A yr in the past, most individuals exterior the ETF

A yr in the past, most individuals exterior the ETF ecosystem had in all probability by no means heard of ARK Make investments. Sitting at $Three billion in property on the finish of 2019, ARK was the 31st largest ETF supplier largely identified for its concentrated high-growth methods. Whereas the popularity of a high-growth-focused funding technique has not modified, the agency has grown property by 1,500% over the previous 14 months and expanded to turn out to be the eighth largest ETF supplier. ARK’s founder, Cathie Wooden, is virtually a celeb who even has her personal merch line.

ARK’s ETFs have seen unimaginable efficiency, largely attributed to Wooden’s confidence in Tesla and different high-growth corporations. The agency’s largest fund, ARKK, returned 152% in 2020! However macro traits have additionally contributed to ARK’s rise over the previous yr — and people traits could also be heading for reversal.

[wce_code id=192]

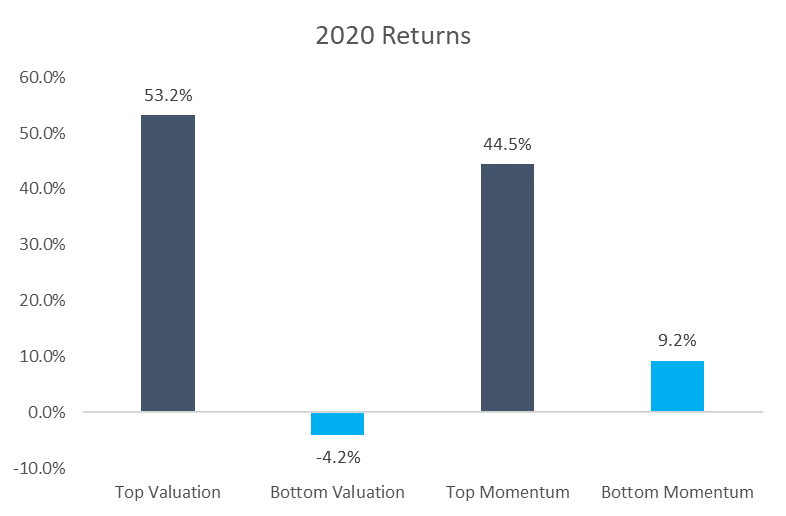

To look at the elements which have contributed to ARK’s success, we will use S&P 500 constituents for evaluation and divide the universe into deciles by explicit elements. Starting with valuations, 2020 was a dramatic yr for the efficiency unfold between low-cost and costly corporations. In truth, by some accounts it was the most important hole ever in a single yr. The second issue that contributed to ARK’s outperformance was momentum. Just like valuations, 2020 noticed dramatic spreads between efficiency of shares with excessive and low momentum.

Supply: Morningstar

The chart above exhibits that the 50 highest-valuation corporations within the S&P 500 on the finish of 2019 outperformed the 50 lowest-valuation corporations by greater than 57%. Possibly much more alarming is the unfold in price-to-earnings ratios of the 2 teams; the costly shares had been 31 instances the worth of the most affordable. It additionally exhibits that the unfold between the highest and backside momentum shares was over 35%. These shares additionally tended to be of upper valuations. Each traits helped increase ARK’s suite of ETFs with 5 out of the eight ETFs seeing returns over 100% in 2020, regardless of lofty valuations.

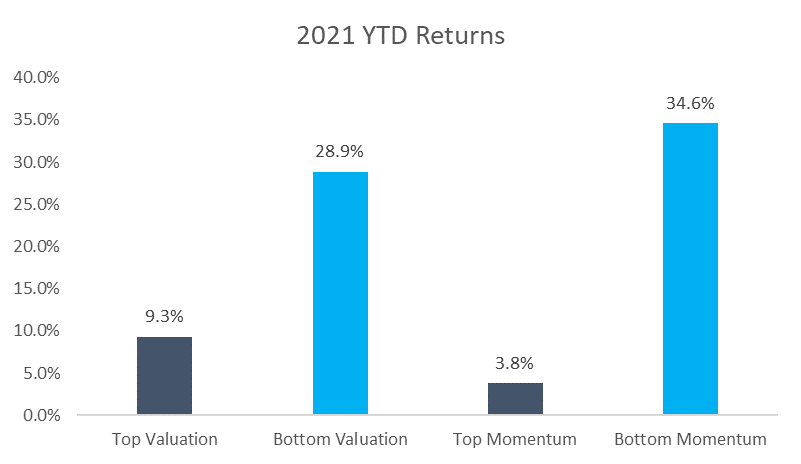

To date in 2021, whereas ARK has been the subject of a lot dialogue given its progress as a agency, a few of its methods haven’t carried out as nicely. Once more, we will look to the earlier two elements as a possible information. See under the identical research for valuations and momentum to this point this yr, by means of March 15.

Supply: Morningstar

These charts present the traits have utterly reversed. Low cost shares have outperformed costly ones by almost 20%, and low-momentum shares have outperformed high-momentum shares by greater than 30%.

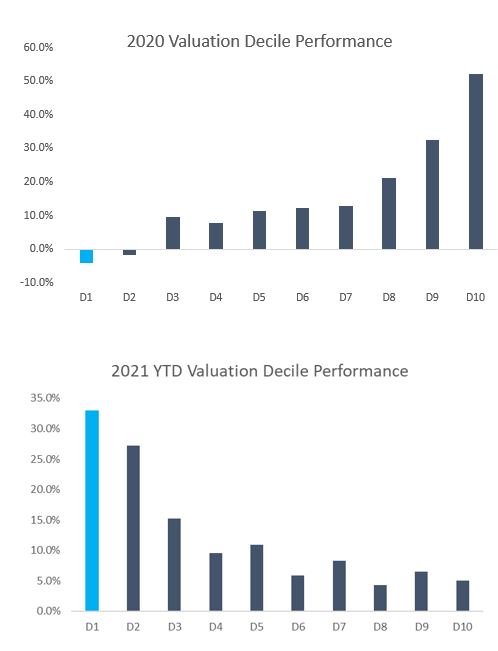

To additional illustrate the reversal in issue efficiency, the charts under present every of the actual deciles for valuations and their corresponding return for 2020 and to this point in 2021. D1 corresponds to the most affordable decile (50 shares) whereas D10 corresponds to the costliest.

Supply: Morningstar

Not solely are you able to visualize the unfold from D1 to D10, but it surely’s almost an ideal glide path with a whole reversal between 2020 returns and what we now have seen to this point this yr. Whether or not or not these traits will persist is anybody’s guess, however for the primary time in a number of years there was significant outperformance by worth. Yields persevering with to rise and financial exercise growing because the world recovers from the pandemic might show to be the tailwinds that worth’s sails want after being battered for years. May a worth restoration imply tough waters forward for ARK? Solely time will inform.

1038-CLS-3/26/2021

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.