By State Avenue World Advisors Throughout a interval of hei

By State Avenue World Advisors

Throughout a interval of heightened volatility, SPDR ETFs served as an efficient value discovery instrument that enabled traders to evaluate the valuation and liquidity of the general market.

ETF spreads widen together with underlying constituents

Together with elevated buying and selling volumes, bid-ask spreads elevated globally throughout all asset courses and monetary devices amid difficult market situations and liquidity constraints. ETFs across the globe skilled a rise in bid-ask spreads throughout March 2020 earlier than reverting again towards their earlier ranges in April and Might 2020.

Within the US, elevated volatility and liquidity constraints throughout underlying securities led to a brief deterioration of conventional market high quality metrics in ETFs.

- US-listed ETFs noticed common bid-ask spreads enhance from 0.37% in 2019 to 1.09% in March 2020.

- SPDR ETFs noticed their common bid-ask spreads enhance from 0.14% in 2019 to 0.37% in March 2020.

Bid-ask spreads in ETFs widened, reflecting elevated market threat and wider bid-ask spreads in underlying devices.

For instance, common spreads of constituents within the S&P 500 Index elevated from 0.05% in January 2020 to 0.19% in March 2020. Throughout that very same time interval, common spreads of U.S. Fairness SPDR ETFs widened from 0.10% in January 2020 to 0.28%, reflecting the elevated price for market makers to transact within the underlying market. In some situations, ETF spreads traded inside or lower than these of their underlying constituents as a result of following:

- Centralized Buying and selling[1] Liquidity is centralized on alternate the place consumers and sellers can transact on the secondary market.

- Broader Person Base ETFs are inclined to have two-way order movement as a result of their broad person base, as each traders and merchants can make the most of ETFs for a wide range of causes, together with as a liquidity car, hedging car or just to achieve publicity to a selected asset class.

