By Daniel Perrone, Director and Head of Operations, ESG Indices, S&P Dow Jones Indices

By Daniel Perrone, Director and Head of Operations, ESG Indices, S&P Dow Jones Indices

Since S&P Dow Jones Indices introduced that Tesla could be added to the S&P 500® on Dec. 21, 2020, many buyers have contacted us asking when this transformative firm will grow to be a member of the S&P 500 ESG Index, the sustainable counterpart to the S&P 500. The reply, in short, is that Tesla won’t robotically be a part of the S&P 500 ESG Index upon its addition to the S&P 500. As a substitute, Tesla might be assessed through the subsequent annual rebalance of the S&P 500 ESG Index, going down on the finish of April 2021. However even then, inclusion into the index is just not assured. Whether or not Tesla turns into an index constituent might be decided by its sustainability efficiency throughout many standards relative to its friends.

Tesla’s ESG Rating

The primary driver of whether or not an organization is chosen to hitch the S&P 500 ESG Index is its S&P DJI ESG Rating. This rating is derived from the annual Company Sustainability Evaluation (CSA), which is run by SAM, part of S&P World. The CSA is a extremely granular, industry-specific questionnaire primarily based on monetary materials ESG metrics. Insights gathered from the CSA type the spine of the ESG rating that’s used to pick firms added to the S&P 500 ESG Index.

