By Rebecca Felton Abstract

By Rebecca Felton

Abstract

- We consider the pattern for worth shares is unsure however enhancing.

- There’s ‘worth’ in proudly owning each worth and development shares, in our view.

- RiverFront has added extra worth publicity to our portfolios not too long ago as momentum has improved.

Is it time so as to add to “Worth”?

Since June, journalists have written numerous articles touting that ‘it’s time’ for conventional worth sectors to take the lead after this 12 months’s development tech-dominated surge in equities. The subject is controversial, partially as a result of there isn’t actually a uniform definition of what constitutes a ‘worth’ inventory. The very existence of the expansion versus worth paradigm is a long-debated subject on Wall Road. The thought of worth is basically credited to Benjamin Graham who is taken into account the daddy of worth investing. Usually, worth buyers purchase securities which might be out of favor with expectations that full valuation will happen at a later date. These securities are seen as worth shares primarily based on metrics akin to price-to-earnings, price-to-book, and excessive dividend yields for screening. Nevertheless, we consider typically the reductions are for a purpose; akin to a persistent downside that warrants the low cost – during which case the label ‘worth lure’ applies. A price lure is a safety that’s low cost for a purpose and continues to underperform.

In a September analysis paper, Evercore ISI’s Macro Analysis Analyst Dennis Debusschere famous that the 2020 rotation isn’t about development versus worth, moderately it’s about ‘Quarantine vs. Restoration and Defensives vs. Cyclicals’. As a result of their cyclicality, Worth sectors normally coincide with an financial upswing, akin to we have now already seen. We consider this time has been totally different as a result of pandemic. We’ve got written many instances of our long-term choice for development sectors which we see as beneficiaries of the change in shopper habits on account of the pandemic. This has not modified, however we acknowledge that the arrival of vaccines might require a tactical shift.

[wce_code id=192]

Don’t combat the pattern:

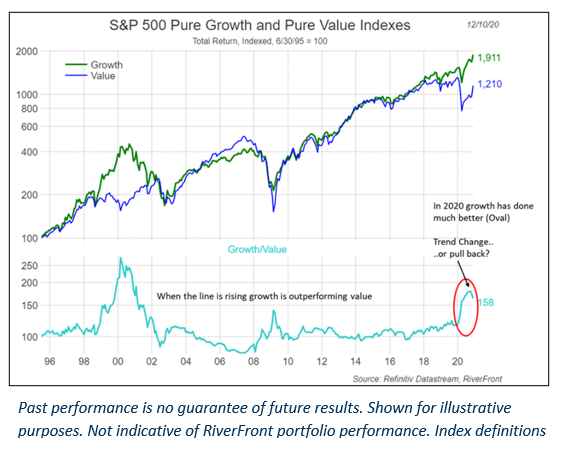

The choice for us is whether or not the latest downturn in relative efficiency for development over worth is sustainable (purple oval on chart). To do that, we consider buyers should look past the probability of a pending financial slowdown as spikes in hospitalizations and deaths are inflicting one other wave of financial restrictions. If buyers are prepared to do that, we consider extra cyclical worth sectors may lead the subsequent part inside international inventory indexes.

On November ninth following the information {that a} vaccine had been efficiently developed, the S&P Pure Worth index jumped as much as its largest in the future transfer in absolute and relative phrases relative to the Pure Development index for the reason that pandemic started in December 2019. We’re all the time prepared to respect important market traits, however for now we consider the jury continues to be out.

Conclusion

At RiverFront, we consider there may be ‘worth’ in diversification throughout each development and worth. We consider that the worth you pay for one thing issues, however we additionally know that momentum is a strong power. Each of those dynamics are foundational to our perception in a well-diversified portfolio, no matter your threat tolerance ranges or time horizons. That doesn’t imply that each investor holds all the identical asset courses or particular person securities, however it does imply that each investor ought to have allocations throughout a number of asset courses, areas, sectors and kinds – together with each ‘development and ‘worth’ – to keep away from the nervousness that happens after they really feel they’re lacking out when one specific group begins to outperform one other.

