With shares buying and selling close to their all-time highs because the economic system continues to bounce again from the pandemic lows of 2020, Wednesday represents a big day for fairness merchants and inventory index ETF buyers: the 125th birthday of the Dow Jones Industrial Common.

The Dow Jones, which debuted over a century in the past with simply 12 members, has climbed to just about 35,000, because it presently trades simply off its finest ranges traditionally. The famed index’s finest yr was in 1915, when the benchmark rallied 81.7%. In the meantime, the index’s biggest losses got here within the post-Melancholy yr 1931, when it sank 52.7%.

The index of these first 12 corporations closed its first buying and selling day, Could 26, 1896, at simply 40.94. The group was made up of corporations like Normal Electrical Co., a still-prominent member of the index, in addition to bygone corporations like American Cotton Oil and Distilling & Cattle Feeding.

Every year the Dow has gained a median of seven.69%, scoring 1,464 document closes, in accordance with Dow Jones Market Information. It first scrambled above 100 in 1906, crested 1000 in 1972, and completed above 10000 in 1999.

For ETF buyers taking a look at investing in Dow shares outdoors of the well-known SPDR Dow Jones Industrial Common ETF Belief (DIA), there are a variety of choices to select from.

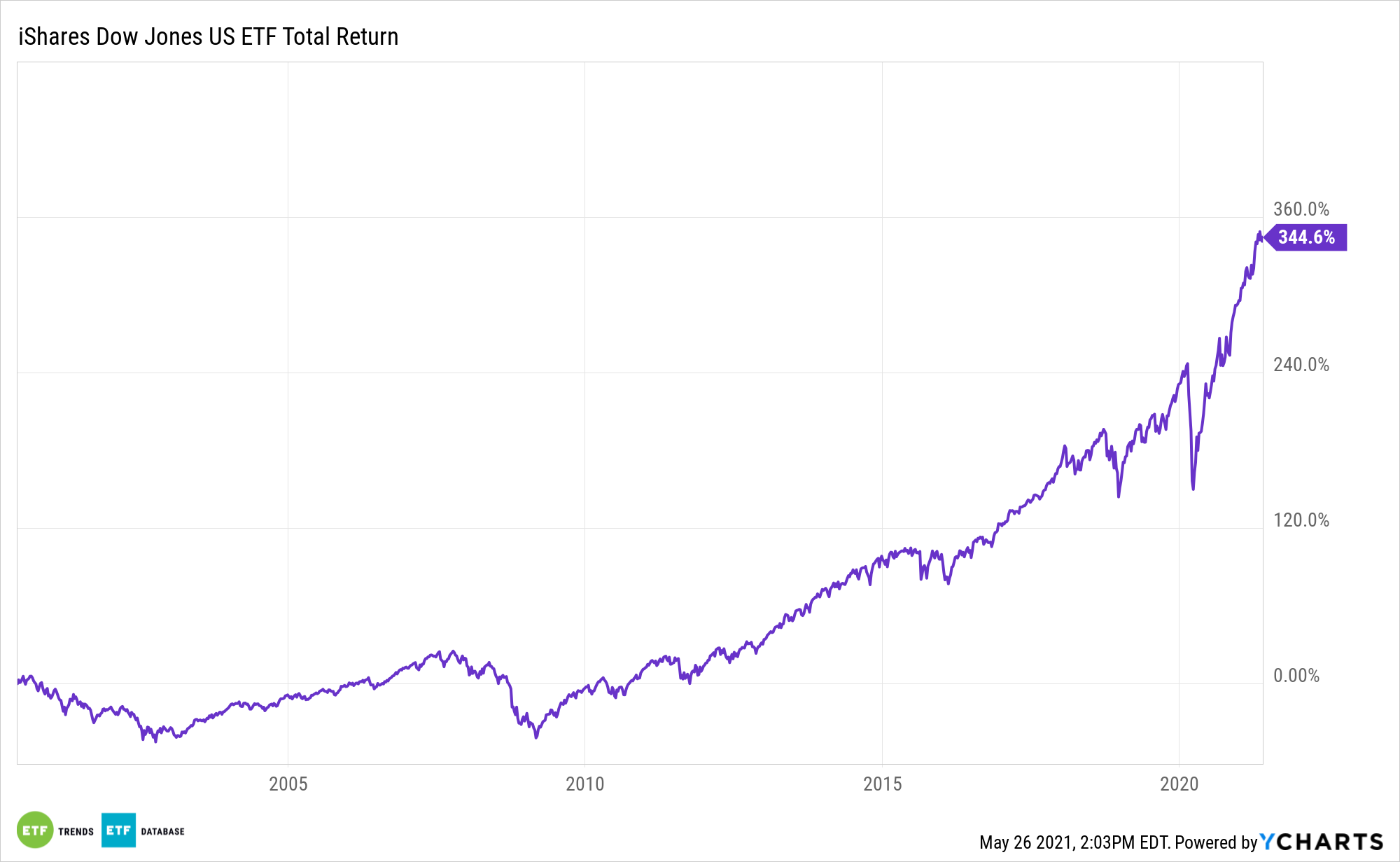

IYY seeks to trace the funding outcomes of the Dow Jones U.S. Index composed of U.S. equities. The fund typically invests no less than 90% of its belongings in securities of the underlying index and in depositary receipts representing securities of the underlying index. The underlying index goals to persistently characterize the highest 95% of U.S. corporations based mostly on a float-adjusted market capitalization, excluding the very smallest and least liquid shares. It has a decrease 0.20% expense ratio and affords publicity to a broad vary of large- and mid-sized U.S. corporations.

