By Fei Mei Chan, Director, Index Funding Technique, S&P Dow Jones Indices

By Fei Mei Chan, Director, Index Funding Technique, S&P Dow Jones Indices

To this point, 2020 has introduced us a world pandemic, a coordinated international financial shutdown, and, within the U.S., a notably contentious election. So it’s no shock that volatility has been, and stays, elevated. Regardless of all this, equities have fared moderately (some would say surprisingly) nicely, with the S&P 500® climbing 13% by way of Nov. 19 because the finish of 2019.

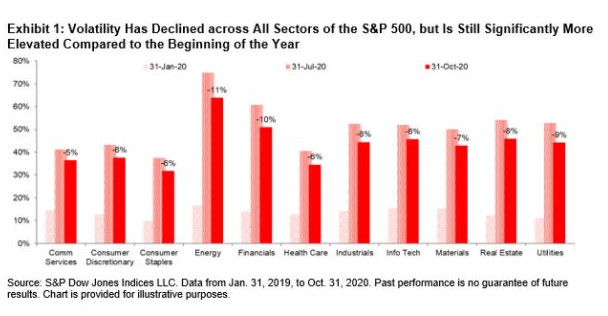

The elevated volatility will be seen throughout all sectors of the S&P 500 relative to the start of the 12 months, regardless of having declined a bit prior to now three months. The best volatility sectors proceed to be Power and Financials.

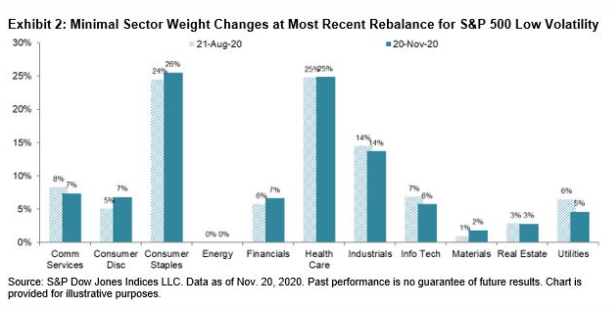

The most recent rebalance for the S&P 500 Low Volatility Index (efficient after market shut Nov. 20, 2020) wrought minimal adjustments. Solely eight names, accounting for about 7% of the index’s weight, cycled out of the index. The Power, Financials, and Utilities sectors, historically low volatility stalwarts, continued to carry solely a small fraction of the portfolio. Client Staples and Well being Care collectively accounted for simply over 50% of the rebalanced portfolio’s weight, as our methodology targets the 100 least risky shares within the benchmark S&P 500.

Initially revealed by Indexology, 11/20/20

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.