By Frank Holmes “Resilience” was final week’s theme as bett

By Frank Holmes

“Resilience” was final week’s theme as better-than-expected market information got here to mild. Earnings season has begun, and to this point experiences have confirmed the doomsayers improper. Even industries which have been hardest hit by the financial downturn, together with air journey, are expressing optimism that we’re on the “finish of the start” when it comes to recovering from the worst well being disaster in 100 years.

That was the opinion of United Airways CEO Scott Kirby, who quoted Winston Churchill final week through the firm’s third-quarter earnings name. Dino Michael, international head of Hilton Worldwide, is likewise optimistic, believing yearend to be the beginning of journey’s turnaround.

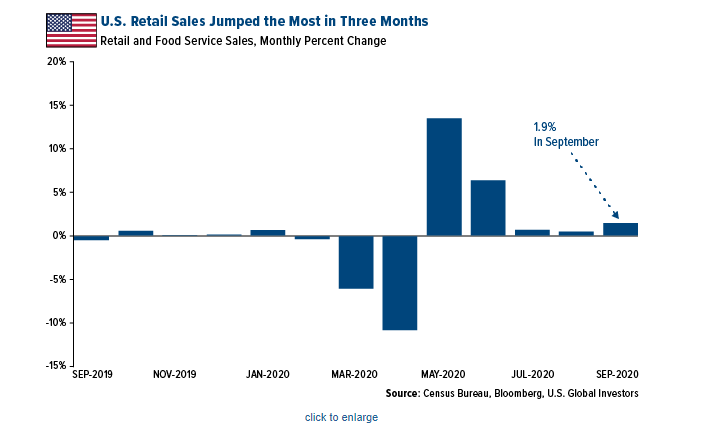

For his or her half, retail gross sales within the U.S. have proven nice resilience, rising for 5 months straight. In September, gross sales grew at a forecast-busting 1.9 % over the earlier month, the quickest such charge since June.

All however considered one of 13 classes improved, with clothes, sporting items and cars main the best way. Gross sales at house enchancment shops similar to House Depot and Lowe’s had been additionally sturdy.

In the event you participated throughout this 12 months’s Amazon Prime Day, this in all probability doesn’t come as a shock. The 2-day gross sales occasion, which concluded final Wednesday, was the most important ever for small and medium-size companies, in keeping with the retail large. “Sellers noticed record-breaking gross sales, surpassing $3.5 billion in whole throughout 19 nations,” Amazon mentioned in a press launch.

Important Enchancment in Luxurious Gross sales

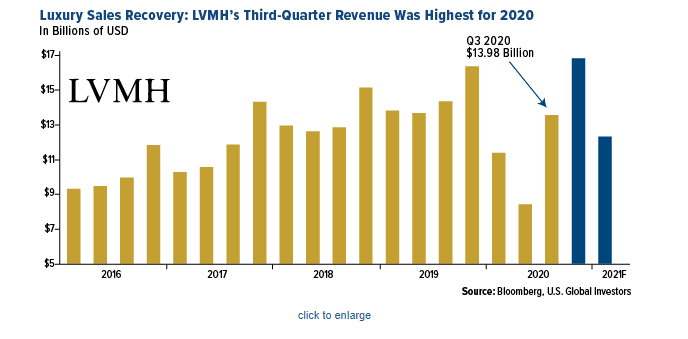

The posh trade has demonstrated spectacular resilience. Luxurious items chief LVMH Moet Hennessy Louis Vuitton reported better-than-expected outcomes final week. Third-quarter revenues rose 63 % from the second quarter to almost $14 billion, its strongest exhibiting to this point in 2020. The conglomerate, an trade bellwether that owns as many as 75 international manufacturers, has formidable ahead estimates of $17.four billion in gross sales for the fourth quarter. If achieved, that may be a file quantity for any quarter in LVMH historical past.

Though income was down some 7 % from the identical interval final 12 months, LVMH noticed double-digit development in demand for vogue and leather-based items, climbing 12 %. Extremely worthwhile Louis Vuitton (LV) displayed “distinctive momentum and creativity,” whereas Christian Dior confirmed “exceptional momentum,” the corporate mentioned in a press launch.