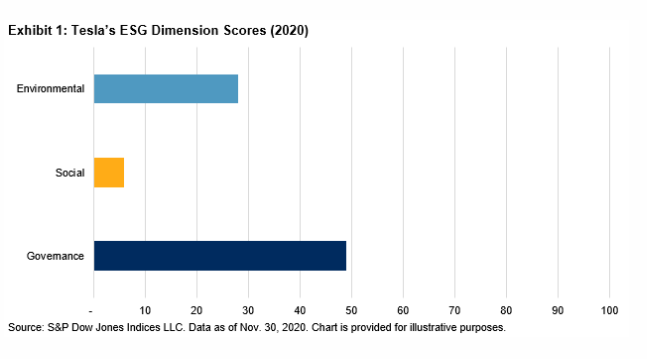

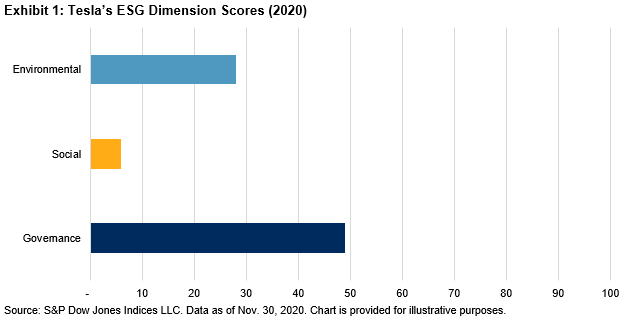

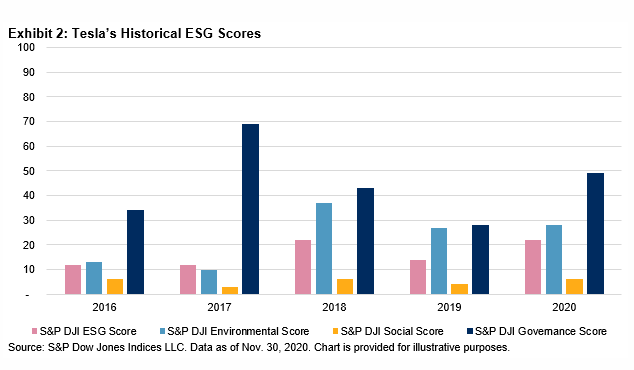

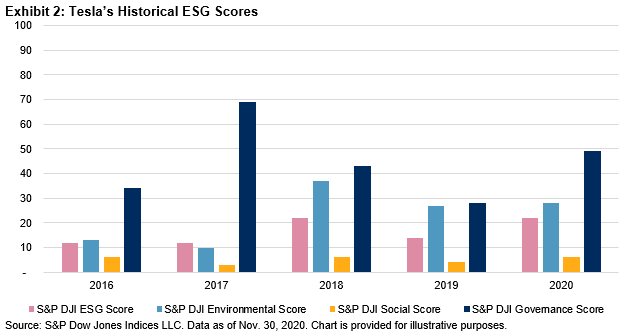

For this present evaluation yr, Tesla’s S&P DJI ESG Rating was 22 out of 100, up eight factors from 2019’s rating. That is pushed by its ESG Dimension Scores, together with an Environmental rating of 28 (up 1 level from final yr), a Social rating of 6 (up 2 factors), and a Governance rating of 49 (up 21 factors). Tesla doesn’t fill out the CSA, so its S&P DJI ESG Rating is decided primarily based on analysis utilizing publicly obtainable info.

Many could also be shocked to see such a low general ESG rating (and Environmental rating) for Tesla, given its deal with electrical autos. Specializing in “inexperienced” merchandise, nonetheless, doesn’t robotically make sure that firms will rating effectively from an general ESG perspective. The S&P DJI ESG Rating is vast ranging in what it encompasses, as it’s meant to seize an organization’s broad sustainability efficiency.

Within the Environmental dimension, Tesla in fact scored effectively within the space of low carbon technique, with a virtually good rating of 99. Nevertheless, the corporate scored low in environmental reporting, local weather technique, and environmental coverage and administration techniques, which suppressed the corporate’s general Environmental rating.[1] Tesla additionally scored particularly low on social metrics throughout the board, which embody human capital growth, social reporting, and labor apply indicators. Tesla did comparatively effectively within the Governance realm, particularly relative to the prior yr.[2]

The S&P 500 ESG Index Methodology

So, what does this imply for Tesla’s standing within the S&P 500 ESG Index? We received’t know till the upcoming annual rebalance is finalized on the final enterprise day of April 2021. At the moment, Tesla might be measured towards its friends throughout many ESG standards. As talked about earlier, nonetheless, the most important determinant of the composition of the S&P 500 ESG Index is an organization’s S&P DJI ESG Rating. But it surely’s not only a firm’s absolute efficiency that issues; an organization additionally must charge effectively relative to its friends.

The S&P DJI ESG Rating is utilized in two methods within the index methodology. First, the underside 25% of firms in every GICS® {industry} group is screened out on a world foundation. This prevents an organization that could be a good ESG performer regionally however poor on a world foundation from making it into the index. Second, firms are ranked by their ESG rating inside the S&P 500 after which chosen from the highest all the way down to get as shut as doable to 75% of the {industry} group’s unique market capitalization.

Will Tesla make it by these two key screens and grow to be a member of the S&P 500 ESG Index? Subsequent April, we’ll know. The S&P 500 ESG Index has no early-entry rule that will afford Tesla further privileges; will probably be handled the identical as another firm.

The writer want to thank Reid Steadman for his intensive contributions to this weblog submit.

Initially printed by Indexology, 12/22/20

1 In accordance with the CSA, low carbon technique (which is a singular criterion to the vehicles {industry}) is outlined as an evaluation of methods carried out by firms to cut back the carbon depth of their core portfolio, whereas local weather technique is outlined as an evaluation of methods put in place by firms to handle the dimensions of the problem local weather change represents for his or her {industry}, and environmental coverage and administration techniques covers administration instruments carried out by firms to be able to enhance their environmental efficiency in a cheap means and cut back the danger of incurring fines or penalties for not complying with environmental laws.

2 To supply some context for Tesla’s scores, the S&P DJI ESG Scores are normalized throughout world industries and are designed to be learn as percentiles. Thus, a rating of 22 implies that that firm had the next rating than 22% of its {industry} friends globally.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.