Investors trying to entry entrepreneurial firms by the ETF wrapper have an ally within the type of the ERShares Entrepreneurs ETF (ENTR).

Utilizing a a bottom-up methodology, ENTR goes past conventional factor-based investing, leveraging synthetic intelligence to ship a basket of entrepreneurial firms spanning a number of sectors.

“With assistance from AI and Thematic Analysis, ERShares incorporates a macro-economic, top-down method that integrates altering funding flows, innovation entry factors, sector development, and different traits right into a dynamic, international perspective mode,” in response to ERShares.

From a regular issue perspective, ENTR has a development really feel to it. However it additionally sprinkles some worth into the combo.

“Development shares are shares that supply a considerably larger development charge versus the imply development charge prevailing out there. It signifies that a development inventory grows at a sooner charge than the typical inventory out there and consequently, generates earnings extra quickly,” in response to the Company Finance Institute (CFI).

The ENTR ETF’s Methodology

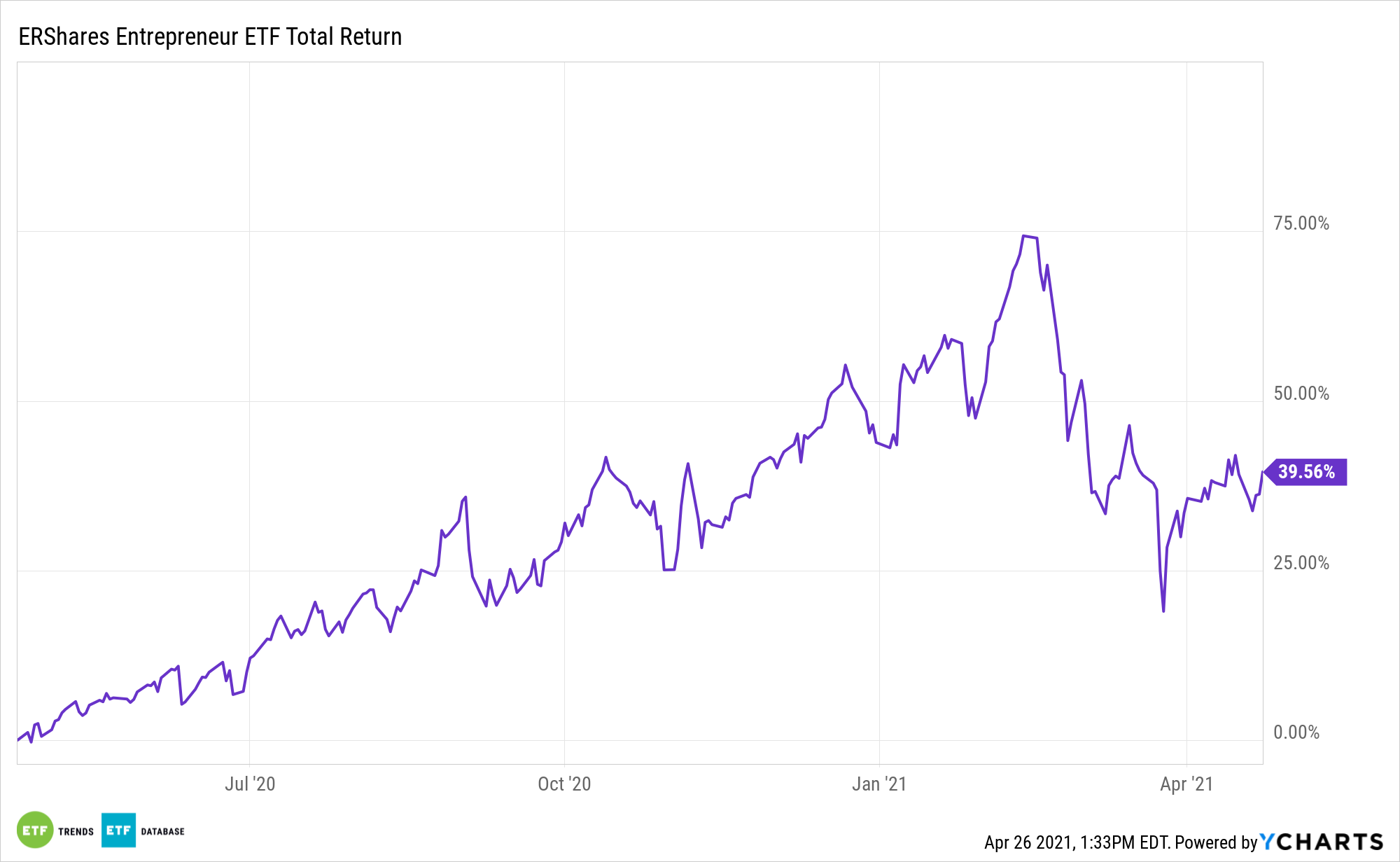

ENTR’s distinctive methodology bears fruit. For the 12 months ending March 31, 2021, the fund’s web asset worth is up 51.43%, in response to issuer information.

