By Horizon Investments Worldwide developed equities slip on

By Horizon Investments

Worldwide developed equities slip on Covid surge in Europe

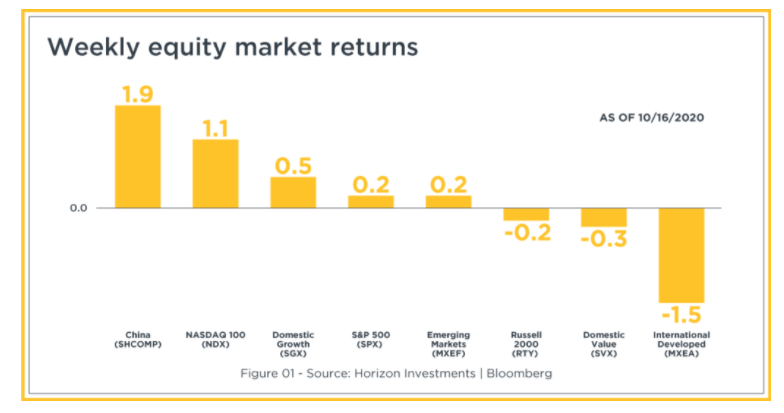

Equities had a uneven week, whipped round by the resurgence of a brand new issue into the prevailing backwards and forwards between stimulus and politics: the coronavirus. Rising case counts and quasi-lockdowns in a lot of Western Europe drove worldwide developed markets to underperform (MXEA -1.5%). U.S. markets (SPX) and rising markets (MXEF) have been neck-and-neck, every up 0.2% [Figure 1].

Mega cap tech and rising markets led final week’s rally

Final week’s rally within the U.S. was led by mega cap tech (NDX +1.1%) and large-cap development (SGX +0.5%) [Figure 1]. Leaders in rising markets have been centered in Asia, with China particularly up 1.9% final week (SHCOMP) [Figure1]. This is sensible to us—each of those segments of the worldwide fairness universe are comparatively proof against upticks in Covid circumstances. Mega cap tech advantages from stay-at-home conduct and an acceleration of technological adoption, and corporations that may truly develop on this surroundings get a premium because of their shortage. China and North Asia proceed to successfully suppress viral unfold, permitting for financial life to go on considerably as regular. This can be a good reminder {that a} rotation into worth and small-caps must be accompanied by altering fundamentals, not simply worth motion, and that the coronavirus is presently on the middle of that.

[wce_code id=192]

Covid circumstances hit all-time highs in Europe, nonetheless greatest mannequin for U.S.

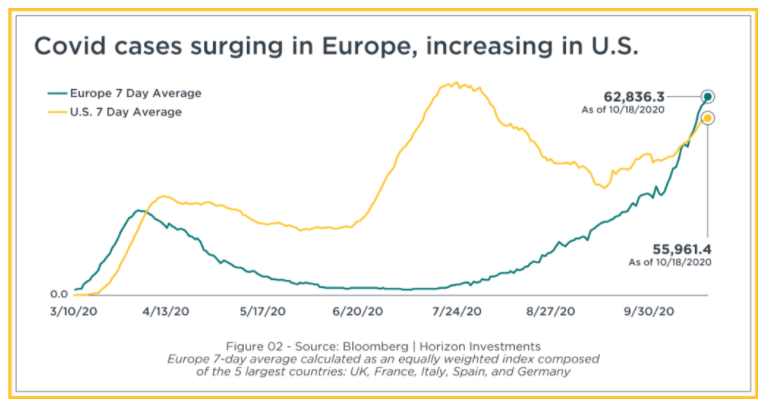

Covid circumstances are ticking up throughout the U.S., reaching ranges not seen since mid-August. And circumstances in Western Europe are hitting recent all-time highs day by day [Figure 2]. Worryingly, deaths are growing in Europe too, forcing governments to behave with lockdowns which are beginning to dent shopper confidence within the restoration.

