Shares fell for his or her fourth straight week, a streak

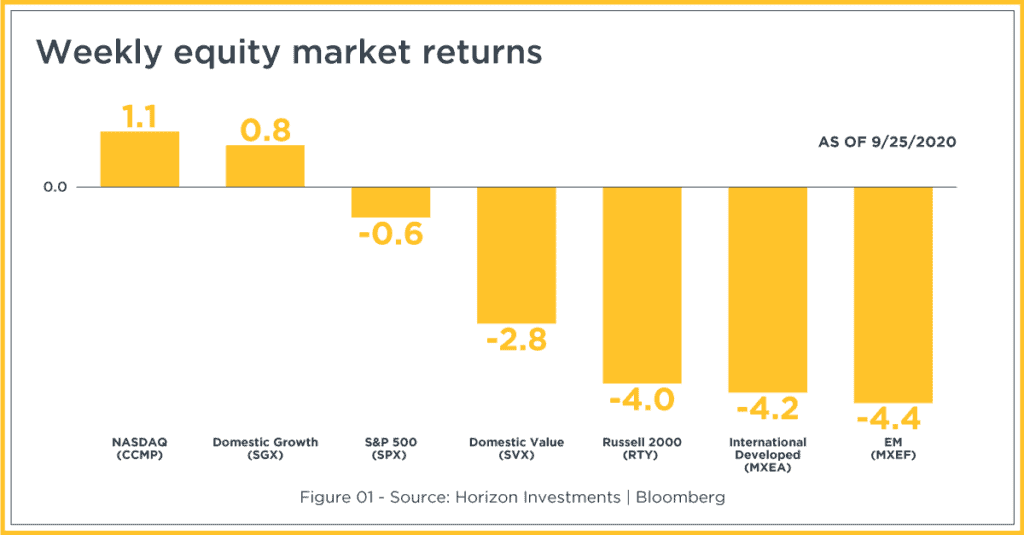

Shares fell for his or her fourth straight week, a streak not seen within the S&P 500 because the commerce conflict escalation final August. In a break with the prior three weeks, nonetheless, the promoting final week was concentrated in non-U.S. equities. The S&P 500 outperformed strongly, down 0.6% on the week, whereas worldwide developed markets fell 4.2% (MXEA) and rising markets was off by 4.4% (MXEF) [Figure 1].

Tech-heavy NASDAQ up barely, an encouraging signal

Fairness market management within the U.S. continues to be uneven, however final week’s stability within the chief on this current dump, the tech-heavy NASDAQ, is an encouraging signal. It was up 1.1% final week, whereas small caps fell 4.0% (RTY) [Figure 1].

Development additionally strongly outperformed worth, pulling forward on the month. Regardless of the fixed chatter, we’re simply not seeing the makings of a sturdy rotation in favor of worth. Fundamentals have to accompany the value motion—in any other case, it’s simply noise.

[wce_code id=192]

The S&P 500 closed Friday about 8% decrease than its peak on September 2nd, however the CBOE Volatility Index (VIX) is principally flat over that point. that very same relationship for the NASDAQ 100 exhibits an approximate 10% loss within the index whereas the CBOE NASDAQ-100 Volatility Index (VXN) is about 2 vols decrease. That lack of hedging curiosity reinforces our view that it is a correction to speculative topside shopping for made worse by low liquidity, not a brand new development.

2020 U.S. Election issues on the rise

Investor concern in regards to the 2020 election is on the rise and appears to have been behind a few of this current promoting in equities. It’s now dearer to hedge, in volatility phrases, for the month of December than November — an indication that buyers predict vital delays within the election outcomes (and probably worse) of the upcoming election. It seems the Supreme Court docket emptiness has energized each side, Democrats and Republicans. Because of this, election odds didn’t change a lot final week. All eyes now are on Tuesday evening’s debate.

Covid-19 again out there’s sights?

Regardless of by no means actually going away, Covid-fatigue had forged a spell available on the market since August. That’s not the case as a real second wave appears to have taken maintain in Europe, which is inflicting new restrictions that ought to gradual and maybe even reverse the financial restoration. Covid’s re-entry into the market’s consciousness probably contributed to the weak spot in worldwide developed equities final week. U.S. instances are rising as effectively. And whereas further restrictions right here within the U.S. will not be but being talked about, in our view Europe stays a greater mannequin than Asia for the U.S.

Providers financial system continues to lag

On the financial information entrance, it’s extra of the identical. Shopper confidence is a standout, supporting the acquisition of products, like sporting and recreation-related tools and residential leisure purchases. Who amongst us hasn’t made a pandemic-related buy to assist counter the results of stay-at-home restlessness and the problem of our ordinary journey and leisure decisions not being obtainable to us? That’s inflicting manufacturing, and export economies, to shock to the upside throughout the globe. Providers, nonetheless, proceed to lag, a troubling signal that tells us the subsequent leg of the restoration will probably be slower and tougher.