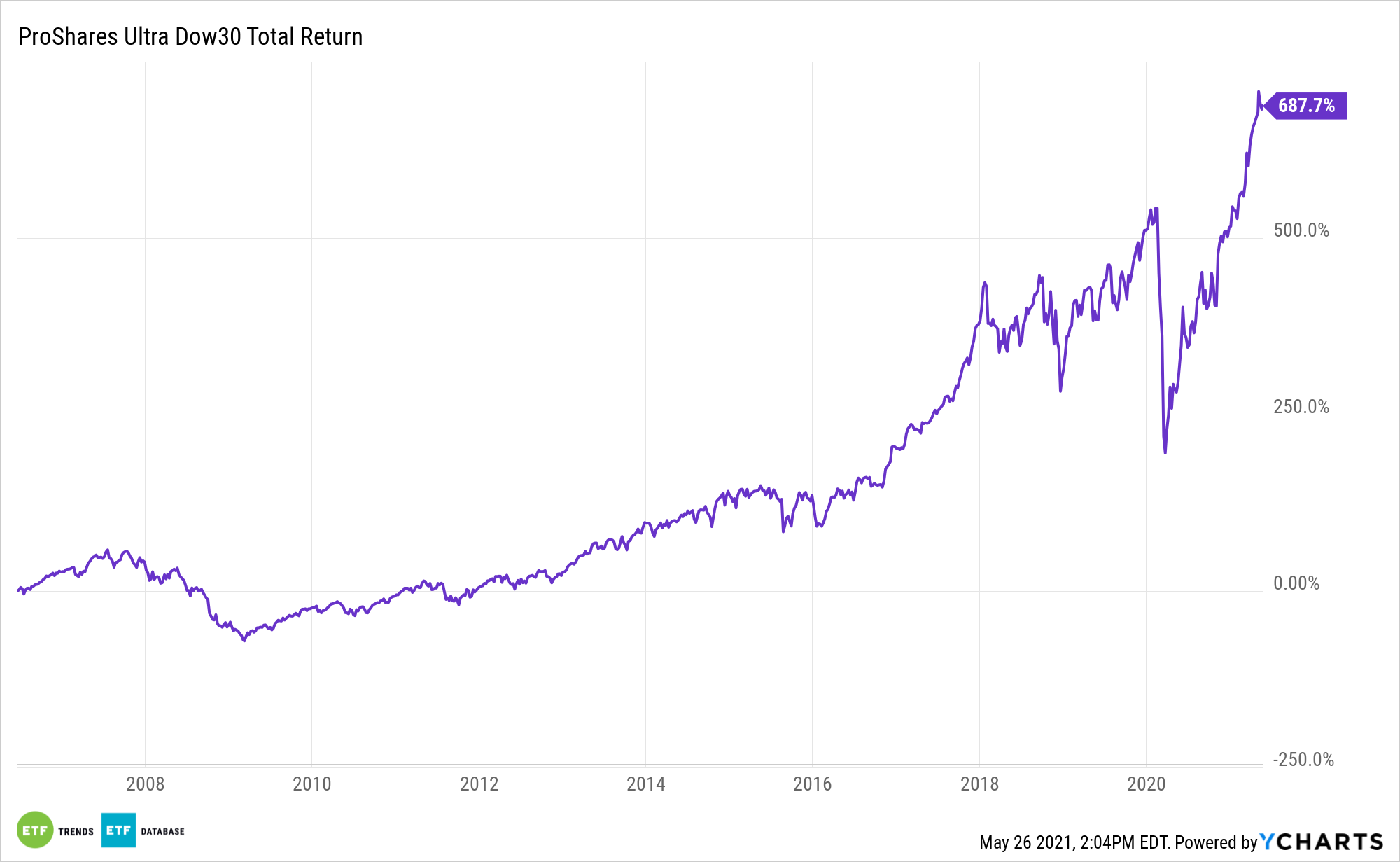

Traders bullish on the returns of the Dow can take a look at this leveraged ETF from ProShares. The Extremely Dow30 is a leveraged ETF that seeks to duplicate two instances the every day efficiency of the DJIA. The fund invests in plenty of securities to attain its goal. Investments embrace fairness securities from the index, derivatives together with SWAP agreements and futures