The Invesco Taxable Municipal Bond Fund (NYSEArca: BAB) as soon as featured “Construct America bonds” in its title, therefore the ticker “BAB.”

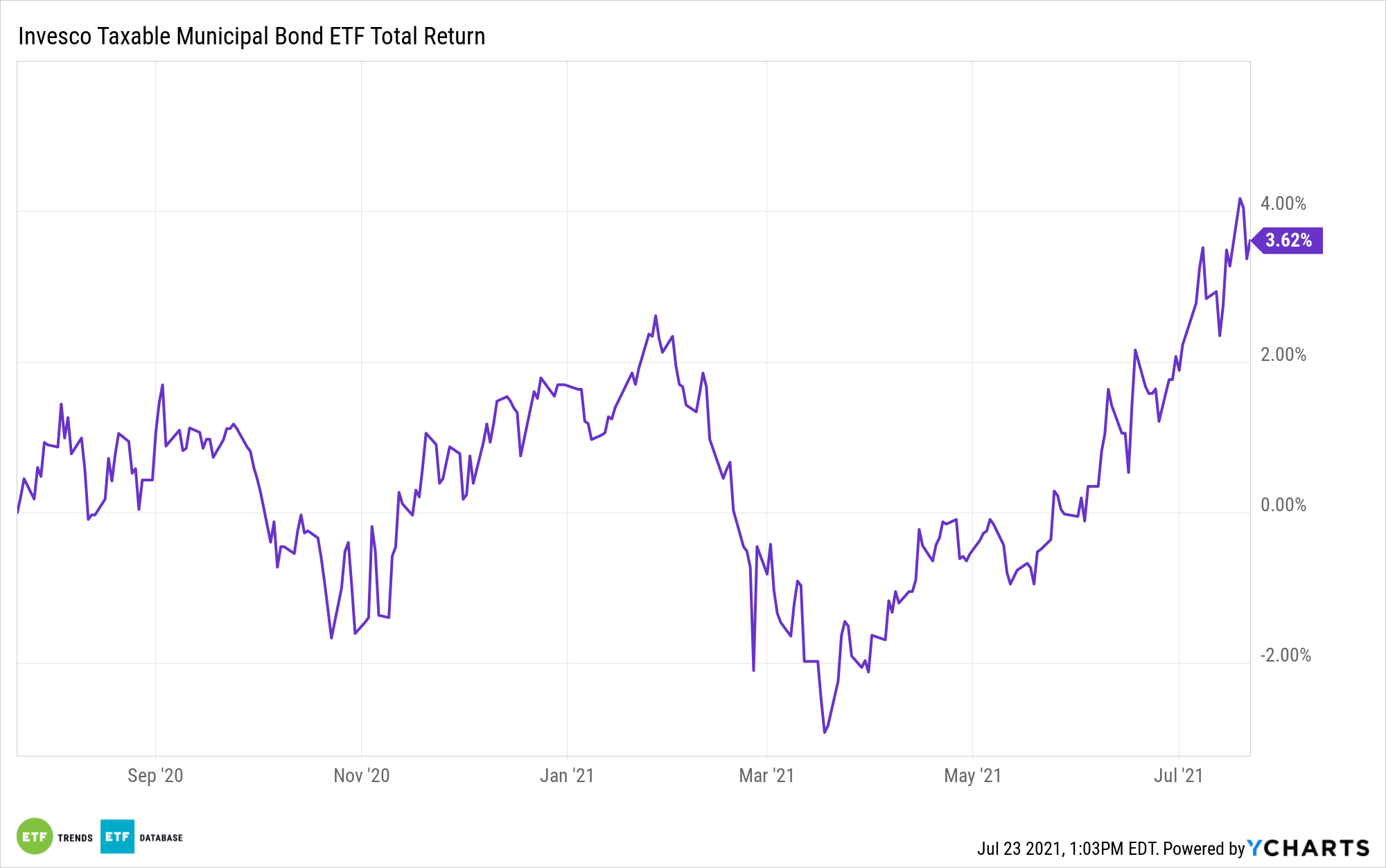

Whereas the alternate traded fund’s title modified, it stays one of many premier avenues for accessing a broad portfolio of taxable municipal bonds, and with some market observers seeing indicators of life within the typically neglected Construct America Bond area, BAB might warrant consideration from income-oriented buyers.

“The issuance of taxable municipal securities has leapt to file ranges since mid-2019 in opposition to a post-tax-exempt advance refunding backdrop of traditionally low charges, persistently low municipal-to-U.S.-Treasury ratios, and heightened curiosity from an increasing world pool of buyers,” stories The Bond Purchaser.

Usually, earnings buyers embrace municipal bonds because of federal and state tax advantages. BAB holdings dwell in a unique a part of the municipal debt tax spectrum. Taxable munis are issued by cities and different issuers for initiatives with slender use. For instance, some cities have issued taxable munis to fund sports activities stadiums.

Because of the slender use of such a venue, the earnings from these bonds is taxed whereas a state’s normal obligation bonds, which normally fund initiatives seen as useful to massive segments of the inhabitants, earn buyers tax breaks.

Consequently, the Construct America Bond market, which hasn’t actually been within the highlight since instantly following the worldwide monetary disaster, is sparsely populated. Morgan Stanley sees alternative for that to alter.

“We see scope for a brand new BABs program to create as much as $880 billion of issuance over 5 years from inception,” in response to the financial institution.

The $2.37 billion BAB, which tracks the ICE BofAML US Taxable Municipal Securities Plus Index, holds 610 bonds. Plans to resuscitate the Construct America Bond market may result in the Invesco fund ultimately replenishing and refreshing its lineup.

There are additionally some political implications to contemplate. On Capitol Hill, there’s bipartisan help for revisiting Construct America Bonds, however states are expressing concern as a result of they wish to know what their tabs will probably be.

“A bunch of 21 Senators suggest together with so-called direct-pay municipal bonds in a $579 billion package deal designed to spur development on roads, bridges and different initiatives, and its bipartisan sponsorship is elevating hopes of passage. The direct-pay provision is being carefully watched by municipal debtors, buyers and bankers due to its similarities to the Construct America Bonds program, which spawned $180 billion of debt gross sales in 2009 and 2010,” in response to Bloomberg.

For extra information, info, and technique, go to the ETF Training Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.