Do you know Louis Vuitton is the world’s most dear luxurious model? Discover out which manufacturers spherical out the highest 10 by clicking right here.

Not surprisingly, Asia was accountable for the biggest share of gross sales recorded by LVMH within the first 9 months of this 12 months. One out of each three {dollars} spent on LVMH luxurious items was spent in Asia. The U.S. represented 24 % of all gross sales.

Gross sales in mainland China “remained extraordinarily sturdy,” in keeping with U.S. jeweler Tiffany, which additionally reported constructive preliminary gross sales outcomes for August and September this week. Working earnings elevated 25 % in comparison with the identical two-month interval in 2019, with constructive gross sales developments persevering with into this month. Tiffany is locked in a authorized feud with LVMH over the circumstances of its acquisition.

As I’ve identified earlier than, Chinese language shoppers at the moment are the world’s greatest spenders on luxurious objects, with three quarters of all purchases made whereas touring overseas. “China’s urge for food appears insatiable for giant manufacturers” like LV, Dior and Moet Hennessy, writes Bloomberg client merchandise analyst Deborah Aitken in a word dated October 15.

Clearly the pandemic has disrupted worldwide air journey, which has additionally impacted luxurious retail—significantly duty-free retail in airports. Earlier than the well being disaster, airports had been the second-fastest rising luxurious retail channel following on-line, in keeping with Vogue Enterprise. Many retailers have expanded their presence in airports, stuffed with center to high-income vacationers ready for his or her flights, and lately some have even seen greater revenues being generated at worldwide hubs than at conventional shops.

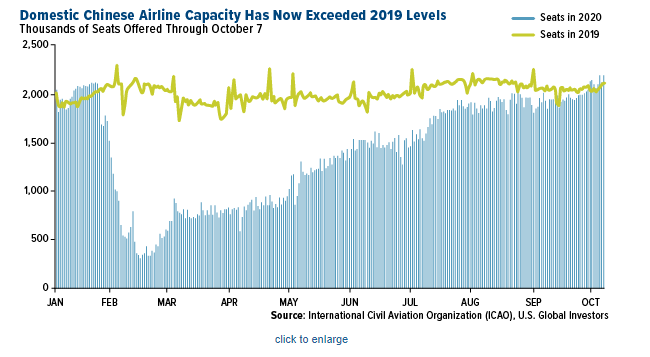

The excellent news is that home air journey in China seems to have recovered to pre-pandemic ranges.

Chinese language Home Passenger Site visitors Recovering Forward of Worldwide Site visitors

That’s in keeping with the Worldwide Civil Aviation Group (ICAO). In an October eight presentation, the company reveals that home passenger site visitors in China, having already bottomed in mid-February, is now above 2019 ranges when it comes to capability. The variety of seats on home industrial flights climbed safely above 2 million per day within the first week of October, forward of airways’ choices a 12 months in the past.

Some areas of Chinese language tourism should not simply surviving however “booming,” in keeping with McKinsey & Firm. That features high-end journey. By the tip of August, occupancy charges at luxurious and high-end motels had been again to round 90 % capability from a 12 months earlier, they usually’ve solely continued to climb since then.

Shares of China Southern Airways, the biggest provider in Asia by passengers served, and China Jap Airways are down 20.four % and 23.7 % year-to-date. That’s about half as a lot because the decline within the Bloomberg World Airways Index, down 40 % over the identical interval.

Once more: Resilience.

Threat of Getting COVID-19 on Business Flights Low, In response to Examine

Right here within the U.S., the place coronavirus circumstances are rising once more, fliers are largely avoiding stepping onto airplanes for concern of being uncovered to the virus. A brand new research by the Division of Protection, nonetheless, says the danger is “very low.”

In response to the Division of Protection (DoD), which researched the unfold of particles in airline cabins over a six-month interval, mask-wearing passengers are at very low danger of being contaminated with the coronavirus, even on a packed flight. That’s thanks not solely to the masks but additionally fashionable aircrafts’ superior air filtration system.