Value dislocation of fairness ETFs

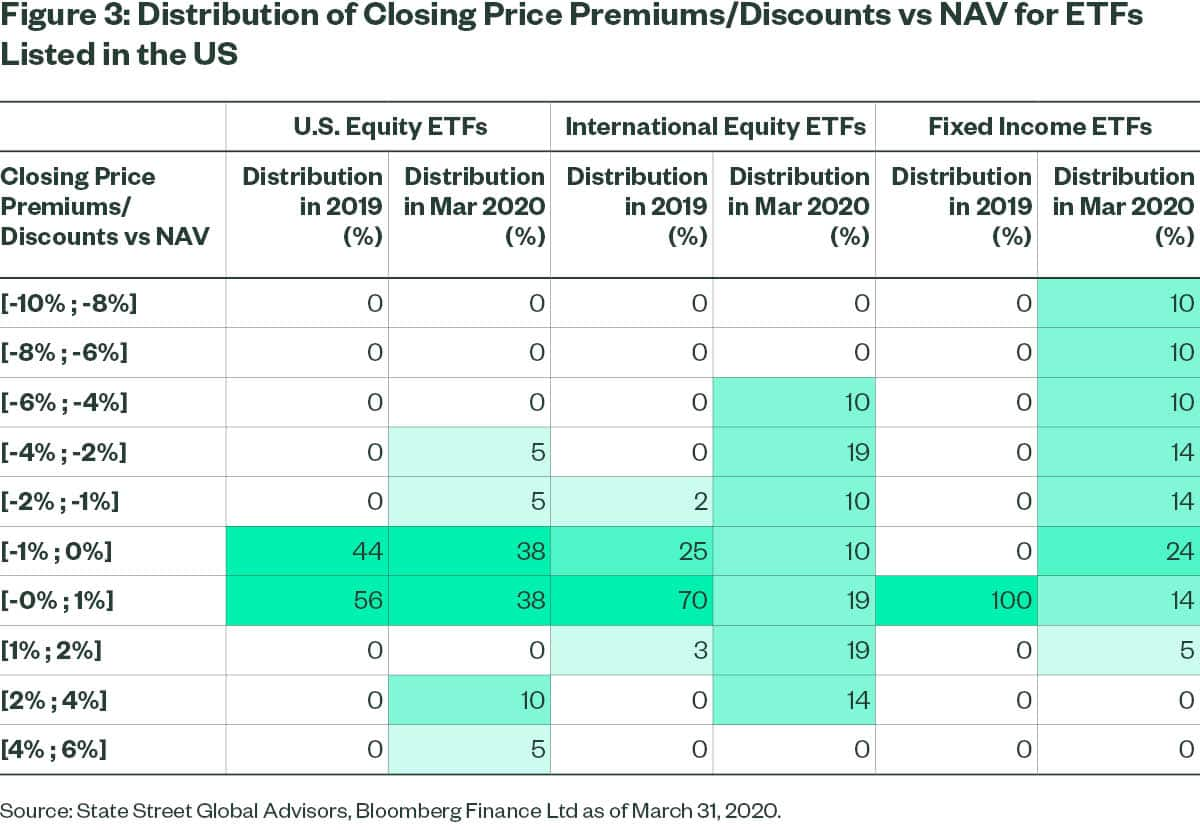

Along with wider spreads skilled in the course of the COVID-19 volatility, ETFs additionally traded at wider-than-normal premiums and reductions to Web Asset Worth (NAV). Determine three signifies that in 2019, on common, U.S. Fairness ETFs traded inside a 1% premium or low cost to their NAVs. Nevertheless, in March 2020, ETFs skilled bigger dislocations, which we are able to probably attribute to better liquidity and market threat. That mentioned, we consider the dislocations seen in U.S. Fairness ETFs had been additional impacted by the next components:

- Timing of the closing auctions of ETFs and shares Within the US, an ETF’s closing public sale is carried out by its main itemizing alternate at 4:00 p.m. Japanese Customary Time. Given the closing auctions of U.S. shares don’t at all times happen at 4pm, notably throughout March 2020, the official closing costs for shares won’t be accessible for market contributors to make use of as inputs for ETF pricing. In fast-moving markets with massive imbalances on the shut, this may result in larger-than-usual deviations between an ETF’s closing value and the NAV calculated with the closing costs of underlying constituents.

- Market volatility might set off quick sale restrictions Brief sale restrictions on varied single shares within the US had been triggered in March 2020 by Rule 201 of Regulation SHO. These restrictions could make it tough for market makers to hedge threat utilizing inventory baskets, notably into the shut on these days during which this rule was in impact. This very probably contributed to larger-than-normal premiums/reductions.

- Premiums/reductions might end result from massive imbalances throughout closing auctions. Through the month of March 2020, ETFs and single shares skilled considerably bigger volumes and imbalances throughout closing auctions. These greater volumes on the shut may have led to bigger premiums/reductions, contemplating different transparency and hedging components had been additionally at play.

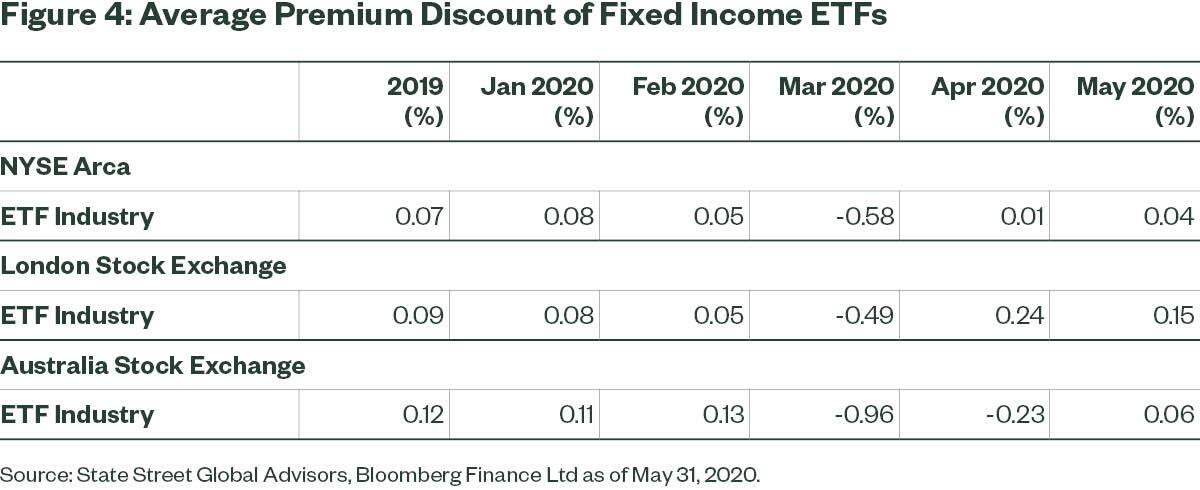

Market liquidity precipitated reductions on mounted revenue ETFs

Much more so, turmoil in mounted revenue markets led to vital dislocations between ETFs and their respective NAVs, leading to larger-than-usual premiums/reductions.

