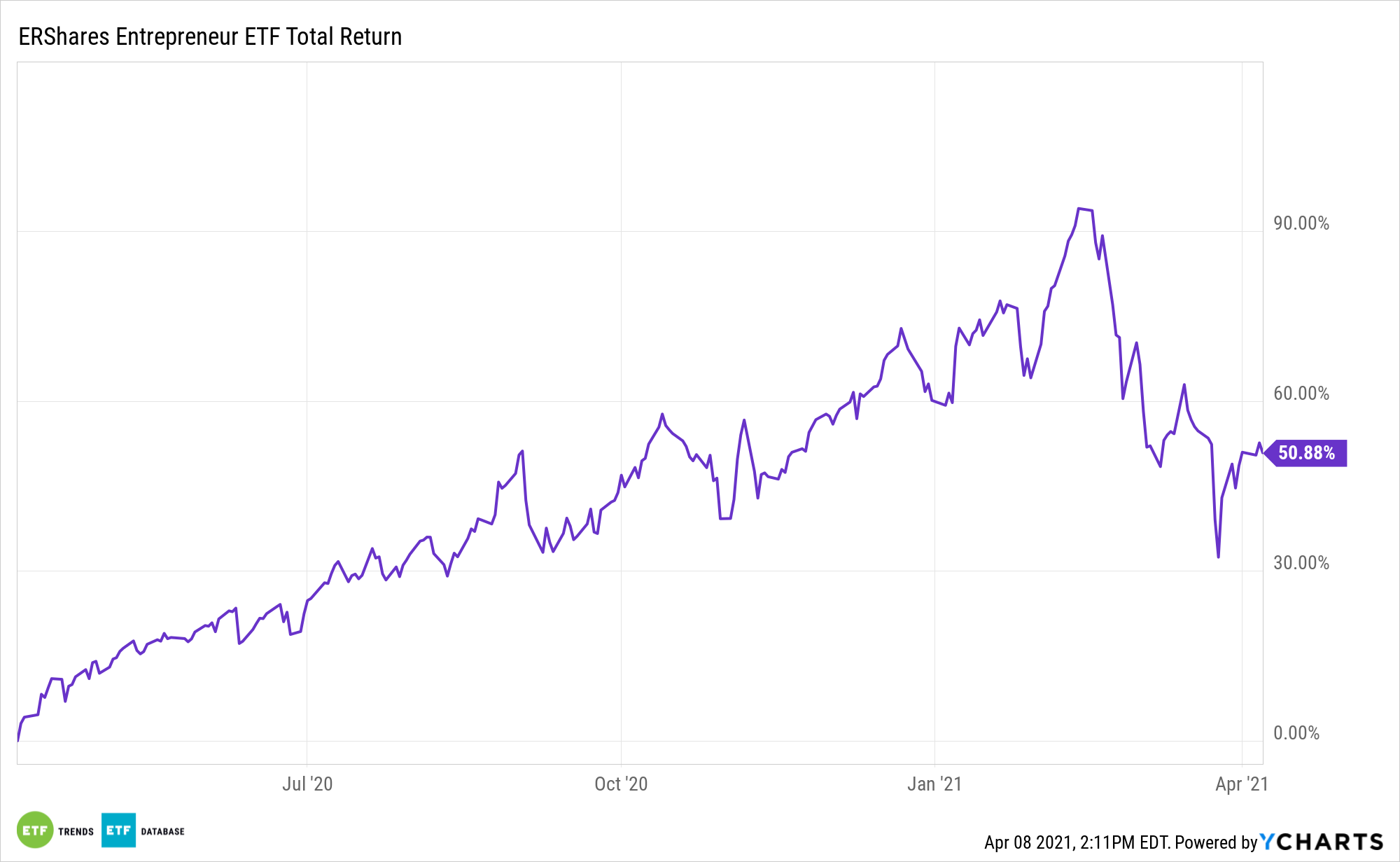

For as soon as, worth shares are getting all of the love, however that does not imply development fare must be glossed over. The ERShares Entrepreneurs ETF (ENTR) is an asset that may place buyers for a development rebound whereas sustaining some worth publicity.

The fund is comprised of 30 U.S. corporations with the best market capitalizations and composite scores based mostly on six standards known as entrepreneurial requirements.

The economic system is at present within the nascent phases of the standard restoration cycle, and buyers mustn’t let short-term noise distract them from development alternatives. Whereas there are the apparent performs in massive tech shares, buyers should not overlook further development alternatives that always fly below the media’s radar. ENTR is an avenue for capitalizing on these alternatives.

Together with expectations of a rebound in revenue development this yr and a restoration in financial exercise, many market observers are arguing that the inspiration for additional inventory market positive aspects is in place.

Breaking Down the ‘ENTR’ Thesis

Progress shares are sometimes related to high-quality, affluent corporations whose earnings are anticipated to proceed rising at an above-average price relative to the market. Progress shares usually have excessive price-to-earnings (P/E) ratios and excessive price-to-book ratios. Nonetheless, knowledge counsel the expansion/worth premium isn’t overly elevated relative to historic norms.

Progress shares could also be seen as exorbitant and overvalued, inflicting some buyers to favor worth shares, that are thought of undervalued by the market. Worth shares are likely to commerce at a lower cost relative to their fundamentals (together with dividends, earnings, and gross sales). Whereas they typically have strong fundamentals, worth shares could have misplaced reputation available in the market and are thought of discount priced in contrast with their opponents.

See additionally: New Title, Identical Features for the Excessive-Flying ENTR ETF

Many entrepreneurial corporations are concentrated within the client discretionary and expertise sectors, cementing ENTR’s development really feel.

ENTR additionally consists of subtle screens to weed out undesirable corporations. The components screened embody administration, which requires set components concerning an organization’s administration, such because the turnover among the many high 5 executives inside an organization in comparison with different corporations within the broader universe. A profitability display requires an organization to fulfill predetermined standards concerning internet revenue over a static threshold to be included, together with the corporate’s internet revenue as in comparison with predetermined benchmarks.

For extra investing concepts, go to our Entrepreneur ETF Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.