The S&P 500 Worth Index jumped 17.9% within the first half of the yr, outperforming the broader S&P 500 by 110 foundation factors, and whereas there are latest inklings that progress shares could also be turning a nook, market observers are nonetheless bullish on worth.

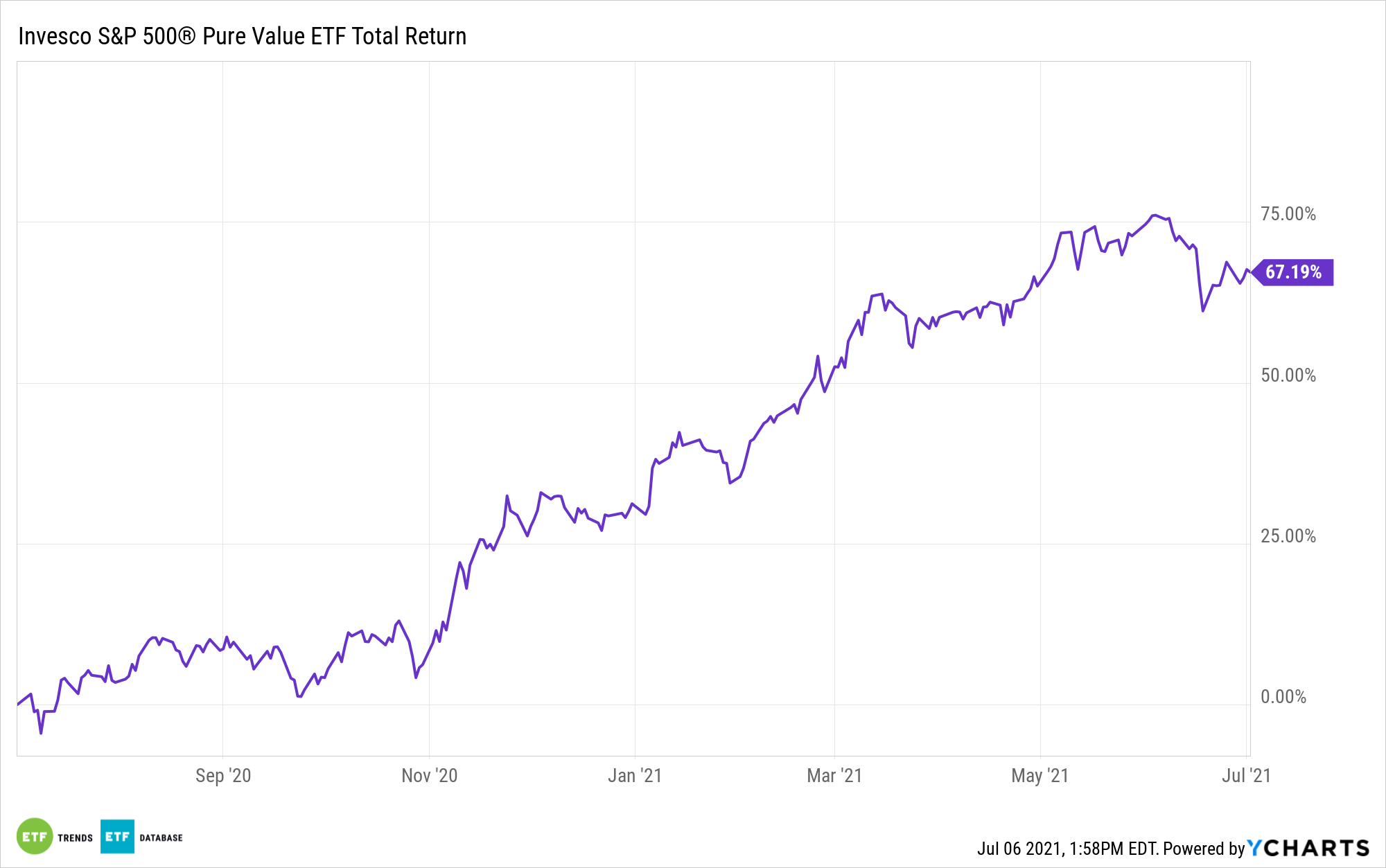

That is excellent news for the Invesco S&P 500® Pure Worth ETF (RPV), an alternate traded fund that surged a stellar 28.3% within the first six months of 2021.

In its latest quarterly report, CNBC surveyed about 100 chief funding officers, fairness strategists, portfolio managers, and CNBC contributors who’re additionally cash managers with 70% saying they consider worth shares will prolong their momentum into the third quarter.

To be exact, two-thirds see worth popping out on high within the July by means of September interval whereas only a third consider progress will win.

A Pause earlier than Extra Upside?

“After a formidable rebound from pandemic lows, the rally in worth shares took a pause because the Federal Reserve’s hawkish coverage pivot and inflationary pressures made traders reassess the outlook for financial progress. The Russell 1000 Worth Index fell 1.3% in June, trailing its progress counterpart by greater than 7 share factors as tech shares outperform with bond yields stabilizing,” based on CNBC.

Certainly, RPV languished in June, however the case for the Invesco alternate traded fund and worth at massive is not useless. If financial progress continues powering greater, cyclical shares, which primarily reside within the worth house, are prone to profit.

The $Three billion RPV, which tracks the S&P 500® Pure Worth Index, has one other ace up its sleeve: huge publicity to financial institution shares, a bunch market observers stay bullish on for the second half.

“On the sector stage, the vast majority of traders (67%) consider financials might be a profitable commerce for the remainder of 2021. The S&P 500 financials sector is the second greatest performer this yr, up 24.5% yr thus far,” based on CNBC.

See additionally: ETF Buyers Await Fed to Unleash Financial institution Payout Progress

RPV allocates about 43.5% of its weight to the monetary companies sector. That is greater than double the S&P 500 Worth Index’s weight to the identical group.

The Invesco ETF additionally affords some inflation safety. Among the many favored selections for inflation buffering of these polled by CNBC are power and client staples equities. These are RPV’s fourth- and fifth-largest sector exposures, respectively, combining for 16% of the fund’s roster.

For extra information, data, and technique, go to the ETF Training Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.