Research reveals that women-led entrepreneurial companies are likely to outperform their less-diverse friends. That’s the funding thesis behind EntrepreneurA (ERA), an SMA technique managed by funding administration agency, ERShares.

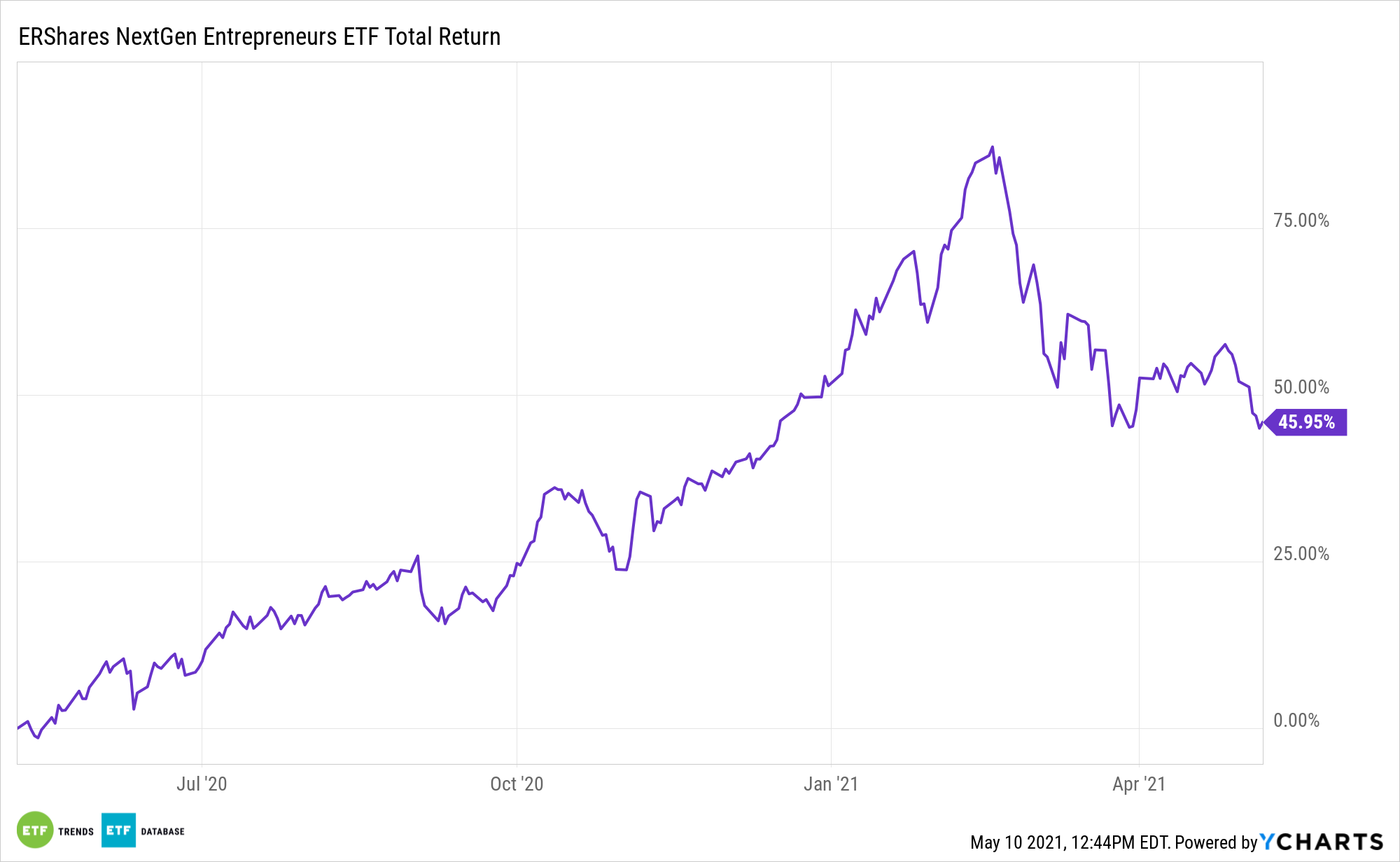

ERShares already has two entrepreneurial ETFs in the marketplace: the ERShares Entrepreneurs ETF (ENTR) and the ERShares NextGen Entrepreneurs ETF (ERSX).

ERA incorporates the identical proprietary Entrepreneur Issue® that drives these two funds, however with an focus towards women-led firms.

“Girls management has translated into higher efficiency and astounding outcomes,” says ERShares on the ERA web site.

Stronger Group, Substantial Change

The concept is easy: analysis has proven that ladies in management positions are likely to create “stronger organizational efficiency.” Within the entrepreneurial area this has been “confirmed to convey substantial change inside all industries,” says ERShares.

Past the agency’s signature Entrepreneur Issue®, the ERA technique distinguishes itself in a number of key methods, together with its give attention to entrepreneurial disruption, an funding course of that’s really international by design, and an emphasis on placing environmental, social, and company governance (ESG) ideas into follow. For instance, ERA’s administration group nears gender parity, with ladies in nearly 50% of management positions.

In reality, ERA’s analysis reveals that feminine leaders could be particularly acutely aware of the ESG impacts their firms have on the world, and that they’ll usually work to mitigate environmental impacts whereas creating robust progress alternatives.

Girls Main Disruptive Change

ERA capitalizes on the truth that ladies are assuming an increasing number of management roles worldwide, bringing recent views and talent units to create progress in historically male-dominated fields.

“Girls-led organizations usually behave otherwise from typical firms, particularly on essential social duty, company turnover, compensation and Board composition metrics,” says the ERA web site.

What’s extra, investing in feminine leaders on a world degree affords nice diversification alternatives for buyers, and will assist create a extra steady portfolio with higher risk-adjusted returns.

To study extra about the advantages of investing in feminine entrepreneurs, go to the EntrepreneurA web site.

For extra information, data, and technique, go to the Entrepreneur ETF Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.