Traders seeking to allocate to U.S. giant caps usually go for passive index merchandise as a approach to obtain market returns with diminished danger.

Energetic administration can take this core allocation to the following degree by offering the chance for greater return potential.

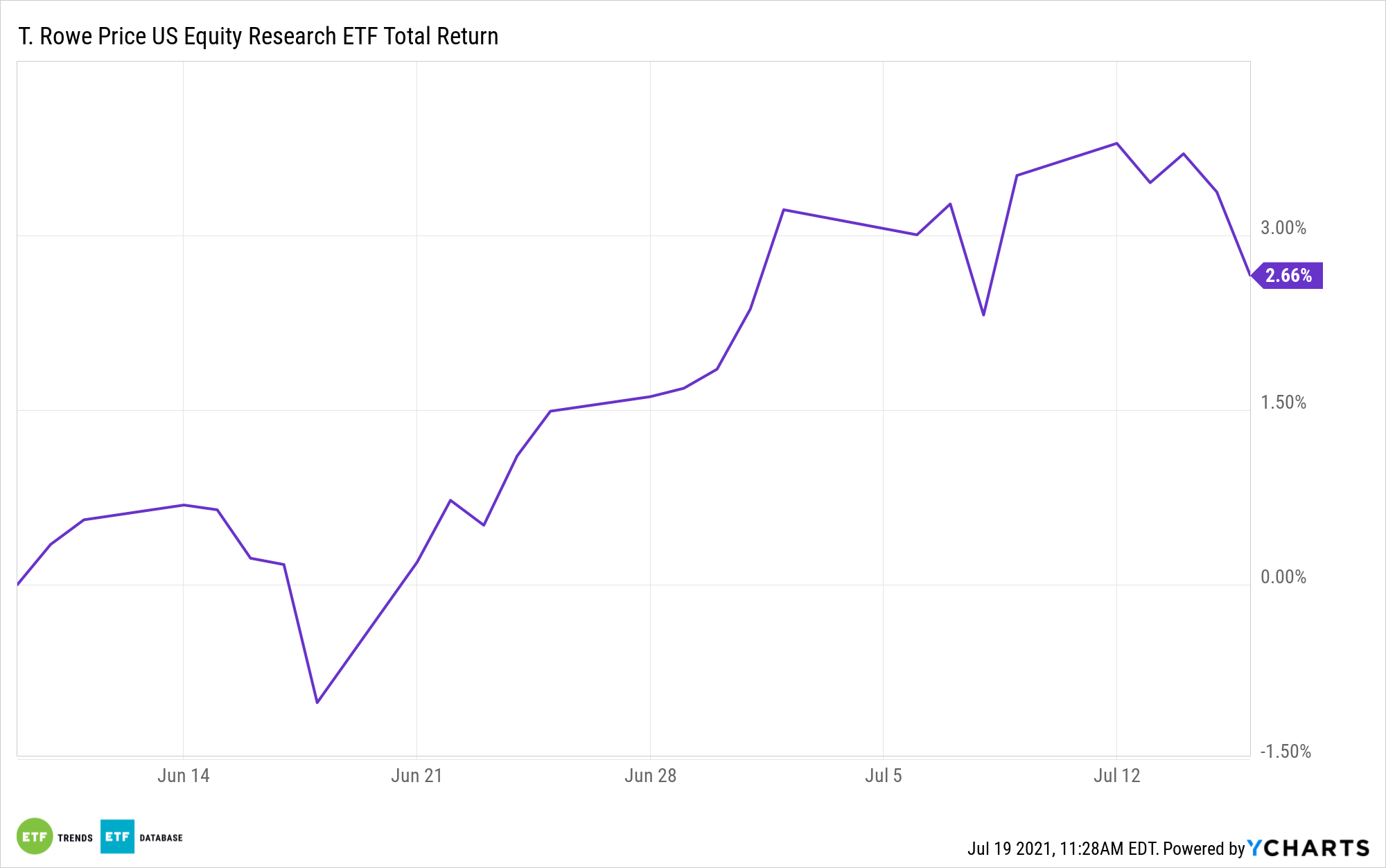

For instance, in T. Rowe Worth’s newest ETF, the T. Rowe Worth US Fairness Analysis ETF (TSPA), the portfolio managers use an lively, research-driven course of to ship giant cap publicity with an identical danger and sector profile because the S&P 500 Index—however with considerably greater efficiency.

TSPA’s funding goal is to hunt long-term capital good points better than the S&P 500 Index over a full market cycle. The ETF matches this benchmark index in sector and business allocation, then makes use of the S&P’s present efficiency to information the weighting, place sizes, and publicity to non-benchmark securities.

T. Rowe Worth has a long time of research-driven investing expertise with its different ETF and mutual fund choices. The mutual fund equal of TSPA, the T. Rowe Worth U.S. Fairness Analysis Fund (PRCOX), was launched in 1994. Since its inception, the mutual fund model of the technique has outperformed the S&P 500 Index, even after bills (by way of Q2 2021).

TSPA is managed by the identical portfolio managers as that mutual fund, who convey with them a long time of analysis and evaluation expertise. Ann Holcomb, Jason B. Polun, Thomas Watson, and Josh Nelson are all vice presidents of T. Rowe Worth Group, Inc. and co-portfolio managers of TSPA.

Nonetheless, the insights of roughly 30 fairness analysis analysts assist to information the fund’s bottom-up inventory choice. They work to pick out outperforming shares while avoiding underperformers, and have proven by way of long-term basic and quantitative analysis to take action successfully.

Most of the corporations in TSPA’s portfolio embrace shares from the S&P 500 universe, together with Microsoft (MSFT), Apple (APPL), and Amazon (AMZN). Nonetheless, TSPA’s managers add worth by figuring out engaging shares from exterior the index, as nicely.

Analysis when evaluating corporations for inclusion in TSPA incorporates an evaluation of the corporate’s total monetary place utilizing key finance metrics, reminiscent of return on capital and earnings per share, in addition to evaluating the enterprise mannequin and market place of the corporate.

T. Rowe Worth’s research-driven strategy signifies that traders can sit safe within the information that the ETF is actively capitalizing on market adjustments, guided by skilled analysts in actual time below an skilled administration workforce.

The purpose of long-term capital good points signifies that the portfolio comprises between 200-275 securities and follows the S&P 500 at a 1.75% predicted monitoring error.

TSPA is an applicable selection for traders seeking to maximize their good points whereas following a diversified core fairness holding much like the publicity usually sought from the S&P 500. The pliability of an actively managed ETF permits for cost-effective investing in a product that can proceed so as to add worth over time.

For extra info, please go to the issuer’s fund web page for TSPA.

For extra information, info, and technique, go to the Energetic ETF Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.