By Canterbury Funding Administration When you've got not al

By Canterbury Funding Administration

When you’ve got not already accomplished so, I might suggest trying out Canterbury’s video that was posted final week. It’s a highly effective replace that gives plenty of context to right now’s market construction:

All through many updates on this yr, we’ve talked in regards to the weak spot of sure asset lessons compared to giant cap shares (the S&P 500 is an index composed of enormous cap shares). On this replace, we are going to take an reverse strategy and say that many segments of the markets, which have beforehand lagged, are actually gaining relative energy over giant cap equities.

Small Cap Equities

Small cap shares, such because the elements of an index just like the Russell 2000, have definitely felt the impacts of the Coronavirus market panic greater than most different equities. Whereas the S&P 500 fell by -34% from peak to trough again in March, small cap equities noticed a bigger decline of -41%, and a smaller rally off the lows.

[wce_code id=192]

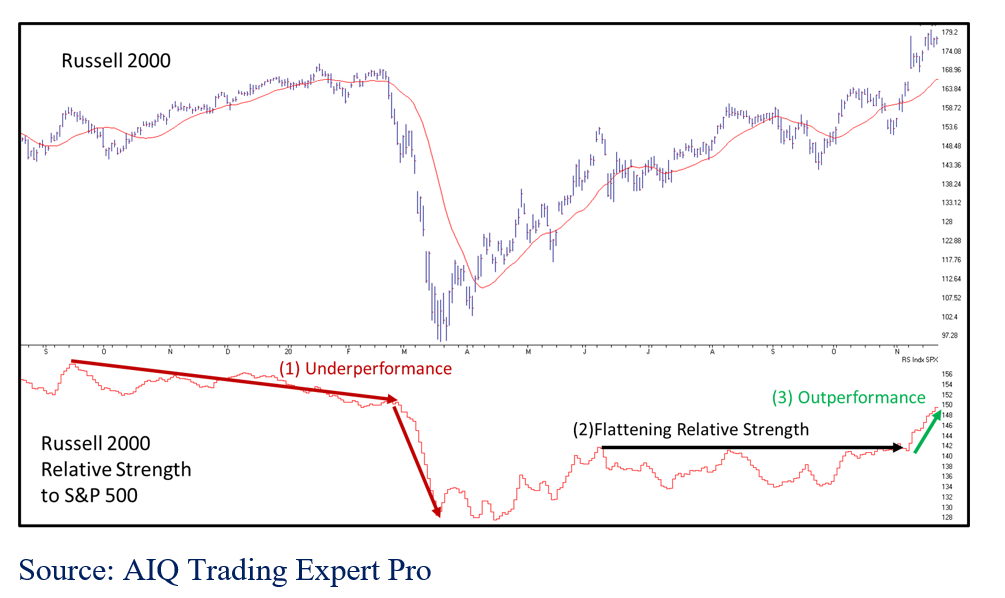

Lately, small cap equities have seen a rise in momentum over giant cap shares, as proven within the chart under. This can be a chart of the Russell 2000 and its relative energy in comparison with the S&P 500. The relative energy line is used to gauge the efficiency of 1 safety or asset class to a different, on this case the Russell 2000 versus the S&P 500. When the road is growing, the Russell is outperforming the S&P 500; when the road is reducing, the Russell is underperforming.

You possibly can see that whereas the Russell underperformed from the top of 2019 nicely into 2020, it had a interval of flat relative efficiency, and is now beginning to outperform once more, with some energy it has not seen in fairly a while.

Worldwide Equities

Canterbury ranks/charges over 100 equities every buying and selling day (plus alternate options), on a danger adjusted foundation. One factor that has change into clear over the previous few weeks, is that worldwide shares, significantly within the rising markets/Asia pacific areas have been on the rise. Out of the highest 20 highest risk-adjusted ranked securities, 15 of them are both worldwide international locations or areas.

Equal Weight S&P 500

The S&P 500 is a cap-weighted index, which means that the biggest shares have a much bigger influence on the index’s actions. For this reason a sector like Know-how, which comprises most of the high shares within the S&P 500 could make up 40% of the index. An equal weight S&P 500 applies the identical weighting to the person 500 shares, so a safety like Apple, the biggest S&P 500 inventory, has the identical influence because the smallest safety within the index.

Discover within the following chart that exhibits the Equal Weight S&P 500’s relative energy versus the cap-weighted S&P 500. It has struggled to achieve any momentum over the cap weighted index all yr, however has not too long ago began to outperform.

Backside Line- Why are we seeing energy in these areas now?

What do the Russell 2000 and the Equal Weight S&P 500 have in widespread that may make them see an uptick in relative energy over the S&P 500? The reply is that they’ve a decrease weighting in direction of technology-related shares. Whereas expertise shares make up 40% of the S&P 500, they solely make up 13% of small cap shares and 15% of an equally weighted S&P 500.

The actual fact is that Know-how has been weaker relative to different sectors over the previous few weeks. Whereas it’s wholesome to see different sectors begin to present some management, which has not been seen too typically over the previous yr, it’s also harmful for a lot of markets. Indexes weren’t created to be environment friendly portfolios, and a market index just like the S&P 500, which has 40% of its weight in expertise, is way from being environment friendly, and has plenty of danger ought to expertise’s bubble formation (which is mentioned in final week’s video) “pop”.

The benefit buyers have in markets, that indexes should not have, is liquidity and the power to adapt. That’s the reason the Portfolio Thermostat, Canterbury’s adaptive portfolio technique, was developed within the first place. Shopping for and holding market indexes topics buyers to any potential giant bear market that may ultimately come. We are actually seeing some rotations away from expertise shares and in direction of different areas of the market, like worldwide shares specifically. Because the market environments proceed to alter quickly, the Portfolio Thermostat will proceed to watch and adapt its holdings to no matter market atmosphere comes subsequent… bull or bear.

Initially printed by Canterbury Funding Administration

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.