By Rod Smyth, Chairman of the Board of Administrators

SUMMARY

- Low rates of interest and rising life expectancy are two main challenges for Monetary Advisors and their shoppers.

- Within the distribute part, portfolios will probably want better publicity to ‘threat belongings’ corresponding to shares and better yielding bonds to satisfy return targets, in our view.

- Managing these dangers is essential when discovering the correct steadiness between present earnings and development of principal.

Purchasers in Retirement Needing Revenue

In a world the place most individuals don’t take pleasure in the advantage of a assured pension, retirement turns into a private duty. The objective for a lot of buyers is to take care of their lifestyle in retirement with the peace of thoughts that their cash won’t run out. Moreover, we consider retirees don’t need to spend their golden years worrying concerning the month-to-month fluctuations within the inventory market.

[wce_code id=192]

The problem of offering a stream of earnings for retirement has modified dramatically for a lot of causes:

- Life expectancy is growing. Within the US, life expectancy has elevated steadily from 68 in 1950 to 79 right this moment, in line with the United Nations, and so they forecast it would rise to 84 by 2055. Due to this fact, the asset pool at retirement have to be bigger than has traditionally been the case.

- Few assured pensions. Most employers not present a assured pension. Within the ‘good ole days’ when many corporations had assured pensions, retirement earnings was your employers’ drawback. Now with outlined contribution plans (corresponding to 401okay plans), that drawback has been shifted to staff who should construct up financial savings and make investments it themselves. Traders with inadequate financial savings are tempted to have extreme publicity to dangerous belongings, making an attempt to attain unrealistic spending targets.

- Low rates of interest on money and bonds. Because of very low rates of interest, we expect a secure portfolio of bonds is unlikely to return near offering sufficient after-tax, after inflation earnings for many of the buyers we serve. For instance: The yield on the usual benchmark bond index is round 1.5% as of June 25, 2021 (based mostly on the Bloomberg Barclays U.S. Combination Index which incorporates Authorities, Company, and Mortgage bonds).

- Excessive yield is commonly excessive threat: yields are normally excessive for a cause. Decrease high quality bonds, particularly these rated beneath funding grade, provide larger yields to compensate buyers for larger volatility and better threat of default. Proudly owning excessive dividend-paying shares will also be riskier than you may assume. Firms with excessive dividends may be extremely indebted and may be concentrated in sure sectors, typically people who have decrease earnings potential.

- Lack of investing expertise. Many retirees have little expertise with investing, managing threat, and managing feelings. Coping with the worth swings of dangerous belongings entails the next dangers in our opinion:

- Emotional Threat: In our expertise buyers plan in 5 and 10-year time horizons, however typically succumb to concern and greed by reacting to present headlines. This may trigger them to desert effectively thought-out plans, made in a relaxed setting. We consider a crucial a part of the retirement planning course of is to evaluate and periodically evaluation threat urge for food to construct a plan that enables the retiree to climate market volatility. This additionally entails a sensible understanding of the potential longer-term tradeoff between returns and security.

- Drawdown Threat: When threat belongings fall considerably in worth, month-to-month withdrawals may cause compelled promoting at unattractive ranges risking the viability of the plan.

Producing a 3-6% after-inflation return in retirement.

Within the present low rate of interest world, we consider a retiree looking for a 3-6% return after inflation, with constant month-to-month earnings, might want to make investments a better portion of their belongings in additional unstable investments to get the upper returns they search. Let’s name these “threat belongings”, which may embrace shares, funding grade bonds, larger yield “junk” bonds, actual property, and different investments.

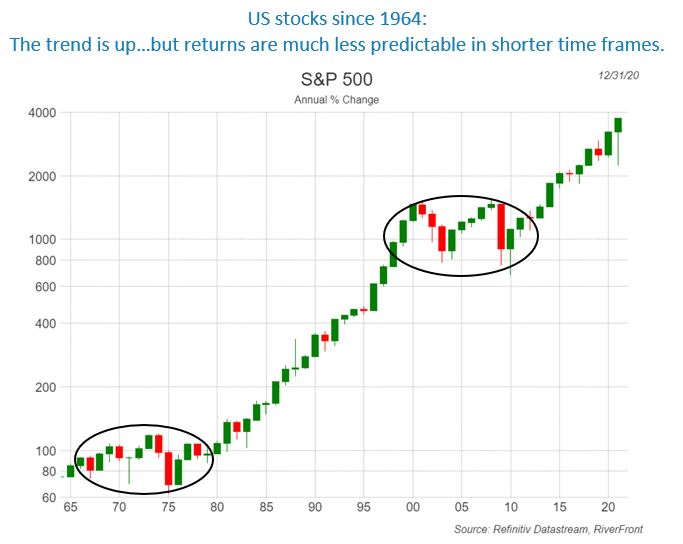

To offer you a way of the journey of a inventory investor, the chart beneath exhibits annual worth returns for the S&P 500 index of enormous US shares from the start of 1964 to the top of 2020. Whereas the worth positive aspects have been appreciable -roughly 40-fold since 1964 – every purple bar represents a declining 12 months. The ovals present extended durations (10-15 years) the place the index basically went sideways, was very unstable, and had a number of down years. A few of the drawdowns in these timeframes had been appreciable with the index dropping roughly half its worth Three instances: 1973-1974, 2001-2003, and 2008. Whereas it may be tempting to take a look at the general returns to resolve an applicable allocation, we expect it’s simply as necessary to think about the journey. Given sufficient time, shares have traditionally been a rewarding funding, however these within the distribution part have differing time horizons. Thus, the quantity allotted to shares all through the retirement journey is a vital a part of the distribution equation and one we take into consideration when designing our portfolios.