These dislocations might have been attributed to the next components:

- Stale or delayed NAV pricing Fastened revenue liquidity grew to become challenged and pricing extra opaque than regular. Fastened revenue ETFs, nevertheless, are inclined to replicate extra real-time sentiment and sensible pricing ranges as to the place the basket of bonds ought to commerce. Consequently, pricing on particular person bonds can lag behind the real-time market sentiment and executable pricing ranges mirrored by the ETF, ensuing within the look of huge reductions to NAV. In some instances, the ETF value might have been a greater illustration of actionable commerce costs of the underlying constituents, when some weren’t at all times quoted by sellers, and thus performing as an environment friendly value discovery venue.

- Discrepancies between NAV strike and ETF closing instances Finish-of-day NAV costs may be struck at a special time than the ETF’s closing public sale, leading to totally different values. Premium and low cost are utilizing just one cut-off date, thus not capturing intraday evolution, and plenty of bond indices have totally different closing instances, relying on the areas. Heightened intraday volatility in March exacerbated the impression of those timing variations.

Whereas some might query the efficiency of Fastened Revenue ETFs throughout March, we consider the reductions precisely mirrored real-time market sentiment and liquidity of their underlying mounted revenue securities. Bond costs lagged real-time market sentiment and sensible buying and selling ranges. The surge in Fastened Revenue ETF buying and selling volumes in March 2020 means that market contributors gravitated towards ETFs as liquidity autos when particular person bond liquidity grew to become tough. It’s illustrated in Determine 5 — buying and selling volumes of investment-grade and excessive yield company bond ETFs elevated considerably as a share of money bond buying and selling throughout March 2020.

Value dislocation: Gold ETFs vs. Gold futures

In recent times, institutional traders have extra extensively adopted using ETFs as belongings and liquidity have grown main traders to extra typically evaluate construction, price, and effectivity between ETFs and different funding autos.