One factor appears sure; “worth investing requires deep reservoirs of persistence and self-discipline,” in response to hedge fund investor Seth Klarman. Well-known ‘worth’ buyers akin to Julian Robertson have been compelled to shut their methods resulting from lack of investor conviction, and even Warren Buffett has needed to endure lengthy stretches of underperformance to passive indexes.

Along with being obese shares versus bonds in our balanced portfolios, RiverFront’s most up-to-date trades noticed us enhance our publicity to a number of the value-oriented areas of the market the place we had beforehand taken a ‘present me’ perspective. Our proactive threat administration course of, primarily based on our tactical view of momentum, pulled us again into these value-oriented sectors.

Initially printed by RiverFront Funding Group, 12/14/20

Necessary Disclosure Info

The feedback above refer typically to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to alter. Previous efficiency is just not indicative of future outcomes and diversification doesn’t guarantee a revenue or defend in opposition to loss. All investments carry some degree of threat, together with lack of principal. An funding can’t be made straight in an index.

Chartered Monetary Analyst is knowledgeable designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of monetary analysts. Candidates are required to go three ranges of exams masking areas akin to accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can turn out to be a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Info or knowledge proven or used on this materials was acquired from sources believed to be dependable, however accuracy is just not assured.

This report doesn’t present recipients with data or recommendation that’s enough on which to base an funding choice. This report doesn’t have in mind the precise funding goals, monetary state of affairs or want of any specific shopper and is probably not appropriate for every type of buyers. Recipients ought to think about the contents of this report as a single think about investing choice. Further elementary and different analyses could be required to make an funding choice about any particular person safety recognized on this report.

In a rising rate of interest surroundings, the worth of fixed-income securities typically declines.

When referring to being “obese” or “underweight” relative to a market or asset class, RiverFront is referring to our present portfolios’ weightings in comparison with the composite benchmarks for every portfolio. Asset class weighting dialogue refers to our Benefit portfolios. For extra data on our different portfolios, please go to www.riverfrontig.com or contact your Monetary Advisor.

Shares symbolize partial possession of a company. If the company does nicely, its worth will increase, and buyers share within the appreciation. Nevertheless, if it goes bankrupt, or performs poorly, buyers can lose their whole preliminary funding (i.e., the inventory worth can go to zero). Bonds symbolize a mortgage made by an investor to a company or authorities. As such, the investor will get a assured rate of interest for a selected time period and expects to get their authentic funding again on the finish of that point interval, together with the curiosity earned. Funding threat is compensation of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Traders ought to concentrate on these variations previous to investing.

Know-how and internet-related shares, particularly of smaller, less-seasoned corporations, are usually extra unstable than the general market.

Customary & Poor’s (S&P) 500 Index measures the efficiency of 500 massive cap shares, which collectively symbolize about 80% of the entire US equities market.

The S&P 500® Pure Worth index is a style-concentrated index designed to trace the efficiency of shares that exhibit the strongest worth traits by utilizing a style-attractiveness-weighting scheme.

The S&P 500® Pure Development index is a style-concentrated index designed to trace the efficiency of shares that exhibit the strongest development traits by utilizing a style-attractiveness-weighting scheme.

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Change Fee. Registration as an funding adviser doesn’t suggest any degree of talent or experience. Any dialogue of particular securities is offered for informational functions solely and shouldn’t be deemed as funding recommendation or a suggestion to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Integrated (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its staff by means of RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and subsequently an oblique proprietor of RiverFront. BFC is the dad or mum firm of Robert W. Baird & Co. Integrated, a registered dealer/seller and funding adviser.

To overview different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Type ADV, Half 2A. Copyright ©2020 RiverFront Funding Group. All Rights Reserved. ID 1448259

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.