Among the different advantages related to entrepreneurial firms are speedy income development and enviable aggressive positioning.

“Development firms normally reveal a considerably larger development charge as a result of they have an inclination to own some sort of aggressive benefit over different firms in the identical business. The aggressive benefit provides development firms a singular promoting proposition (USP), which helps them promote and develop higher than different firms throughout the identical business,” notes CFI.

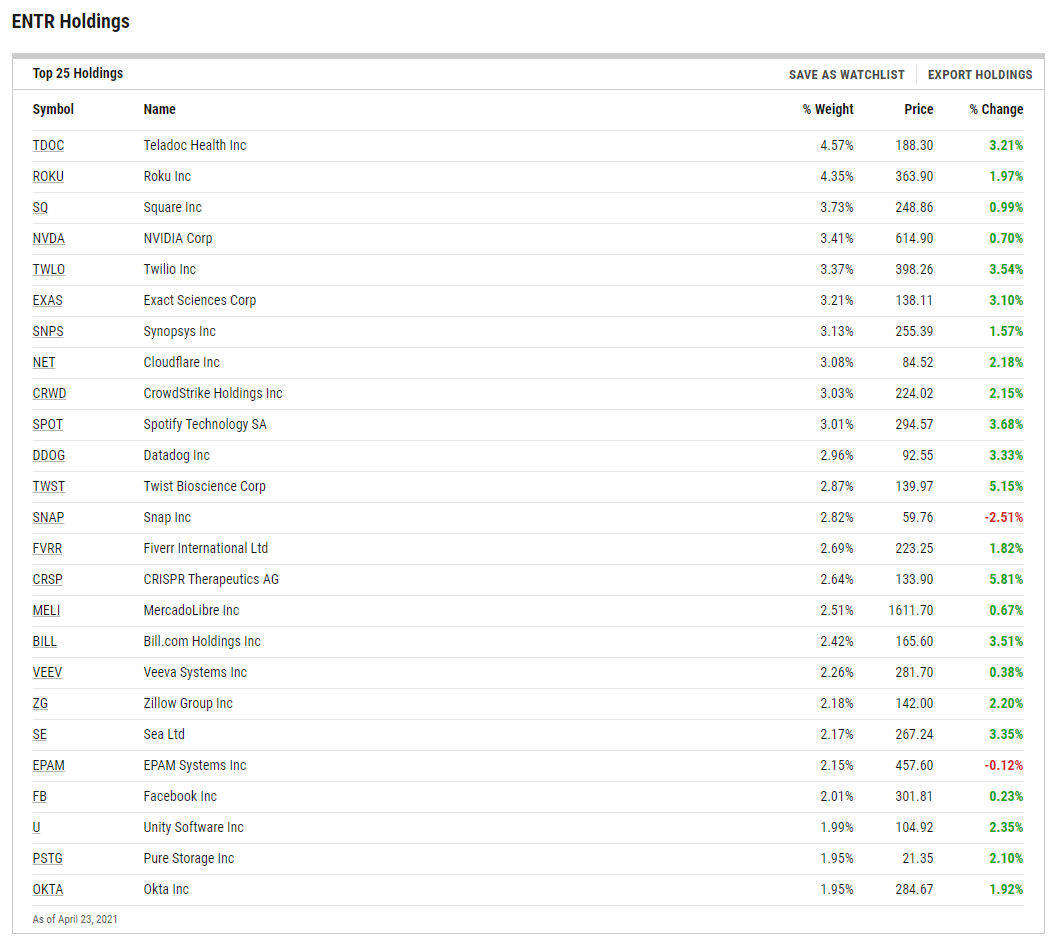

None of ENTR’s 50 holdings account for greater than 4.65% of the fund’s roster, indicating single-stock threat is minimal.

On the sector degree, ENTR is heavy on expertise and healthcare shares, amongst different teams, however its business allocations are extra vital as they differentiate ENTR from old-school development ETFs. For instance, the fund options publicity to 3D printing, AI, genomics, and healthcare innovation names – shares hardly ever present in conventional sector and development funds.

For extra investing concepts, go to our Entrepreneur ETF Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.