It’s been simple being a “capital preservation” investor for a very long time. One merely needed to spend money on income-producing investments and experience the development of falling long-term rates of interest. Traders might get earnings AND complete return with comparatively low volatility. What could possibly be higher?

Nonetheless, the development in long-term rates of interest is perhaps altering and, if that occurs, it implies the definition of “capital preservation” might considerably change. Discovering a single funding that gives earnings, complete return, and low volatility would possibly develop into very troublesome.

Charges observe nominal GDP

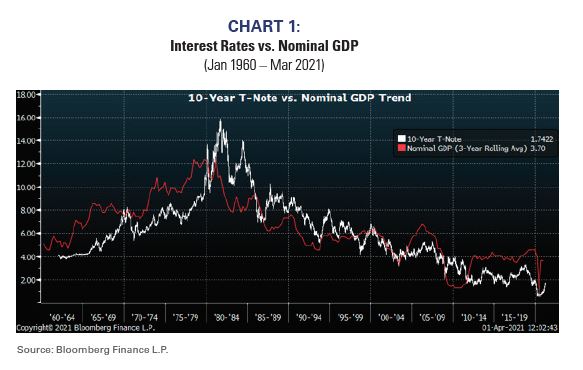

Lengthy-term rates of interest usually observe the development progress of the nominal economic system (i.e., actual progress plus inflation), and the US’s 40-year financial deceleration has prompted a 40-year secular lower in long-term rates of interest and a 40-year bond bull market.

Chart 1 exhibits how the secular slowdown in US progress has dragged down rates of interest. The chart compares the 3-year development of nominal GDP progress to the 10-year T-Word yield. Decrease development progress was most likely the first issue fueling the bond bull market.

[wce_code id=192]

Previous to the 1980’s inflation-fighting Federal Reserve, there was an upward development in nominal progress and bond yields accordingly rose. Nominal GDP progress pulled charges up through the 1960s and 1970s, which can be related to as we speak’s markets. It seems that the pandemic and never development progress led to final yr’s rate of interest decline. Previous to the pandemic it seems nominal progress stopped reducing and charges accordingly began to commerce in a band. If nominal progress begins to speed up, then it might observe longer-term rates of interest also needs to improve.

Present median consensus forecasts for nominal GDP are about 8% for 2021 and 5% for 2022[1]. If these forecasts show true, then long-term rates of interest appear poised to extend and as we speak’s capital preservation methods, which rely closely on fixed-income, is perhaps inappropriate.

Capital Preservation within the 1960s and 1970s

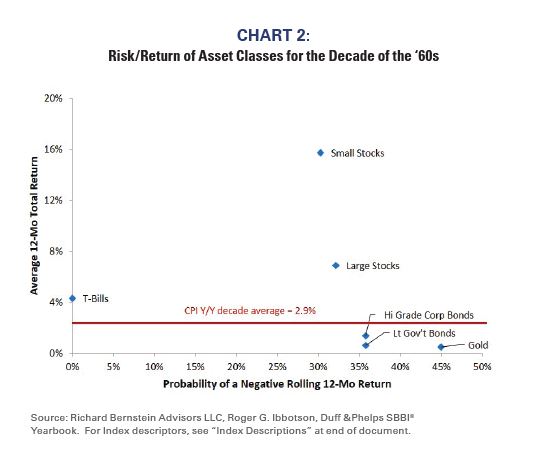

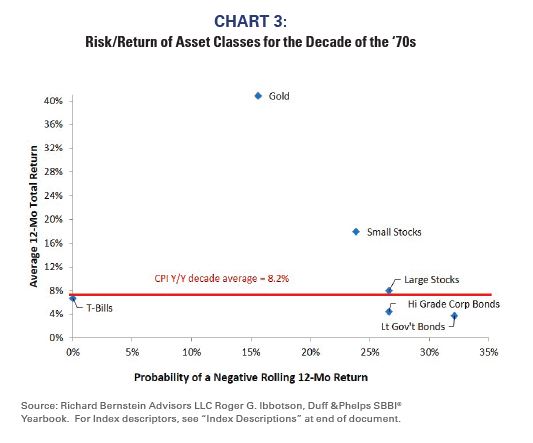

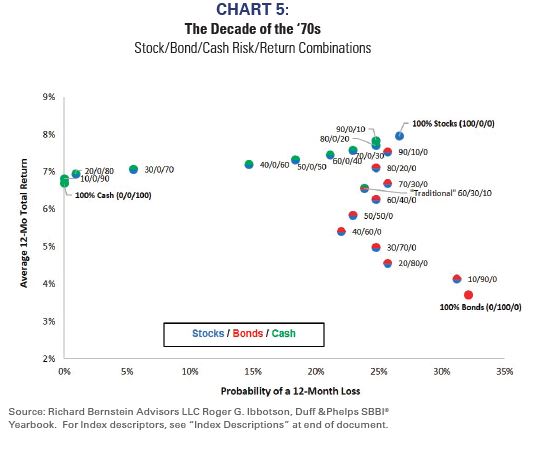

If nominal progress might conceivably mimic the traits of the 1960s or 1970s, it might be price understanding what asset courses really supplied a larger diploma of capital preservation throughout these intervals. Charts 2 and three present danger/return traits for numerous asset courses for the last decade of the 1960s and the 1970s. Importantly, danger is outlined in these charts because the likelihood of a loss amongst rolling 12-month intervals somewhat than the everyday commonplace deviation danger measure as a result of capital preservation methods are imagined to particularly restrict draw back danger.