Bond yields fell, curve flattened

Authorities bond yields fell final week as a slew of Fed governors had been on the tape discussing their new coverage framework. The curve flattened, led decrease by the long-end, with the U.S. 30-Yr Treasury down 6 foundation factors (bps) for the week and the 10-Yr and 2-Yr down Four bps and 1 bps, respectively.

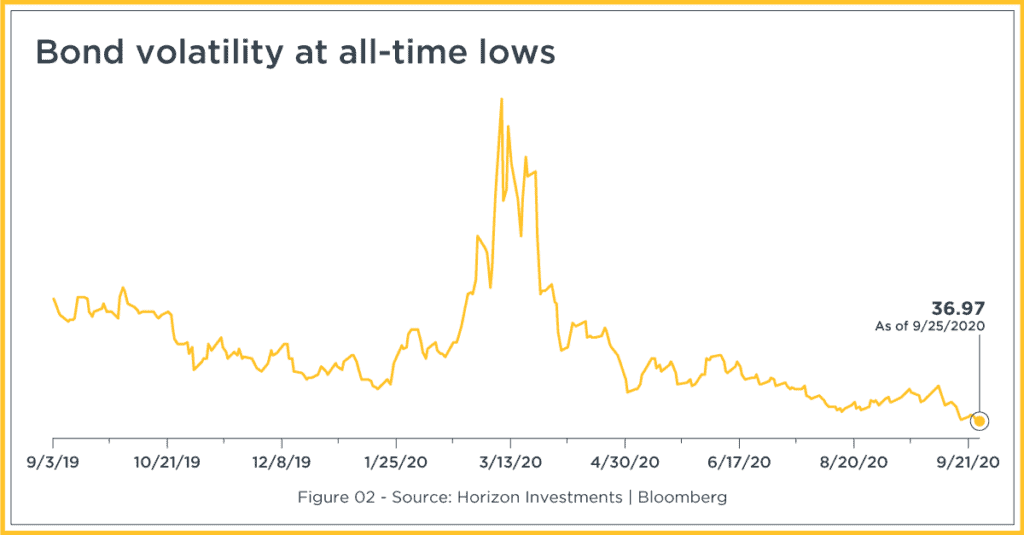

Every of those main benchmarks has moved lower than 2 bps within the month of September. That’s regardless of a pointy sell-off in equities and new ahead steering from the Fed. Our take? Get used to it. Decrease for longer means all yields decrease, not simply the entrance finish. And it means volatility will stay subdued; the MOVE Index, a measure of bond volatility, closed at all-time lows on Friday [Figure 2].

Inflation expectations proceed to say no

Market-based inflation expectations proceed to say no as effectively. After peaking on the finish of August, 10-year breakevens are down 22 bps. As soon as once more, this was a false daybreak within the rotation/reflation commerce thesis. The Fed can’t be pleased with this, and their conflicting remarks this previous week point out that they nonetheless have some work to do in speaking their new framework.

Stress on credit score spreads

Credit score had a tricky week, with noticeable stress on spreads throughout the board, as investment-grade (IG) and high-yield (HY) had been up 12 bps and 47 bps, respectively. The outflows in HY had been significantly giant, a pointy distinction to the low quantity strikes we’ve seen within the fairness market. To us this simply appears to be some catch-up with the weak spot in equities; previous to final week, IG spreads had been really tighter for the month of September, whereas HY was solely 13 bps wider.

Rumors of the greenback’s demise tremendously exaggerated?

