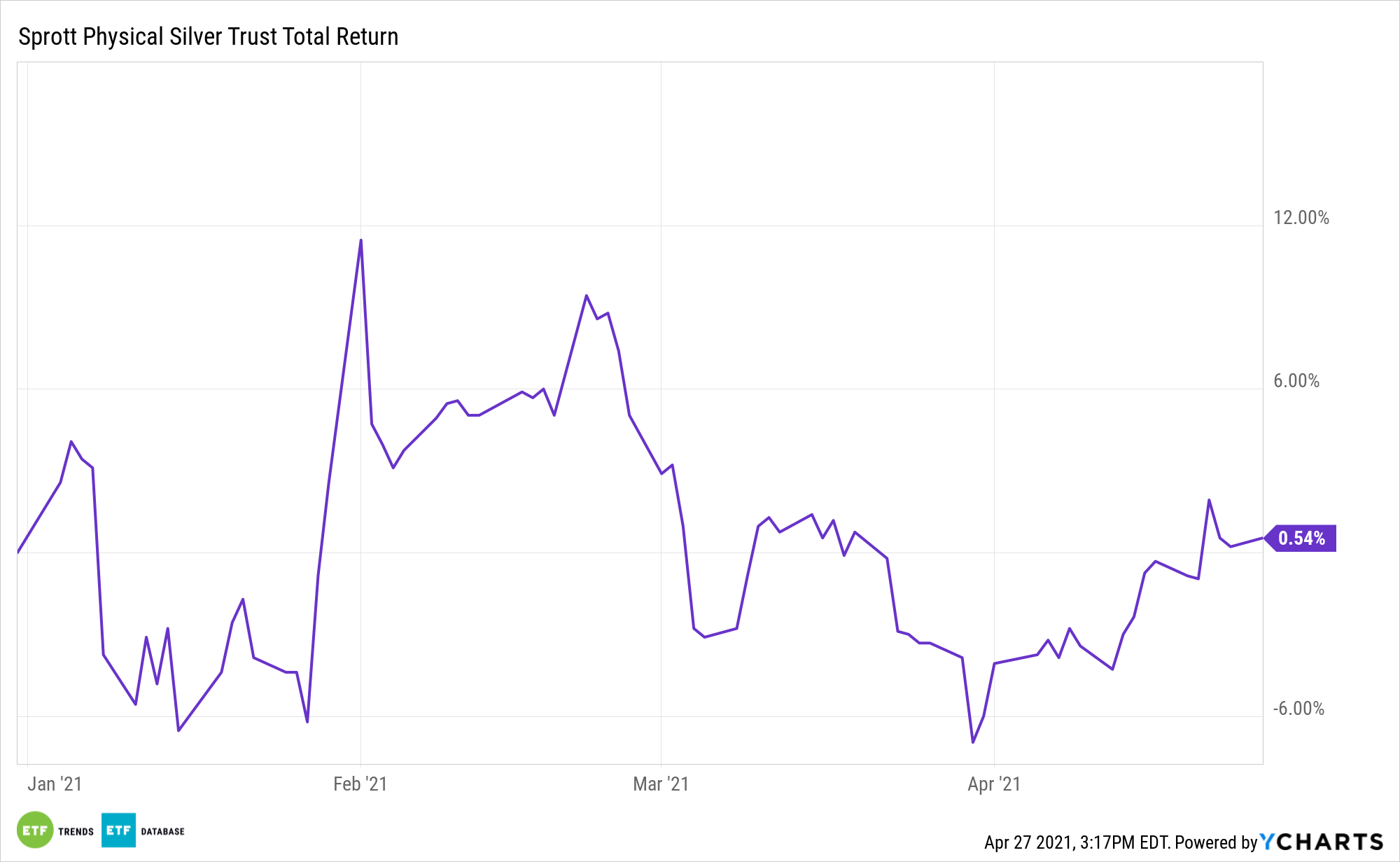

As of January 31st, 2021, PSLV held 98,208,680 ounces of silver price $2.52 billion {dollars}, in response to the fund’s most up-to-date factsheet. Yr thus far, PSLV is up 0.54%, inserting it among the many high 5 performing ETFs in ETFdb’s Valuable Metals class.

For extra information, info, and technique, go to the Gold & Silver Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.