Flying isn’t utterly risk-free, in fact, however this is good news for vacationers and carriers alike. A latest survey by Journey Leaders Group discovered that 70 % of People and Canadians had been planning on taking a trip subsequent 12 months, and of these, almost half mentioned they’d be flying. The DoD’s research ought to assist alleviate any lingering issues they nonetheless might need.

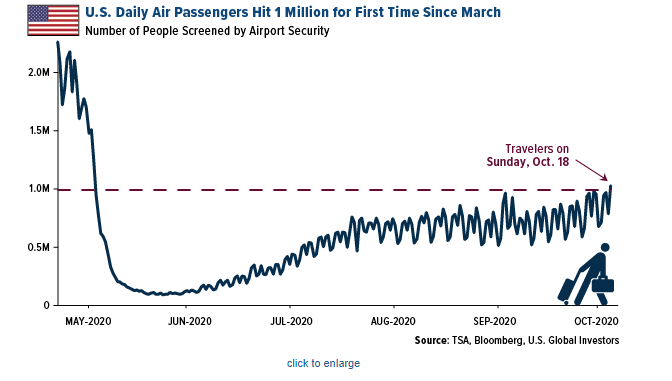

Variety of U.S. Air Passengers Hit 1 Million for First Time Since March

Air site visitors within the U.S. continues to enhance from its April low. On Sunday, October 18, the variety of air passengers within the U.S. exceeded 1 million, essentially the most since March, and an indication that the trade continues to get better amid the pandemic. The precise quantity on Sunday was 1,031,505 folks, in keeping with the Transportation Safety Administration (TSA), or about 40 % of site visitors in comparison with the identical day a 12 months in the past. Wheels up!

Congratulations to Thunderbird Leisure!

On a ultimate word, I’d like to increase my congratulations to Thunderbird Leisure (TBRD:CA) on its Emmy Award win for the apocalyptic zombie animated youngsters’s collection, The Final Youngsters on Earth, which streams on Netflix. Effectively deserved!

Lots of chances are you’ll not know that U.S. International Buyers is an investor in Thunderbird, and I sit on its Board of Administrators. On a ultimate word, I’d like to increase my congratulations to Thunderbird Leisure (TBRD:CA) on its Emmy Award win for the apocalyptic zombie animated youngsters’s collection, The Final Youngsters on Earth, which streams on Netflix. Effectively deserved!

With theaters nonetheless closed and folks working from house, streaming providers are in want of latest content material like by no means earlier than. Final week the Walt Disney Firm introduced a “strategic reorganization” of its leisure enterprise, placing its digital Disney+ service on the prime of its listing of priorities.

This can be a tailwind for modern content material creators similar to Thunderbird.

The Vancouver-based leisure firm appeared on Canadian Enterprise’s listing of quickest rising corporations in Canada, primarily based on income development during the last 5 12 months. Thunderbird reported income of $81.Three million for the fiscal 12 months ended June 30, an unbelievable 41 % enhance from the identical interval a 12 months earlier.

Mark Your Calendars

Weeks in the past, chances are you’ll recall me saying that I might be participating in a webcast with Mr. Great himself, Kevin O’Leary, of Shark Tank fame. After some calendar changes, we now have a agency date set: Thursday, October 29.

We’ll be discussing web and e-commerce corporations and airways.

In the event you’re all in favour of listening in, please e-mail me with the topic line “Oct. Webcast” at [email protected], and I’ll ship you the hyperlink. I hope you’ll be a part of us!

Initially printed by U.S. Funds, 10/19/20

All opinions expressed and information offered are topic to vary with out discover. A few of these opinions might not be applicable to each investor. By clicking the hyperlink(s) above, you’ll be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all data equipped by this/these web site(s) and isn’t accountable for its/their content material.

The Bloomberg World Airways Index is a capitalization-weighted index of the main airways shares within the World.

Holdings might change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. International Buyers as of (09/30/2020): United Airways Holdings Inc., The House Depot Inc., Lowe’s Co Inc., Amazon.com Inc., LVMH Moet Hennessy Louis Vuitton SA, China Southern Airways Co. Inc., China Jap Airways Corp. Ltd.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.