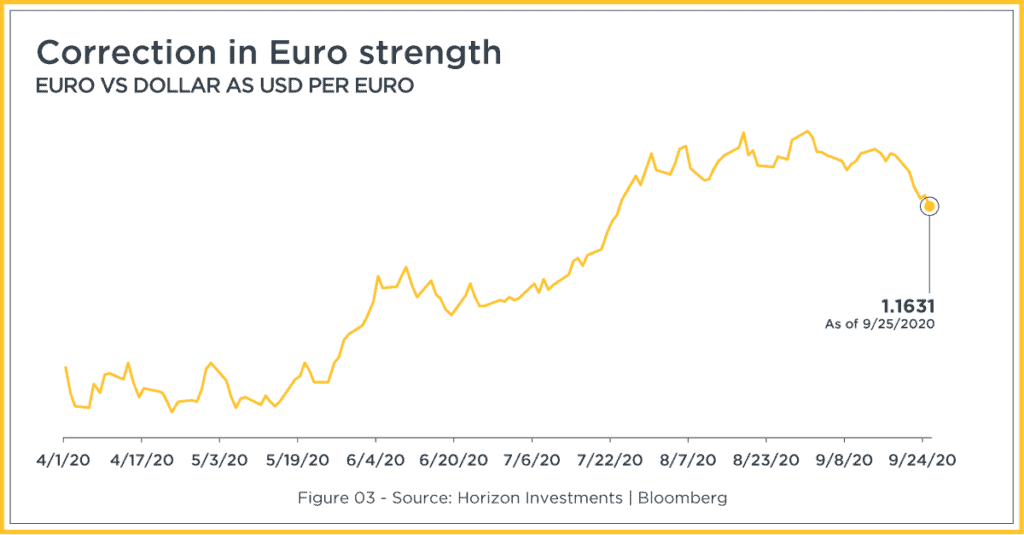

The USD rose strongly, up 2.0% on a broad foundation (BBDXY), as key technical ranges had been damaged and short-term cease losses triggered. Final week’s transfer was the most important since early April, and serves as a reminder that the “greenback demise” thesis works higher in academia than in actuality. It additionally highlights that the current USD weak spot was actually a narrative of Euro energy, now one thing known as into severe query as their Covid state of affairs deteriorates [Figure 3].

What to look at now

Covid-19

Markets can be carefully watching Covid instances, particularly in Europe, the place the imposition of further restrictions on exercise is anticipated. With Covid instances on the rise, too, in practically half of U.S. states, we’ll be expecting any rollback in reopening measures on a state-by-state foundation.

U.S. Jobs Report

The Division of Labor’s September U.S. Jobs report comes out on Friday, the final report attributable to be launched earlier than the election. Whereas the unemployment fee is anticipated to tick decrease, it stays traditionally excessive. Consensus is that the tempo of job beneficial properties has slowed considerably and that the monetary pressure of job losses might begin to chunk, particularly with additional stimulus probably out of attain. Whereas final week noticed some renewed optimism a few Part IV deal following Fed Chairman Powell’s urging, the 2 political events in D.C. nonetheless look like very far aside. And to us, the 6% loss within the S&P 500 this month (as of Friday’s shut) doesn’t look like sufficient to carry them collectively. Wanting obviously terrible new information, we don’t see a Part IV deal coming anytime quickly.

U.S. Private Earnings & Spending

On Thursday, The Bureau of Financial Evaluation will launch its private earnings and spending figures for August. Private earnings is anticipated to fall by 2.4% over July, because of the expiration of the $600 monthly unemployment insurance coverage complement. Whereas August spending is anticipated to point out a rise, consensus is that it is going to be decrease than what we noticed in July. We’ll be watching to see if the shortage of fiscal stimulus begins to gradual consumption or if the buyer can stay resilient.

International PMIs

International PMIs for manufacturing and providers come out Thursday. Manufacturing is anticipated to point out continued energy. The larger query is whether or not the providers aspect of the financial system can shock to the upside, which might be significantly vital for the U.S. and Europe.

U.S. Shopper Confidence

The Convention Board will launch its month-to-month snapshot of shopper confidence on Tuesday. Whereas anticipated to come back in barely greater than final month, when the index dropped considerably, consensus is that it’s going to nonetheless be effectively under June highs. The ultimate outcomes of the College of Michigan Shopper Sentiment Survey can even be launched on Friday. The constellation of those shopper indices ought to give us a clearer image of the place shopper sentiment is trending and if the buyer can stay optimistic within the face of recent election and Covid issues—and with out further stimulus prone to come anytime quickly.

Federal Reserve and ECB Audio system

We’ll be listening for added readability from the Fed in regards to the implementation of its 2% common inflation goal. European Central Financial institution (ECB) audio system might additionally reveal what extra they’ll do to ease, particularly with Covid instances on the rise and with the current energy within the Euro threatening their manufacturing-led restoration.

To obtain a duplicate of this commentary and the chart of the week, click on the button under.

To debate how we will empower you please contact us at 866.371.2399 ext. 202 or [email protected].

Nothing contained herein must be construed as a suggestion to promote or the solicitation of a suggestion to purchase any safety. This report doesn’t try to look at all of the info and circumstances that could be related to any firm, business or safety talked about herein. We’re not soliciting any motion based mostly on this doc. It’s for the final data of shoppers of Horizon Investments, LLC (“Horizon”). This doc doesn’t represent a private advice or keep in mind the actual funding aims, monetary conditions, or wants of particular person shoppers. Earlier than performing on any evaluation, recommendation or advice on this doc, shoppers ought to take into account whether or not the safety in query is appropriate for his or her explicit circumstances and, if crucial, search skilled recommendation. Traders might understand losses on any investments. It’s not doable to take a position instantly in an index.

Previous efficiency will not be a information to future efficiency. Future returns will not be assured, and a lack of unique capital might happen. This commentary is predicated on public data that we take into account dependable, however we don’t signify that it’s correct or full, and it shouldn’t be relied on as such. Opinions expressed herein are our opinions as of the date of this doc. We don’t intend to and won’t endeavor to replace the data mentioned on this doc. No a part of this doc could also be (i) copied, photocopied, or duplicated in any kind by any means or (ii) redistributed with out Horizon’s prior written consent.

Different disclosure data is obtainable at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered logos of Horizon Investments, LLC

©2020 Horizon Investments LLC

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.