By Marc Odo, CFA, FRM, CAIA, CIPM, CFP®, Consumer Portfolio Supervisor

By Marc Odo, CFA, FRM, CAIA, CIPM, CFP®, Consumer Portfolio Supervisor

Enhancing Market Evaluation with Choices Market Insights

GDP development, unemployment, and client confidence. Nonetheless others preserve their gaze centered on authorities coverage and base their selections on what comes out of Congress or the Fed.

A much less understood supply of data is the huge market of put and name choices. By analyzing components just like the VIX, skew, and the time period construction of choices, you’ll be able to achieve perception into the hopes and fears of broader, conventional markets. Since these measures are complementary, you’ll be able to achieve extra perception by trying on the interplay of those components than them in isolation.

When markets are unsure, you’ll be able to look to those measures to determine how a lot uncertainty there’s (VIX), the place the uncertainty is positioned (Skew), and when uncertainty would be the highest (time period construction).

[wce_code id=192]

THE VIX

The VIX tells us the implied volatility, or how a lot uncertainty there’s available in the market.

For many individuals the metric that measures volatility begins and ends with the VIX. The VIX is usually referred to as “the concern gauge” however that definition is fairly free and casual. So what does the VIX really measure?

The VIX is an index of choice costs. Similar to we’ve got indices just like the S&P 500 or the Dow 30 that observe the costs of a basket of shares, the VIX is a basket of each name choices and put choices. The choices which might be included on this basket are typically very brief time period in nature and canopy a variety of strike costs.

Finally provide and demand drive the costs of choices.

- When traders are afraid of a market sell-off, this drives up the demand for put choices.

- If traders count on the markets to run up, this drives up the demand for name choices.

Both of those demand components will drive up the costs of choices, and the VIX rises accordingly.

Alternatively, if traders assume the markets will stay quiet the demand for choices decreases, so the costs of choices fall, and the VIX declines. Because of this the VIX is usually referred because the “concern gauge” as a result of it gives perception into how traders are feeling about and what they’re anticipating from the markets.

You will need to take into account that the VIX is a measure of implied volatility. Precise, realized volatility can solely be measured after-the-fact. Implied volatility is a forward-looking “greatest guess” as to what volatility is perhaps sooner or later.

Extending the comparability of the VIX to a standard inventory index, nobody is aware of what the earnings of the S&P 500 shares are prematurely. Nevertheless, the worth of the S&P 500 displays the expectations of the longer term earnings of these 500 shares. If individuals count on earnings to be robust, the costs of the S&P 500 shares will rise; if individuals count on earnings to be weak, the costs will fall. Likewise, if individuals count on excessive volatility, the VIX will rise on account of demand for choices; if individuals count on volatility to be low, the VIX will fall.

Solely time will inform if the volatility implied by choice costs integrated by the VIX can be justified, similar to solely time will inform if the earnings of the S&P 500 justify the inventory costs. However each measures are related within the sense that they mirror the market’s forward-looking, mixture expectations.

SKEW

Beforehand we talked about that the VIX incorporates the demand for each put choices and name choices, which mirror the demand for draw back threat safety and upside market participation, respectively. So how helpful is a the VIX if it lumps each components collectively?

That is the place skew is available in to play. Skew measure the relative demand between put choices and name choices. It tells us the place the uncertainty located-to the upside or the draw back. Are traders inserting a bigger wager to draw back dangers or upside dangers?

Underneath regular circumstances put choices are typically valued extra extremely than name choices. The concern of shedding cash is bigger than the concern of lacking out on a chance to make cash, so the costs and demand for choices tends to be skewed in direction of places relative to calls.

That stated, markets are all the time in a state of flux, and the relative demand for calls and places (and therefore the skew) will range relying upon market situations. If the market is promoting off dramatically and everybody is worried about losses, you’ll probably see the skew to places be greater than regular. Alternatively, if the market is operating and individuals are extra frightened about lacking out on good points, you’ll probably see calls tackle a bigger proportion of the skew index.