contracts, and cash market devices for short-term money administration. The fund’s expense is a bit greater at 0.95%.

ETF buyers also can discover the next funds for worth and dividend investing:

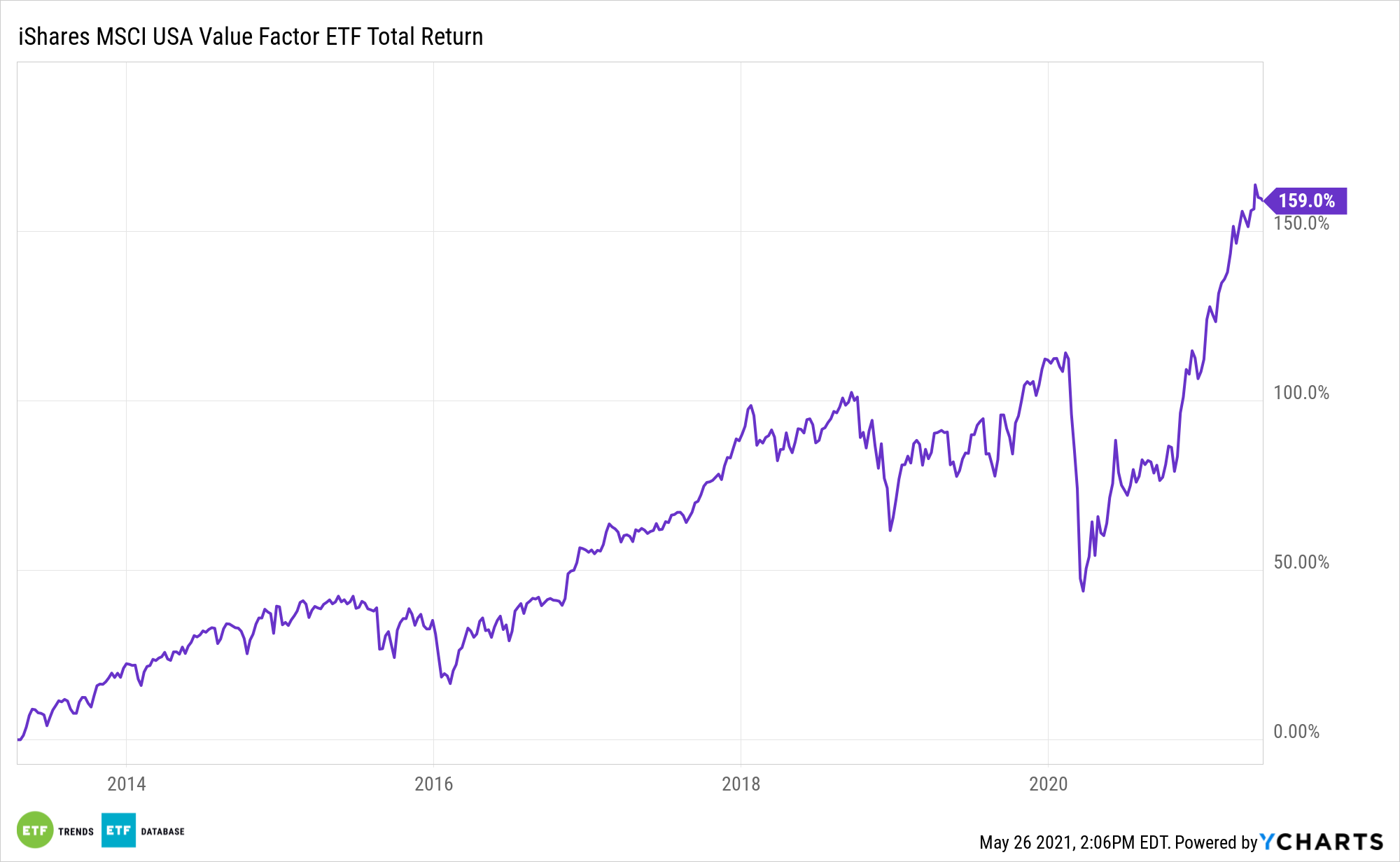

VLUE seeks to trace the funding outcomes of the MSCI USA Enhanced Worth Index, which consists of U.S. large- and mid-capitalization shares with worth traits and comparatively decrease valuations.

