Today, I’m going to reply a query that’s doubtless in your thoughts.

It’s in regards to the inventory market’s current unusual conduct and the one factor ALL traders and merchants ought to be doing about it.

You see, I’ve been scripting this weekly RiskHedge Report for nearly three years now, and one of many very first shares I ever really useful simply reported phenomenal earnings.

Gross sales jumped 37%. The corporate acquired a file variety of prospects, and it forecasts nice gross sales once more subsequent quarter.

What do you suppose occurred to the inventory worth?

We’ll come again to this in a second.

Chances are you’ll notice I’m speaking about The Commerce Desk (TTD).

We don’t personal the inventory in any of our premium advisories. However I “pounded the desk” to purchase it a number of instances again in 2018, when it was buying and selling for lower than $100/share.

It soared to over $950—making it the primary 10-bagger I ever really useful publicly.

Briefly, TTD runs a “inventory change” for digital advertisements. The corporate helps advertisers purchase the best advertisements on the web—and enterprise is booming.

In 2020, entrepreneurs spent a file $4.2 billion on its platform. And the variety of corporations shopping for over $1 million price of advertisements has greater than doubled.

And as I discussed, it simply reported blowout earnings.

Now, usually, nice earnings = the next inventory worth for TTD.

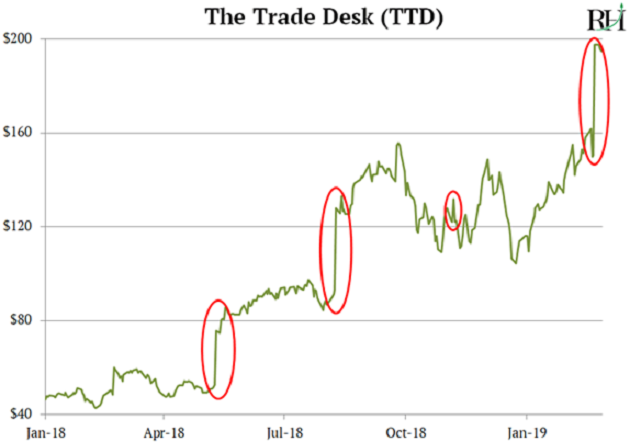

You possibly can see what I imply within the chart beneath. It covers a interval from 2018–2019 once I was recommending the inventory.

The pink circles mark the times that TTD introduced quarterly monetary outcomes.

As you’ll be able to see, three of the 4 bulletins produced large spikes within the inventory worth… together with a 31% achieve on February 21, 2020.

However this time, the precise reverse occurred…

TTD dropped 26% on Monday after reporting nice earnings.

That’s proper. The corporate knocked earnings out of the park… and its inventory misplaced 1 / 4 of its worth.

And TTD’s not the one firm falling after reporting nice earnings…

Peloton’s gross sales greater than doubled—its inventory dipped 15%.

Craft market Etsy achieved its greatest quarter ever, recording 135% gross sales development, and the inventory has slumped to its lowest ranges since final December.

Telehealth pioneer Teladoc grew revenues 151%, and the inventory dropped to its lowest ranges since earlier than the COVID pandemic.

Progress powerhouses Amazon, Microsoft, and Apple additionally reported file earnings not too long ago.

But, their shares dropped.

This shines a lightweight on the kind of market we’re in proper now.

2020 was among the best years in historical past for fast-growing corporations.

COVID lockdowns jabbed an enormous syringe of development into virtually each tech firm.

With gyms shut, of us cycled Peloton bikes of their residing rooms. As an alternative of sitting in ready rooms, People “visited” medical doctors on-line by way of Teladoc. Zoom conferences changed boozy work lunches with colleagues.

However as America reopens, traders have turned bitter on fast-growing tech shares.

It doesn’t matter if an organization posts file earnings or not.

On this irrational market, my message is easy: Don’t give attention to the earnings outcomes.

As an alternative, pay very shut consideration to how a inventory reacts to earnings.

In my expertise, the market’s response to outcomes issues greater than anything within the brief time period.

That’s very true when the response isn’t what you’d anticipate.

If a inventory falls on unhealthy earnings, that doesn’t imply a lot. That’s what’s “supposed” to occur.

However when an organization posts nice outcomes and its inventory falls, that’s a warning signal. It’s robust proof the inventory will wrestle for the following couple of weeks or months.

And proper now, many development shares are flashing this warning signal.

Does that imply you need to promote your weakest shares as we speak?

That will depend on the way you reply this query: Why did you purchase the inventory within the first place?

Did you purchase it as a result of it’s an important enterprise that may compound your cash for the following 20 years?

If that’s the case, and it reported nice outcomes, and nothing in regards to the firm has modified…

Don’t promote it.

As an alternative, contemplate shopping for extra.

In spite of everything… you’ll be shopping for extra of an important firm, at a greater worth, than you may’ve a month or two in the past.

However not all shares are supposed to be held for years.

Possibly to procure the inventory as a commerce, and also you meant to money out inside weeks or months for a fast revenue.

In that case, you need to significantly contemplate promoting a inventory that plunges on nice earnings.

In spite of everything, it was a commerce. You aren’t married to the inventory. You’re simply courting it.

My suggestion: Dump it and transfer on. You possibly can at all times get again in later when an uptrend reestablishes itself.

I need to be 100% clear…

We’re firmly in a bull marketplace for shares.

There’s zero proof that the volatility we’re seeing in development shares is something greater than a passing storm. One which’s hitting final yr’s largest winners—development and tech shares—the toughest.

So, what actions are we taking in our premium providers?

In Disruption Investor, I give attention to bigger, safer disruptor shares that may assist us construct lasting wealth. As a result of most of those shares are long-term performs, we’re utilizing this volatility to build up extra shares in world-class disruptors.

In Disruption Dealer, my co-editor, Justin Spittler, and I’m going for faster earnings in fast-moving development shares. Within the final couple of weeks, we’ve been closing out weaker trades and taking some threat off the desk.

We’re additionally being extraordinarily selective in coming into new trades till the volatility passes.

This essay has been a bit completely different from the disruptive tech I normally write about. Did you discover it helpful?

Initially revealed by Mauldin Economics, 5/17/21

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.