Previous efficiency isn’t any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency. Index definitions can be found within the disclosures.

The constructing blocks of a 21st Century Retirement Plan

Threat Belongings: When establishing a retirement plan, we consider buyers ought to use sufficient ‘threat belongings’ to supply the required returns. Riskier belongings require extra cautious choice and nearer scrutiny. For instance, when incorporating high-yield bonds, we expect it is very important perceive the particular dangers of every bond, which will not be apparent upon cursory evaluation. We consider all these bonds can play an necessary function in boosting money circulate, however we additionally consider it is a resolution that must be actively managed and monitored.

A Balanced Construction: We consider buyers ought to make sure the portfolio has not solely a stream of mounted earnings funds, but additionally a combination of shares that produce a mix of rising dividends and earnings. We are inclined to choose corporations with the best potential to develop dividends, somewhat than these with the best beginning yield, as we consider development of earnings is necessary within the distribution part. Additionally, corporations in faster-growing sectors typically reinvest their extra money circulate to develop and don’t pay dividends. We don’t need to exclude these shares as we expect they’ll play an necessary function in rising the retiree’s asset base.

Money Reserve: We consider buyers ought to maintain a money reserve that ensures retirement earnings may be drawn down throughout market corrections thereby minimizing inventory gross sales throughout bear markets. Handle the money reserve by promoting some probably overvalued, appreciated belongings in good instances to fund the money pool. In dangerous instances, portfolio earnings may be supplemented by promoting low threat, much less unstable belongings.

How RiverFront might help

Whereas retirement is the top of the Accumulate or Maintain journey, it’s the starting of a probably lengthy Distribute part as life expectancy continues to extend. At RiverFront, we consider buyers might want to preserve a bigger allocation to shares within the distribution part so long as the money circulate from bonds and cash markets stays so low; and our portfolio options replicate this perception. This may probably contain larger swings in quarterly portfolio values.

With the assistance of a monetary advisor, a professionally crafted retirement plan may be tailor-made to the buyers’ wants, and threat tolerance. We predict our concentrate on portfolio building, threat administration, transparency, and constant communication are crucial parts in giving Monetary Advisors and their shoppers the peace of thoughts to stay with the agreed plan.

Necessary Disclosure Data

The feedback above refer usually to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to vary. Previous efficiency isn’t indicative of future outcomes and diversification doesn’t guarantee a revenue or defend towards loss. All investments carry some stage of threat, together with lack of principal. An funding can’t be made immediately in an index.

Chartered Monetary Analyst is knowledgeable designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of economic analysts. Candidates are required to move three ranges of exams protecting areas corresponding to accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can change into a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Data or information proven or used on this materials was obtained from sources believed to be dependable, however accuracy isn’t assured.

This report doesn’t present recipients with info or recommendation that’s adequate on which to base an funding resolution. This report doesn’t have in mind the particular funding targets, monetary state of affairs or want of any specific shopper and will not be appropriate for all sorts of buyers. Recipients ought to contemplate the contents of this report as a single think about investing resolution. Extra elementary and different analyses could be required to make an funding resolution about any particular person safety recognized on this report.

In a rising rate of interest setting, the worth of fixed-income securities usually declines.

Shares characterize partial possession of a company. If the company does effectively, its worth will increase, and buyers share within the appreciation. Nevertheless, if it goes bankrupt, or performs poorly, buyers can lose their whole preliminary funding (i.e., the inventory worth can go to zero). Bonds characterize a mortgage made by an investor to a company or authorities. As such, the investor will get a assured rate of interest for a selected time frame and expects to get their authentic funding again on the finish of that point interval, together with the curiosity earned. Funding threat is reimbursement of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Traders ought to concentrate on these variations previous to investing.

Yield to worst is calculated on all attainable name dates. It’s assumed that prepayment happens if the bond has name or put provisions and the issuer can provide a decrease coupon fee based mostly on present market charges. If market charges are larger than the present yield of a bond, the yield to worst calculation will assume no prepayments are made, and yield to worst will equal the yield to maturity. The belief is made that prevailing charges are static when making the calculation. The yield to worst would be the lowest of yield to maturity or yield to name (if the bond has prepayment provisions); yield to worst could be the similar as yield to maturity however by no means larger.

There are particular dangers related to an funding in actual property and Actual Property Funding Trusts (REITs), together with credit score threat, rate of interest fluctuations and the influence of assorted financial circumstances.

Excessive-yield securities (together with junk bonds) are topic to better threat of lack of principal and curiosity, together with default threat, than higher-rated securities.

Index Definitions:

Bloomberg Barclays US Combination Bond Index measures the efficiency of the US funding grade bond market. The index invests in a large spectrum of public, investment-grade, taxable, mounted earnings securities in america – together with authorities, company, and worldwide dollar-denominated bonds, in addition to mortgage-backed and asset-backed securities, all with maturities of multiple 12 months.

Commonplace & Poor’s (S&P) 500 Index measures the efficiency of 500 massive cap shares, which collectively characterize about 80% of the full US equities market.

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Trade Fee. Registration as an funding adviser doesn’t indicate any stage of talent or experience. Any dialogue of particular securities is offered for informational functions solely and shouldn’t be deemed as funding recommendation or a suggestion to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Included (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its staff by means of RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and due to this fact an oblique proprietor of RiverFront. BFC is the mum or dad firm of Robert W. Baird & Co. Included, a registered dealer/vendor and funding adviser.

To evaluation different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Kind ADV, Half 2A. Copyright ©2021 RiverFront Funding Group. All Rights Reserved. ID1701822

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.