Whether you help President Donald Trump or not, it's essential to acknowledge that one of many bedr

Whether you help President Donald Trump or not, it’s essential to acknowledge that one of many bedrocks of his governing model is unpredictability. To some critics, Trump’s conduct and decision-making course of could seem erratic, however I consider they make a type of sense when considered by the lens of sport concept.

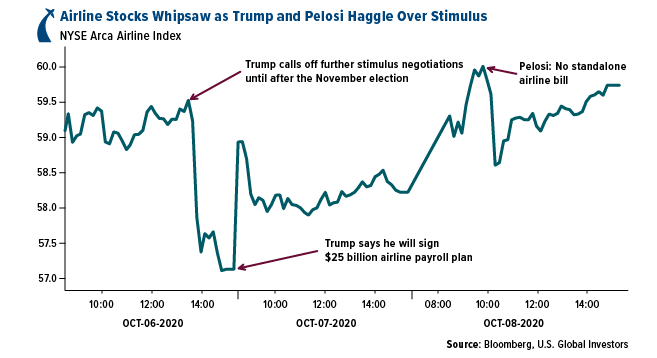

Take, for instance, his hot-and-cold stance on a brand new coronavirus stimulus invoice final week. On Tuesday, Trump unexpectedly tweeted that negotiations with Home Speaker Nancy Pelosi would halt till after the election. “After I win, we are going to go a significant Stimulus Invoice that focuses on hardworking People and Small Companies,” he mentioned.

That very same day, Trump appeared to alter his thoughts—reportedly after he noticed how the inventory market, and notably airline shares, reacted to the information. (I typically say that he’s the primary American president who retains his eye on the inventory market and sees it as a gauge of his success.) “The Home & Senate ought to IMMEDIATELY Approve 25 Billion {Dollars} for Airline Payroll Assist,” he tweeted.

Once more, to some, this conduct may appear irrational, however in sport concept, unpredictability may be an efficient software that leaves an opponent guessing.

In case you’re unfamiliar, “sport concept” is the examine of how and why individuals make choices to realize a sure final result. A couple of sport theorist predicted Trump’s victory in 2016, and I wouldn’t be stunned to study that some are doing the identical within the 2020 contest.

That’s regardless of Trump trailing Joe Biden in nationwide polls. In the meantime, PredictIt information exhibits that betting odds favor a Biden win, with the unfold having widened additional since Trump’s optimistic COVID-19 prognosis. However when you recall, then-candidate Trump was in an identical underdog place in opposition to Hillary Clinton heading into the election 4 years in the past.

Observe the Trendline, Not the Headline

We’re near 20 days out from the election, and like Trump himself, it’s certain to be unpredictable. It may very effectively be contested, as there have been stories of each candidates hiring tons of of legal professionals in anticipation of a authorized battle.

That’s why I consider it’s greatest proper now to hearken to the market reasonably than the unfavourable political rhetoric, to comply with the trendline and never the headline. As I shared with you in August, markets have precisely predicted presidential elections almost three out of each 4 occasions since 1948. That is “Knowledge of Crowds” in motion.

It’s additionally value being reminded that 80 p.c of all inventory buying and selling at the moment is pushed by quants and algos, which haven’t any political desire. Their fashions are utterly agnostic to who’s within the White Home. Equally, what issues most to us as lively cash managers usually are not the political events however the insurance policies.

Gold Anticipated to Head Greater on Contemporary Stimulus

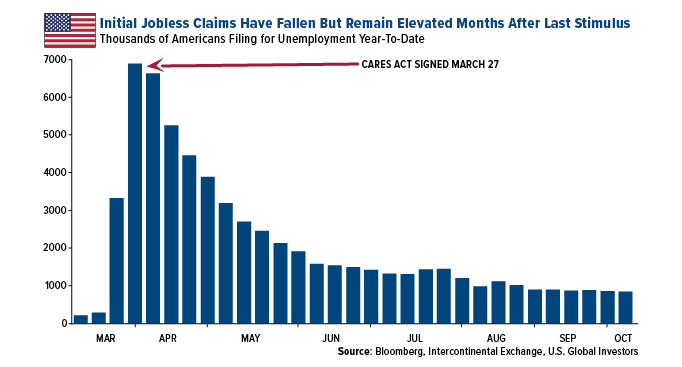

Talking of coverage, the Wall Road Journal reported on Friday that the White Home is making ready a coronavirus stimulus provide valued at $1.eight trillion, regardless of Trump’s earlier touch upon ending negotiations. It’s been seven months because the final aid package deal, the CARES Act, was signed, and in that point, the variety of People submitting for jobless advantages has remained elevated.

