With the calendar turning to July, one other month has been added to the worth rally. For these retaining rating, it is now 10 months outdated, and if historical past is any information, this may be in regards to the time buyers begin rotating out of decrease high quality worth shares – those that ignited the present rally – and into larger high quality fare.

If that state of affairs performs out, it may benefit high quality trade traded funds, together with the WisdomTree U.S. High quality Dividend Progress Fund (NasdaqGM: DGRW). As its identify implies, DGRW is a dividend progress technique with high quality leanings. These are ideas which are interesting in any atmosphere, however these perks can also result in larger valuations. That is not the case in the present day.

“One other attention-grabbing dynamic taking maintain is that high quality methods—which choose progress and high quality corporations—are displaying valuations that rival conventional worth indexes however with a unique composition and sector combine,” writes Jeremy Schwartz, WisdomTree international head of analysis.

Certainly, the $5.96 billion DGRW is not closely allotted to conventional worth sectors. Of these teams, solely monetary companies are considerably prominently displayed inside DGRW. Emphasis on “considerably” as a result of monetary shares account for simply 5.59% of the ETF’s weight – good for simply the sixth-largest sector publicity within the fund.

Avoiding Junk

As famous above, some decrease high quality shares have pushed the worth issue larger this 12 months. Earlier worth rallies reveals that state of affairs has a shelf life.

“Robust steadiness sheet shares are related to higher-quality corporations, and weak steadiness sheet corporations are related to low-quality shares—and this huge return dispersion—30 proportion level differential returns during the last six months or so—are resulting in valuation discrepancies in these basket,” provides Schwartz.

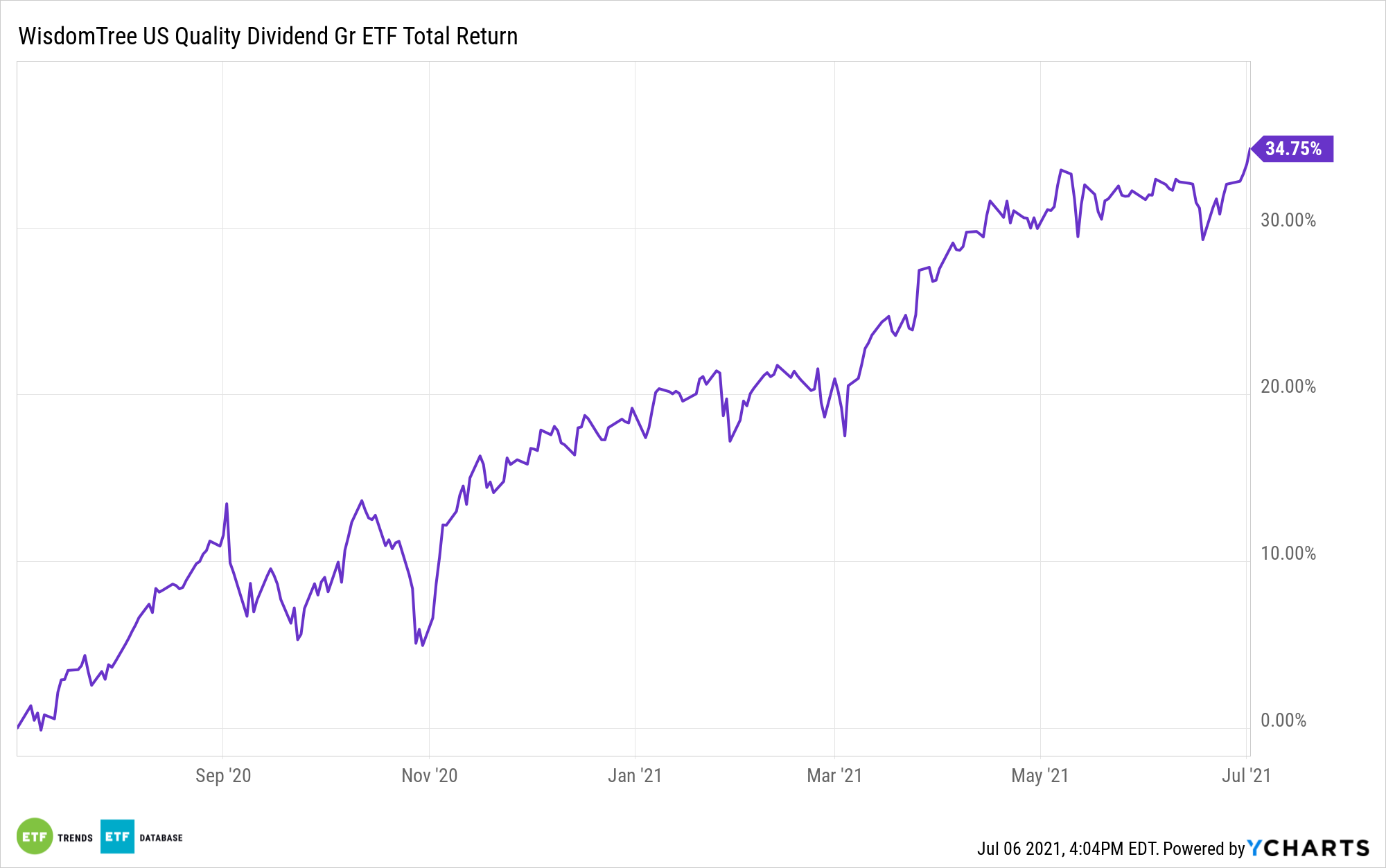

That hole and the contributions of low high quality to worth’s energy this 12 months are favorable for DGRW on the idea that the chasm could possibly be narrowed and market contributors may quickly renew their affinity for now discounted high quality shares. As it’s, DGRW is not sitting idly by this 12 months. The fund is up nearly 12% year-to-date and resides close to all-time highs.

One other level in DGRW’s favor is that lots of its elements rating nicely on the idea of return on belongings (ROA) and return on fairness – one thing that can’t be mentioned of many conventional worth indices. DGRW’s multiples are much more enticing than a few of these old-school worth benchmarks.

“Whereas conventional worth methods choose corporations that earn decrease returns on capital (measured by return on fairness (ROE) and even return on belongings (ROA)), the WisdomTree High quality Dividend Progress Fund (DGRW) is displaying valuation multiples as compelling as the worth benchmarks however with a course of that focuses on excessive return on capital and robust steadiness sheet shares,” continues Schwartz.

For extra on learn how to implement mannequin portfolios, go to our Mannequin Portfolio Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.