VLUE typically will make investments no less than 90% of its belongings within the part securities of the underlying index and should make investments as much as 10% of its belongings in sure futures, choices and swap contracts, money, and money equivalents. The index is predicated on a standard market capitalization-weighted guardian index, the MSCI USA Index, which incorporates U.S. large- and mid- capitalization shares.

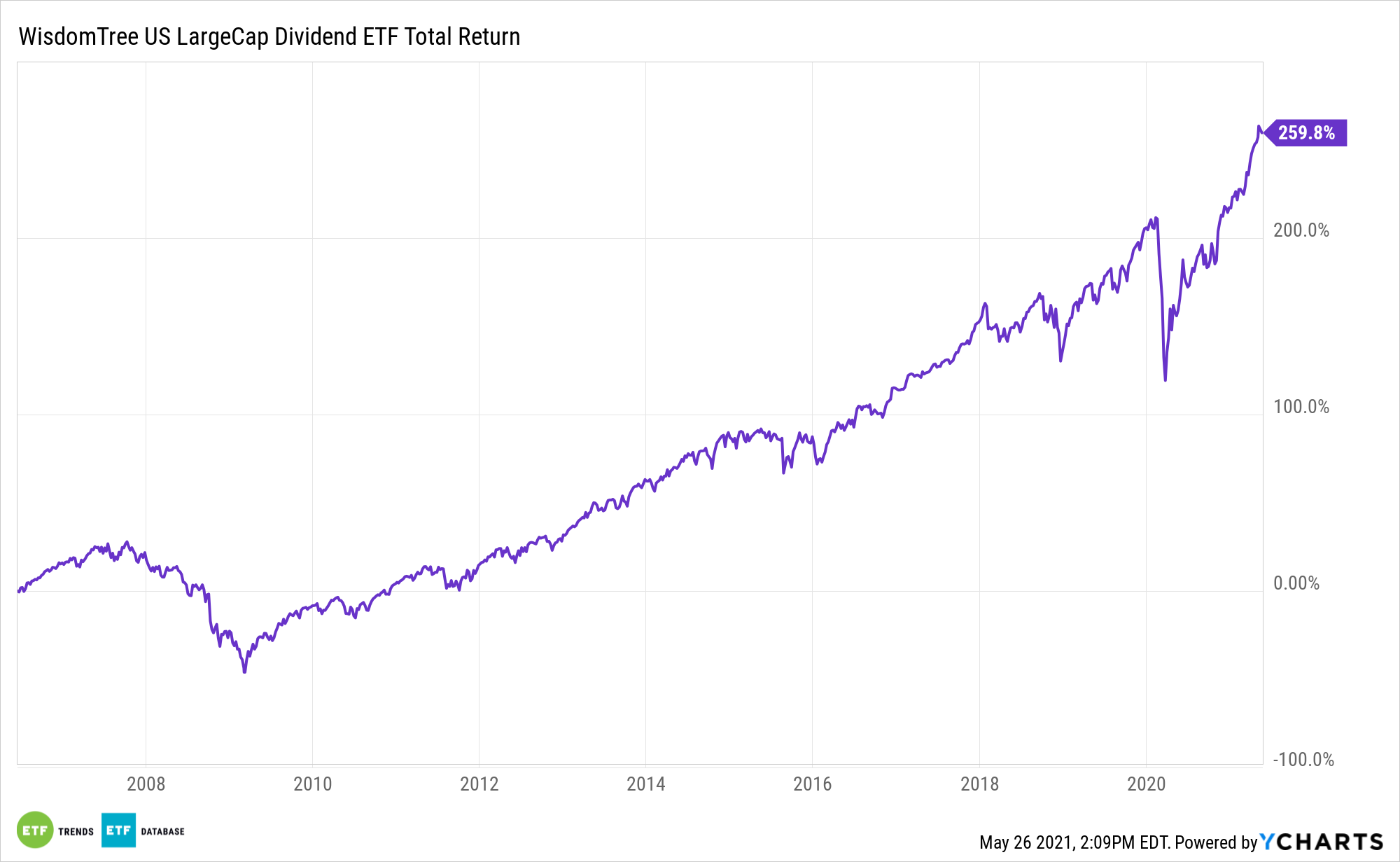

DLN seeks to trace the value and yield efficiency, earlier than charges and bills, of the WisdomTree U.S. LargeCap Dividend Index, which is a basically weighted index that’s comprised of the large-capitalization phase of the U.S. dividend-paying market.