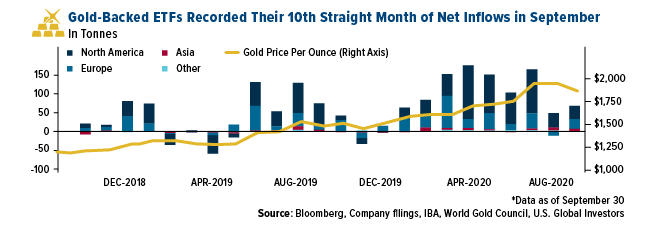

With the nationwide debt now topping $27 trillion, such a package deal isn’t good for the federal government’s stability sheet, but it surely’s good for gold. Certainly, the yellow steel traded up as a lot as 1.eight p.c on the information.

And I consider there’s further upside potential—irrespective of who wins the election. In 22 days, hundreds of thousands of People might be betting on “crimson,” hundreds of thousands of others on “blue.” I’ll be betting on gold.

I’m removed from the one one. Leon Cooperman turned simply the newest billionaire investor to purchase gold. In a latest interview, the Omega Advisors chairman and CEO mentioned: “I purchased gold for the primary time in my life every week in the past. I perceive the case for gold. We’re on the way in which to some banana republic scenario. No person’s worrying in regards to the debt that’s being created.”

In the meantime, ETFs backed by bodily gold climbed to a document quantity final Monday, touching 111.05 million ounces. In accordance with the World Gold Council’s (WGC) September report, world gold ETFs noticed their 10th straight month of inflows final month. For the primary time ever, such funds added greater than 1,000 tonnes of gold thus far this 12 months, the equal of $55.7 billion.

Gold Miners to Report “Most Unbelievable Margins”

Then there’s gold mining shares. Corporations within the NYSE Arca Gold Miners Index put in a robust displaying on Friday, ending the session up 4.2 p.c, its greatest single-day bounce since August 17. For the week, the group superior greater than Four p.c.

Just like the steel they mine, gold producers may see a good greater bounce once they start to report third-quarter earnings. With gold having averaged $1,911 an oz. throughout the quarter, and hitting its all-time excessive of $2,070 in early August, producers generated a number of the highest revenues they’ve ever skilled, to not point out margins.

That was the message of my buddy Pierre Lassonde, talking to Kitco Information final month. The legendary co-founder of Franco-Nevada mentioned that “gold miners have by no means had it so good,” explaining that the “margins they’re producing are the fattest, the most effective, absolutely the unbelievable margins they’ve ever had.”

An explosion in exploration exercise may happen in consequence, in line with Pierre. “I believe the budgets might be up extra seemingly by 50 p.c to 75 p.c” in 2021, he mentioned.

It’s not too late to take part!

Luxurious Shares Have Been Resilient Through the Pandemic

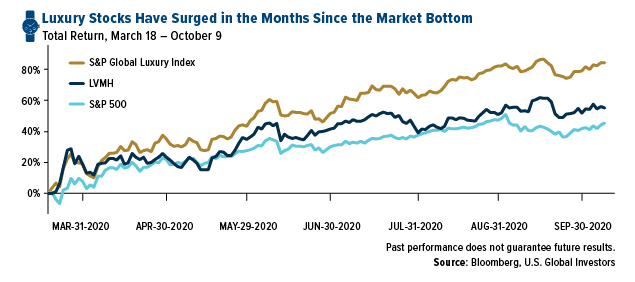

On a last word, I’m very happy to see how effectively luxurious items firms as an entire have held up throughout the pandemic months. For the reason that market backside in mid-March, the S&P World Luxurious Index has elevated greater than 84 p.c, near double the return of the S&P 500. Big multinational LVMH Moet Hennessy Louis Vuitton is up almost 54 p.c as of Friday.

As the one largest weighting within the index, Tesla has had an unbelievable 12 months, returning 418.7 p.c. Different shares that we like have additionally carried out effectively, together with Lululemon Athletica (up 49.5 p.c), Remy Cointreau (41.Four p.c) and Hermes Worldwide (14.three p.c).

I preserve my name for $4,000 gold within the subsequent three years because of document stimulus spending and money-printing, which can result in excessive forex debasement. Get my full ideas by watching my interview with CNBC beneath, and ensure to love and subscribe to our YouTube channel!

Initially printed by U.S. Funds, 10/12/20

All opinions expressed and information supplied are topic to alter with out discover. A few of these opinions will not be acceptable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. World Buyers doesn’t endorse all info provided by this/these web site(s) and isn’t answerable for its/their content material.

The S&P 500 Inventory Index is a well known capitalization-weighted index of 500 widespread inventory costs in U.S. firms. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded firms concerned primarily within the mining for gold and silver. The S&P World Luxurious Index is comprised of 80 of the most important publicly traded firms engaged within the manufacturing or distribution of luxurious items or the supply of luxurious providers that meet particular investibility necessities. The NYSE Arca Airline Index is an equal-dollar weighted index of essentially the most extremely capitalized firms within the airline business.

Holdings could change each day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. World Buyers as of (09/30/2020): Tesla Inc., LVMH Moet Hennessy Louis Vuitton SE, Lululemon Athletica Inc., Remy Cointreau SA, Hermes Worldwide, Franco-Nevada Corp.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.