Although roughly 60% of the S&P 500 has delivered earnings updates for the June quarter, there are nonetheless some marquee studies coming this week.

That is significantly true for traders within the VanEck Vectors Video Gaming and eSports ETF (NASDAQ: ESPO), as a broad swath of the change traded fund’s online game writer holdings step into the earnings confessional this week.

Activision Blizzard (NASDAQ: ATVI) and Digital Arts (NASDAQ: EA) are among the many big-name online game software program corporations reporting outcomes this week. That duo combines for almost 10% of ESPO’s roster, in response to issuer knowledge.

With Activision, EPSO’s seventh-largest holding, “count on a steady-as-she-goes quarter when Activision (ATVI) studies its second-quarter outcomes after the closing bell Tuesday. No big launches, and the regular drumbeat of revenue from Name of Responsibility and different franchises will probably drive its estimated earnings of 75 cents on an adjusted bases, and bookings of $1.9 billion,” studies Max Cherney for Barron’s.

Digital Arts, ESPO’s ninth-largest element, studies earnings on Wednesday. Analysts count on earnings per share of 62 cents on bookings of $1.three billion.

Response to EA’s report could not focus on its June quarter outcomes as a lot because it does on the corporate’s outlook for the again half of the 12 months. EA is slated to launch Battlefield 2042 and FIFA 22 in October.

With the brand new {hardware} cycle having taken place late final 12 months, ESPO and rival funds may discover much-needed catalysts from software program releases, significantly these which might be new installments of common franchises.

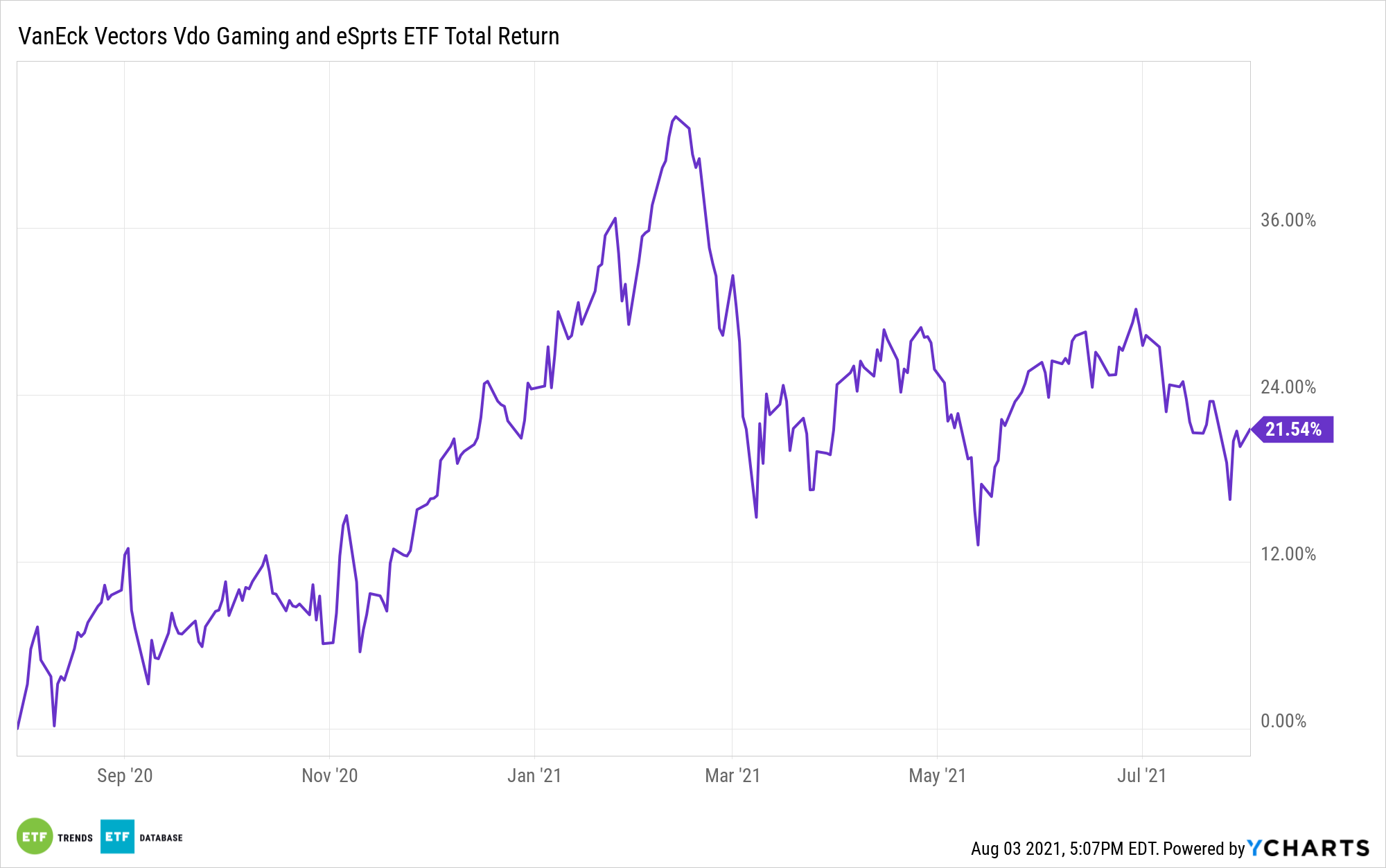

That would show pivotal for ESPO’s writer holdings as a result of after online game equities surged final 12 months due to coronavirus-induced stay-at-home directives, some analysts and traders fretted the group was due for a pullback this 12 months.

“We at present see ‘return to normalcy’ dangers and valuation dangers for online game corporations, however we consider supportive long-term traits are nonetheless in place round client demand for interactive digital leisure, cord-cutting and demographics,” in response to VanEck.

On that word, whereas many politicians say they’re detest to revisit the shutdown mannequin of 2020, the delta variant of the coronavirus could also be a drag on the reopening commerce and will immediate of us to revisit a few of final 12 months’s beloved stay-at-home leisure choices, together with streaming and video video games.

For extra information and data, go to the Past Primary Beta Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.