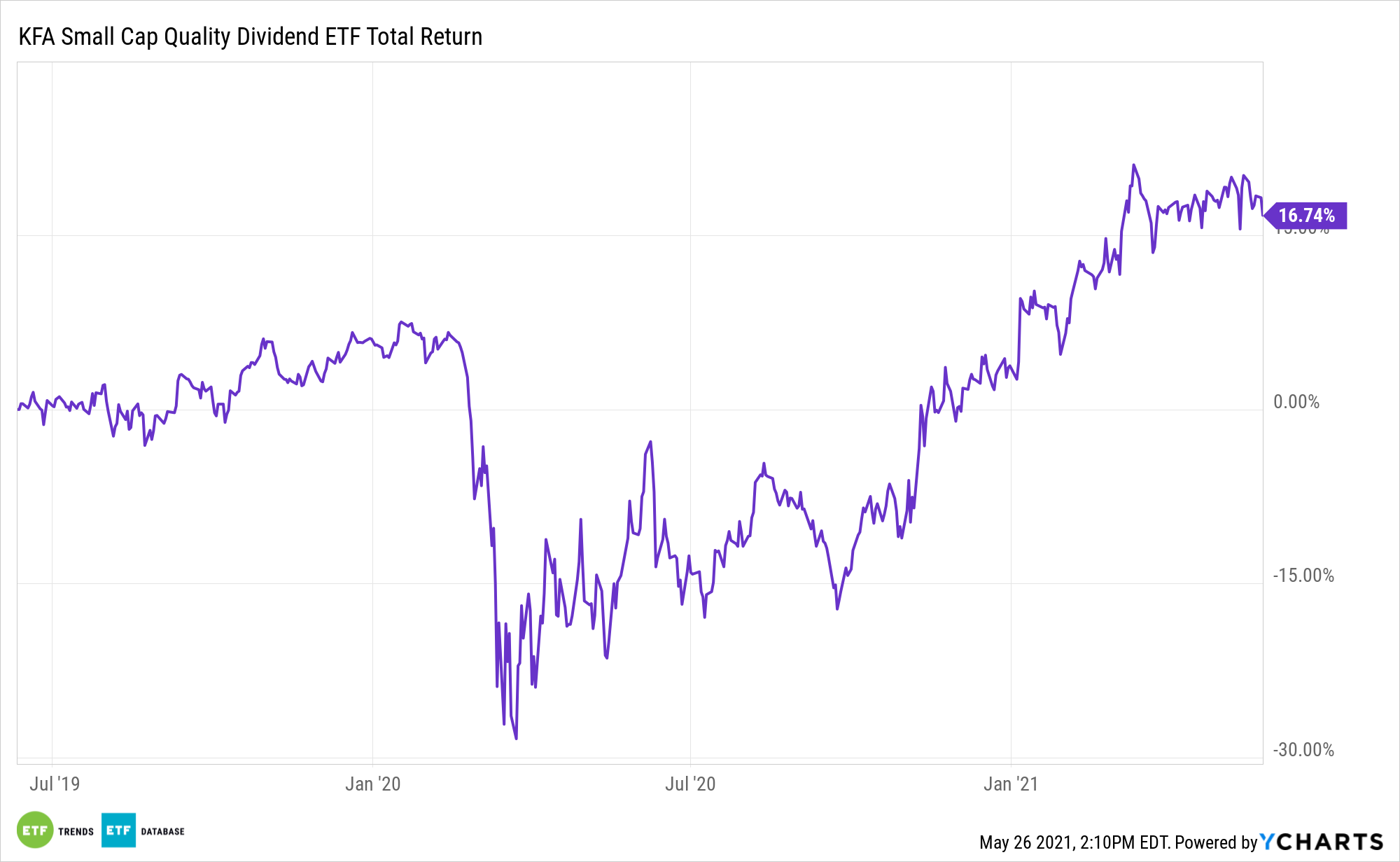

KSCD seeks publicity to corporations with dependable dividend progress and a robust document of steady money flows, wholesome steadiness sheets, and sturdy enterprise fashions, in accordance with KraneShares. KSCD makes use of a wise beta technique and gives dividend progress methods that may doubtlessly enhance efficiency in down markets.

The fund invests 80% of its belongings within the Russell 2000 Dividend Choose Equal Weight Index. The index “takes a wise beta strategy to investing in U.S. small cap corporations,” per KraneShares. “The technique seeks to measure the efficiency of US corporations which have efficiently elevated their dividend funds over a interval of ten years.”

For extra market traits, go to ETF Tendencies.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.