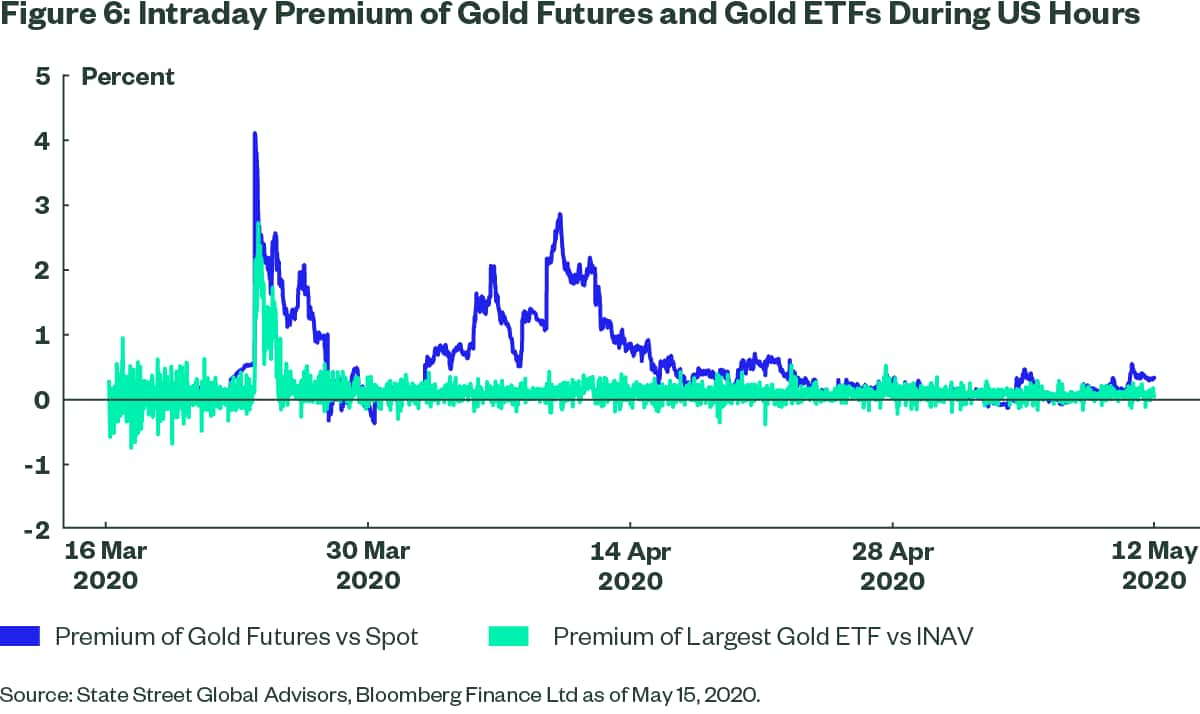

A standard comparability amongst sure institutional traders is ETFs vs futures. This relationship got here to the forefront throughout a number of days in March, when futures and ETFs that monitor the spot value of gold diverged.

On March 23, 2020, three main Swiss gold refineries on the earth introduced that they had been suspending manufacturing solely for not less than every week as a result of outbreak of COVID-19. With flights grounded and gold refineries closing, merchants grew to become involved that it will turn into difficult to fulfill futures contract settlement obligations in the event that they had been unable to maneuver 100-oz.COMEX bars from Europe to New York.

On account of provide chain considerations, on March 24, 2020, with the demand for gold nonetheless obvious as a result of COVID-19 disaster, gold futures in New York and gold spot costs in London diverged considerably. The gold futures premium prolonged over a number of weeks in March and April 2020.

Determine 6 signifies that this premium rippled by means of the gold ETF market, with the biggest gold ETF listed within the US buying and selling at a premium on March 24, 2020. Nevertheless, this ETF resumed buying and selling nearer to its honest worth after solely at some point, on March 25, 2020. It is because this specific ETF tracks the gold spot market, which operates primarily out of the London gold market hub and continued with none reported points.

The construction of this ETF performed an essential differentiating issue for traders in search of to trace the gold spot value throughout this era of market stress.

In abstract, regardless of among the aforementioned market high quality and value dislocations in the course of the COVID-19 pandemic, ETFs have offered traders with liquidity after they wanted it most. Learn extra in regards to the street forward.

Initially revealed by State Avenue World Advisors, 11/13/20

1 In some situations, ETF buying and selling just isn’t centralized. For instance, in Europe, a majority of the ETF buying and selling exercise occurs exterior of inventory exchanges.

Investing includes threat together with the chance of lack of principal.

State Avenue World Advisors and its associates (“SSGA”) haven’t considered the circumstances of any specific investor in producing this materials and are usually not investing advice or performing in fiduciary capability in reference to the availability of the data contained herein.

The views expressed on this materials are the views of SPDR Americas Analysis and are topic to vary based mostly on market and different situations. This doc accommodates sure statements that could be deemed ahead trying statements. Please be aware that any such statements are usually not ensures of any future efficiency and precise outcomes or developments might differ materially from these projected.

ETFs commerce like shares, are topic to funding threat and can fluctuate in market worth. The funding return and principal worth of an funding will fluctuate in worth, in order that when shares are offered or redeemed, they might be value roughly than after they had been bought. Though shares could also be purchased or offered on an alternate by means of any brokerage account, shares are usually not individually redeemable from the fund. Buyers might purchase shares and tender them for redemption by means of the fund in massive aggregations often known as “creation items.” Brokerage commissions might apply and would cut back returns. Please see the fund’s prospectus for extra particulars.

Efficiency of an index just isn’t illustrative of any specific funding. It’s not attainable to speculate straight in an index.

Bonds typically current much less short-term threat and volatility than shares, however comprise rate of interest threat (as rates of interest increase, bond costs normally fall); issuer default threat; issuer credit score threat; liquidity threat; and inflation threat. These results are normally pronounced for longer-term securities. Any mounted revenue safety offered or redeemed previous to maturity could also be topic to a considerable achieve or loss.

Fairness securities might fluctuate in worth in response to the actions of particular person corporations and common market and financial situations.

Whereas the shares of ETFs are tradable on secondary markets, they might not readily commerce in all market situations and will commerce at vital reductions in durations of market stress. Diversification doesn’t remove the possibility of experiencing funding losses.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.