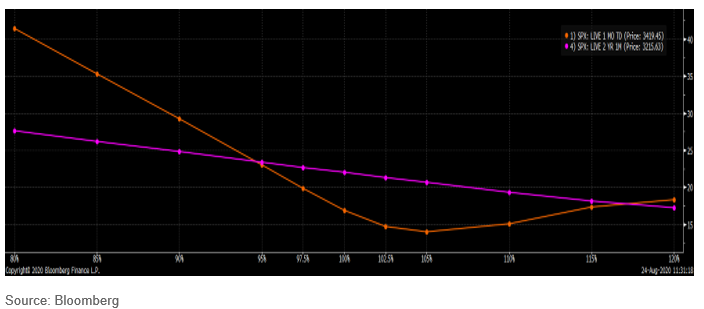

The chart beneath, you could entry by way of Bloomberg, illustrates the idea of skew. The purple line exhibits the relative worth of two-year choices and the orange line represents one-month choices. The truth that the purple line is downward sloping illustrates that usually talking places (to the left on the graph) are extra extremely valued than calls (to the appropriate of the graph). That stated, the orange line is actually skewed. The put-side is way greater than the call-side of the orange line, as a result of at this second in time markets had been very involved concerning the threat of an enormous sell-off within the short-term.

Returning to the S&P 500 analogy, the index is comprised of various sectors. By breaking the S&P 500 down into its constituent components we will achieve perception into what’s driving the market. In 2020 Know-how has been doing all the heavy lifting and sectors like Vitality have been a detriment. By breaking out the volatility market into completely different subsegments utilizing skew, that provides us an concept on a relative foundation what’s driving the choices market. We are able to see if the provision and demand for choices is being pushed by calls or by places and the place individuals assume the market is heading.

TERM STRUCTURE

Choices have a wide selection of expiration dates out there. Choices can have lifespans extending weeks, months, and even years into the longer term. By analyzing the relative costs of brief, medium, and long-term choices we will decide when choices traders assume uncertainty would be the highest.

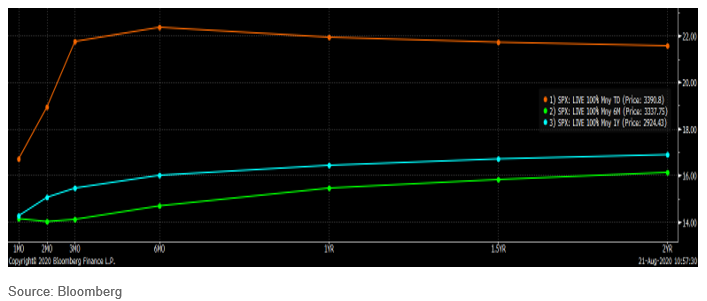

This information is usually offered as a line connecting the varied expiration date, with the shorter expirations to the left and the longer expirations to the appropriate. Though normally clean, generally the time period construction can have kinks within the line, particularly if there’s a recognized occasion threat on the horizon. The graph beneath illustrates the time period construction for at-the-money put choices on the S&P 500. The orange line is the time period construction as of August 21, 2020. The inexperienced and blue traces characterize the time period construction six and twelve months beforehand, respectively.

Two takeaways stand out. Initially, the general stage of uncertainty was a lot greater in August 2020. Second, the height of the present line is three to 6 months ahead of August 2020. This hump displays the concern and uncertainty markets have surrounding the U.S. elections in early November and on by way of Inauguration Day in January 2021.

Right here the most effective analogy is just not the S&P 500, however the yield curve for bonds. Like choices, bonds have maturities extending out over an array of time frames. Market watchers attempt to forecast the relative energy of the economic system based mostly upon the degrees and steepness of the yield curve. The time period constructions for choices can be utilized for related perception to the market.

Enhance Your Market Insights with the Choices Market Indicators

Incorporating choices market insights into your common market commentary supply an added layer to your understanding of the markets and supply some context round different indicators. You’ll be able to have a look at VIX, Skew, and time period construction individually or collectively to get a greater sense of how a lot uncertainty is within the markets, the place it’s location, and when it’s predicted to be, respectively.

In consequence, it is possible for you to to put together your shoppers’ portfolios for uncertainty and supply higher into perception into the markets throughout unprecedented occasions.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.