There are a number of fascinating factors in these charts:

- Holding money was helpful and period was penalized as rates of interest rose. T-bills supplied extra draw back safety than did company and authorities bonds and likewise outperformed bonds throughout each the 1960s and the 1970s. Money was the one asset class to offer constant draw back safety through the twenty years.

- Small shares considerably outperformed bonds and supplied barely extra draw back safety. Though small shares have been hardly a riskless funding, they have been certainly superior to bonds in each many years. Even giant cap shares had destructive return much less typically than did bonds.

- Gold[2] didn’t carry out effectively through the 1960s, however carried out exceptionally effectively through the 1970s. Gold was one of the best performing asset class through the 1970s and bonds gave destructive returns virtually twice as typically as did gold.

- If the definition of capital preservation is sustaining the buying energy of the portfolio, then bonds have been a horrible asset class throughout each the 1960s and the 1970s as a result of the typical return was lower than the typical inflation price.

The return of money?

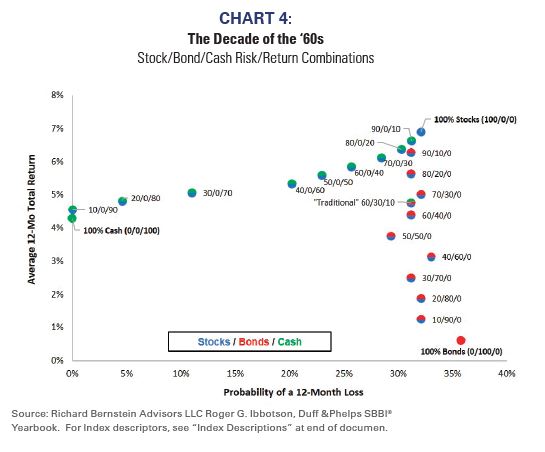

Most buyers as we speak shun money as an asset class due to traditionally low yields. Nonetheless, money could possibly be a superior capital preservation funding to bonds ought to the economic system and markets return to one thing resembling the 1960s or 1970s. Money returns weren’t solely much less unstable than have been bond returns throughout these two

many years, however money really had increased returns. Charts four and 5 present danger/return mixtures for shares, bonds, and money. The blue/inexperienced dots depict mixtures of shares and money, whereas the blue/pink cots depict mixtures of shares and bonds.

For the reason that 1980s bonds have been thought-about the cornerstone of nearly each capital preservation portfolio. Nonetheless, they have been a horrible capital preservation funding throughout each the 1960s and the 1970s. No mixture of shares and bonds was superior to a mix of shares and money throughout these twenty years.

The definition of “capital preservation” is altering

As we’ve written in a lot of our commentaries, the likelihood inflation could possibly be increased and last more than is present consensus appears to be rising, and institutional and particular person buyers’ portfolios appear sick ready ought to that occur.

Particularly, the definition of capital preservation is perhaps altering. Through the 1960s and 1970s bonds weren’t a capital preservation technique. They supplied destructive returns extra typically than did different asset courses and misplaced buying energy as inflation ramped up.

It appears unlikely buyers will face 1970s-type inflation, nevertheless it does appear probably present capital preservation methods could possibly be inappropriate for the altering inflation, rate of interest, and nominal progress backdrop.

Capital preservation has been very simple for a really very long time as such methods supplied earnings, returns, AND low danger. Nonetheless, historical past exhibits it hasn’t all the time been really easy, and it appears probably current capital preservation methods’ success could possibly be examined through the subsequent decade.

Traders might must take a extra nuanced strategy to capital preservation methods. If normal disinflation does change to normal inflation, capital preservation might concentrate on sustaining buying energy. Historical past means that is perhaps achieved with mixtures of excessive money and excessive fairness allocations, i.e., usually ignoring fixed-income as an asset class.

As a result of money is as we speak extensively scorned as an funding and equities are sometimes thought-about too unstable, convincing buyers and oversight committees of the capital preservation advantages of such money/inventory barbell portfolios could possibly be a sizeable problem.

Initially revealed by Richard Bernstein Advisors, April 2021

- Median Actual GDP Consensus forecast plus Median CPI Consensus forecast for CY 2021 and CY 2022. Supply: Factset.

- The Bretton Woods system (1944) mounted the US greenback to gold @ $35 per ounce parity. In March 1968, a two-tiered pricing system was created with a freely floating personal market and official transactions on the mounted parity. President Richard Nixon formally unpegged the greenback from gold in August 1971 and gold has been free traded since then in keeping with the World Gold Council. https://www.gold.org/about-gold/history-of-gold/bretton-woods-system.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.