By Justin Spittler Tremendous-genius Albert Einstein referr

By Justin Spittler

Tremendous-genius Albert Einstein referred to as it “the eighth surprise of the world.” Legendary investor Warren Buffett attributes his $81 billion fortune to this power. And it’s how traders from everywhere in the world have turned small stakes into tens of millions of {dollars}.

I’m speaking about “compounding.” However not in the way in which you’re in all probability pondering. Most of us study concerning the energy of “compound curiosity” in class. Again within the “good previous days” when banks truly paid curiosity, you possibly can put your cash in a financial savings account.

Slowly however certainly, it will develop. $10,000 compounded at 5% per yr grows to $16,289 in 10 years, $26,533 in 20 years, $43,219 in 30 years.

Compounding works in dividend-paying shares, too. You purchase shares in a rock-solid firm like Apple (AAPL) and constantly reinvest the dividends to purchase extra inventory. In 30–40 years, you’ll have much more cash than you began with.

However what if you happen to don’t have 30 years to attend round? What if you happen to may pace up compounding? On this essay, I’ll present you precisely find out how to do it.

I Name It “Compounding Capital Beneficial properties”

Earlier than I proceed, truthful warning: That is an unconventional strategy. Most folk don’t find out about it. However even when they totally understood how profitable it may be, the overwhelming majority nonetheless couldn’t observe it. That’s as a result of it’s human nature to need to spend your buying and selling income.

I’m suggesting you do it in another way than most people. I’m suggesting you save and reinvest some or your entire winnings from one commerce into the following commerce, with the intention to snowball your account shortly.

Do that properly, and also you’ll get pleasure from “compound curiosity on steroids.” I’m speaking 200%–300% returns in months—the type of positive factors that usually take years or a long time to appreciate. I do know you is likely to be pondering: To bag these sorts of huge, fast positive factors, don’t it’s worthwhile to tackle big dangers?

By no means. In reality, if you happen to observe my golden rule of buying and selling, this is without doubt one of the most secure methods on the market. Let me present you. For the sake of instance, the typical acquire throughout all our IPO Insider trades within the final yr (counting profitable trades and shedding trades) is 72.6%.

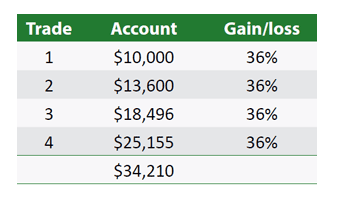

To be conservative, let’s take half that: 36%. Now think about you strung collectively a few 36% profitable trades in a row. However as an alternative of spending the income, you rolled all of them into the following commerce.

What number of trades do you suppose you’d need to string collectively to triple your account? You could discover the reply shocking. Simply 4 trades is all it will take to triple your buying and selling account from $10Okay to $34Okay:

Of Course, There Are Some Issues With This Oversimplification

- Beneficial properties are by no means this easy.

- You wouldn’t essentially roll all of your income into the following commerce.

- You’ll actually incur losses alongside the way in which.

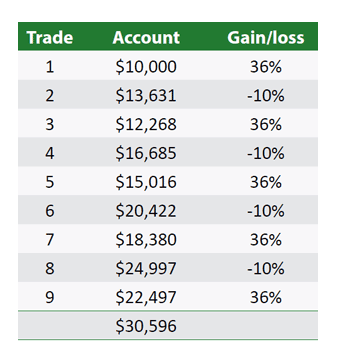

So let’s assume you probably did not string collectively a bunch of winners. Let’s assume you incurred some losses, however adopted my golden rule of buying and selling: Minimize your shedding trades early. On this situation, you bought a 36% win, adopted by a 10% loss, and that sample repeated. After 9 trades—regardless that almost half your trades have been “duds”—your $10Okay changed into $30Okay:

9 trades and also you’ve tripled your account. In contrast to the previous method of compounding curiosity or dividends slowly, my “capital acquire compounding” works finest with fast-moving shares.

Particularly, it really works finest on the brand new class of “hypergrowth” shares which might be, fairly merely, the fastest-moving shares in America.

You see, not like slow-moving “maintain eternally” shares, you solely need to maintain hypergrowth shares when momentum is on their facet. In different phrases, once they’re rising quick.

And if a inventory loses steam, that’s okay. You merely take your positive factors and reinvest them into the following hyper-growing alternative. Your objective is to attain a “snowball impact” the place your rising account steadiness can compound quicker and quicker.

With the explosion in new hypergrowth shares available on the market, many extra alternatives like this come alongside than chances are you’ll suppose. In reality, a whopping 223 US shares have soared greater than 30% over the previous month, whereas 81 have rallied 50%! If you happen to haven’t but, think about using my “ compounding capital positive factors” technique.

Get our report “The Nice Disruptors: three Breakthrough Shares Set to Double Your Cash”. These shares will hand you 100% positive factors as they disrupt complete industries. Get your free copy right here.

Initially revealed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.