This stays the most effective mannequin for our expertise within the U.S., and buyers must be contemplating how shortly and immediately this dynamic will translate into authorities actions as we proceed via the autumn season. Two trials from main pharmaceutical firms have been paused final week. This isn’t out of the bizarre, however could serve to delay trial outcomes previous November or into the brand new 12 months probably.

No progress on stimulus regardless of optimism

Regardless of continued optimism out there round huge stimulus, talks made no progress final week. Senate Majority Chief Mitch McConnell will vote on a $500 billion invoice this week, however Home Speaker Nancy Pelosi has rejected a piecemeal strategy and set a Tuesday deadline for a deal previous to the election. We proceed to suppose that nothing will likely be handed earlier than the election, and given the partisan backdrop, passing a invoice within the lame duck interval might be difficult.

Financial information nonetheless factors to sooner restoration

Whereas the above could not appear rosy, financial information within the U.S. continues to level to a sooner restoration. Retail gross sales exceeded expectations final week, one other signal of shopper well being [Figure 3]. However industrial manufacturing lagged, highlighting how uneven and stimulus-driven the restoration has been.

With Covid making a significant comeback and stimulus seemingly far off, we don’t but see a elementary shift to maneuver into overwhelmed down market segments, like small-caps and worth.

Earnings haven’t modified the narrative

Financial institution earnings final week did little to alter the prevailing narrative. Earnings proceed this week and actually choose up within the final week of October, when lots of the market’s largest names will report. Expectations have risen all quarter, a stark break from typical developments. This might set elementary buyers up for disappointment over the subsequent few weeks.

Bond yields fell, unwinding stimulus-induced steepening

Bond yields fell in a holiday-shortened buying and selling week, persevering with to unwind the stimulus-induced steepening from just a few weeks in the past. Given our views on the problem of passing further stimulus proper now, this worth motion makes good sense to us. The U.S. 10-12 months Treasury yield fell three foundation factors (bps) and the 30-12 months fell Four bps.

Blended week for credit score markets, issuance slows

Credit score markets had a combined week, underperforming authorities bonds however nonetheless rising in worth because of falling risk-free yields. Funding-grade (IG) spreads tightened 1 bps whereas high-yield (HY) widened 2 bps. After a busy September, issuance has began to decelerate. As we strategy the election and the top of the 12 months, that is prone to proceed, which must be supportive for spreads.

USD pushed larger by Covid and Brexit considerations in Europe

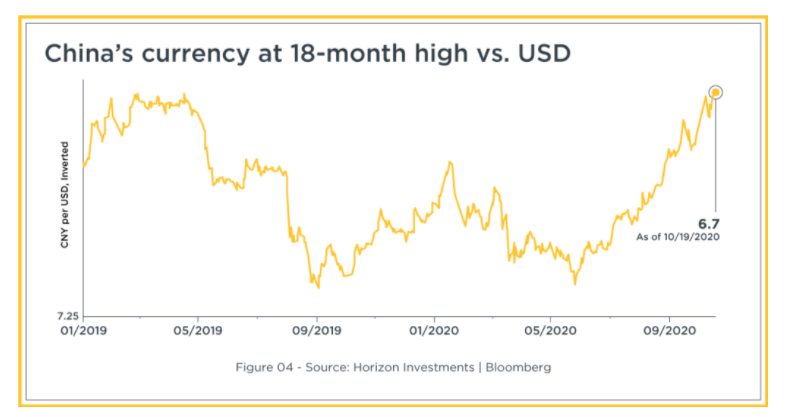

The greenback rose final week in uneven buying and selling, pushed by risk-off sentiment from the European continent because of Covid circumstances and onerous Brexit considerations. Broadly talking, the greenback is in the course of the vary it has been in for the reason that finish of July. However China’s forex continues to strengthen towards the greenback because of a rising commerce surplus and continued inflows into their bond market [Figure 4]. The onshore yuan, intently managed by the Folks’s Financial institution of China and state banks, closed at its highest stage since mid-April 2019, regardless of a rule change that made it cheaper for locals to hedge lengthy yuan (CNY) positions.

China’s manufacturing-led restoration sooner than another

The market will likely be taking note of China’s huge information launch on Monday: Q3 GDP and September retail gross sales and industrial manufacturing. Their restoration continues to be the other of ours, led by manufacturing and never the buyer. Regardless, China has rebounded sooner than another main nation, and GDP launched over the weekend confirmed 4.9% year-over-year development in Q3. The U.S. and Europe, in contrast, aren’t anticipated to regain 2019 GDP ranges till the top of 2021 on the earliest.

What to observe this week

Covid in U.S. and Europe

Final Friday, the day by day case rely within the U.S. reached over 60,000, with extra rural areas seeing a surge in new circumstances, particularly within the higher midwest. Public well being officers in Europe have warned of a possible exponential rise in new circumstances there. Nations throughout Europe are introducing new restrictions and shutdowns, so we’re anticipating markets to be paying extra consideration to the Covid state of affairs in Europe this week.

Stimulus

The place are stimulus negotiations going? Nowhere, in all probability. Stakeholders are too far aside, with Democrats at $2.2 trillion, the White Home at $1.eight trillion, and Senate Republicans solely at $500 billion. Over the weekend, Home Speaker Nancy Pelosi gave the White Home 48 hours (or by Tuesday, October 20th) to succeed in a deal.

International PMIs

International PMIs for September broadly confirmed the restoration slowing down, particularly in Europe, and that’s previous to the brand new measures taken to sluggish the unfold of Covid. We’ll be watching this Friday’s launch to see if final month’s report was a one-off or the beginning of a brand new pattern.

Presidential Debate & U.S. Politics

The second Presidential debate of this election season takes place on Thursday evening in Nashville. Polls present Former VP Biden has a commanding lead. To meaningfully shift the trajectory of the race, President Trump might want to enhance on his prior efficiency.

Jobless Claims

Final week, new preliminary jobless claims ticked up. Whereas this was considerably because of technical reporting causes, the extent to which these technical points can account for the rise isn’t completely clear. This week we’ll be watching to see if the rise was, in actual fact, a extra ominous signal of a brand new pattern.

FDA Vaccine Panel

The FDA’s Vaccines and Associated Organic Merchandise Advisory Committee is scheduled to satisfy this Thursday, however we don’t anticipate any particular vaccine bulletins to come back out of it. The committee has stated solely normal vaccine growth data will likely be mentioned. Earlier this month, FDA Commissioner Stephen Hahn, MD, stated that earlier than any vaccine could be accepted, it might want the committee’s enter, a step some are involved may sluggish the method of bringing a vaccine to market.

To obtain a duplicate of this commentary and the chart of the week, click on the button under.

To debate how we will empower you please contact us at 866.371.2399 ext. 202 or [email protected].

Initially printed by Horizon Investments, 10/19/20

Nothing contained herein must be construed as a suggestion to promote or the solicitation of a suggestion to purchase any safety. This report doesn’t try to look at all of the details and circumstances that could be related to any firm, trade or safety talked about herein. We’re not soliciting any motion primarily based on this doc. It’s for the final data of shoppers of Horizon Investments, LLC (“Horizon”). This doc doesn’t represent a private advice or take note of the actual funding goals, monetary conditions, or wants of particular person shoppers. Earlier than performing on any evaluation, recommendation or advice on this doc, shoppers ought to think about whether or not the safety in query is appropriate for his or her specific circumstances and, if mandatory, search skilled recommendation. Traders could understand losses on any investments. It isn’t attainable to take a position immediately in an index.

Previous efficiency will not be a information to future efficiency. Future returns aren’t assured, and a lack of authentic capital could happen. This commentary is predicated on public data that we think about dependable, however we don’t characterize that it’s correct or full, and it shouldn’t be relied on as such. Opinions expressed herein are our opinions as of the date of this doc. We don’t intend to and won’t endeavor to replace the knowledge mentioned on this doc. No a part of this doc could also be (i) copied, photocopied, or duplicated in any kind by any means or (ii) redistributed with out Horizon’s prior written consent.

Different disclosure data is obtainable at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered logos of Horizon Investments, LLC

©2020 Horizon Investments LLC

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.