By Frank Holmes On Saturday, Joe Biden was named president-

By Frank Holmes

On Saturday, Joe Biden was named president-elect. In hindsight, the market clearly predicted this final result. As I confirmed you again in August, if the S&P 500 is up between July 31 and October 31 earlier than an election, it has traditionally favored the incumbent get together. And if it’s down, it has favored the challenger. Following a lack of 5.6% for the week earlier than the election, the S&P was underwater about Four foundation factors from the tip of July.

A lot of you studying this are little doubt disenchanted. In a ballot I ran again in August, 76% of you stated you believed President Donald Trump can be higher for the inventory market than Biden.

I’m right here to let you know there’s most likely no want for handwringing at this level, particularly since projections of a “blue wave” didn’t materialize. The destiny of the Senate will likely be decided by two Georgia runoff races in January, however Democrats had been typically unable to flip a variety of Congressional seats.

Buyers had been strongly in favor of this improvement, with the S&P ending the week up 7.3%. This can be a superb signal for shares for the remainder of the month and 12 months. In accordance with my good pal Pimm Fox, “the route of the S&P 500 didn’t change from the interval starting the day after the election for the rest of November, nor for the remainder of the 12 months.”

If historical past is any indication, a Biden presidency and divided Congress could very properly find yourself being essentially the most favorable final result for equities. With Republicans probably controlling the Senate, we’re much less prone to see massively consequential laws handed comparable to huge tax hikes, drug pricing limits, nationalized well being care and spending for the Inexperienced New Deal. Each chambers might want to compromise to go one other stimulus bundle. Different coverage could proceed to be made principally by presidential government order, which might simply be rolled again by the subsequent president.

Companies love Congressional gridlock for this very cause. Tech shares had been trending down for days earlier than the election as they confronted antitrust scrutiny, however now that it seems sure Congress will stay divided, they’ve recovered most of their losses. The tech-heavy Nasdaq 100 jumped near 9.5% for the week.

Give attention to the Insurance policies, Not Essentially the Events

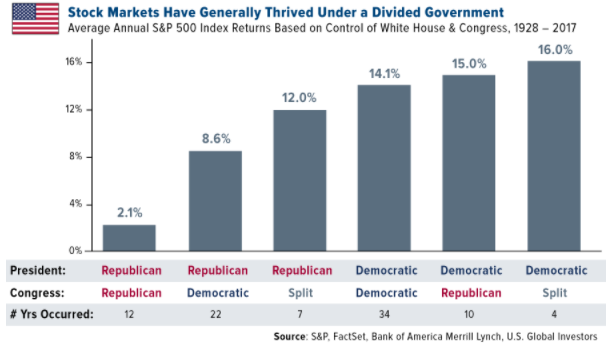

Beneath is a chart I shared with you two years in the past, after the 2018 midterm elections. Wanting all the way in which again to 1928, common annual inventory returns had been highest (16%) when there was a Democratic president and cut up Congress, in keeping with Financial institution of America (BofA). One caveat: This specific setup has a really small pattern dimension, seen solely within the final 4 years of President Barack Obama’s eight-year administration.

The biggest pattern dimension is when there was a Democratic president and Democratic Congress, seen in 34 out of 89 years. Throughout these years, common returns had been a nonetheless enticing 14%.

The rationale I level that final half out is as a result of you could be questioning in regards to the ramifications ought to Democrats take full management of Congress in 2022. By my rely, 22 Republican senators will face reelection that 12 months, giving Democrats a chance to flip the higher chamber.

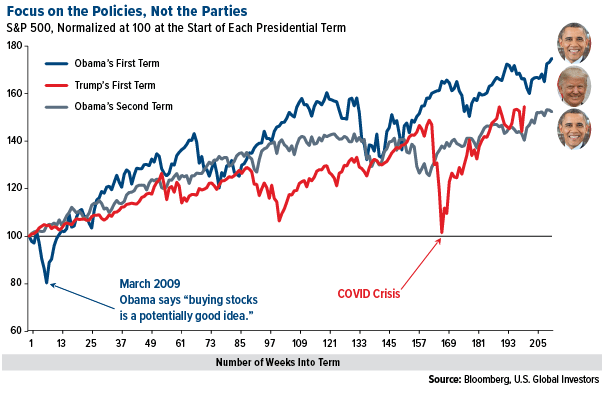

As I steadily say, it’s not the get together that issues, however the insurance policies. We imagine authorities coverage is a precursor to vary, and that cash may be made in America irrespective of who’s in cost.

Working example: Shares recovered properly in Obama’s first time period following the housing market crash, regardless of there being a legislature managed by Democrats. Well being care shares, specifically, had been large winners between January 2009 and January 2013, rallying greater than 80%.

Time to Hedge for Hyperinflation? Gold Above $1,950, Bitcoin at $16,000

I don’t need to reduce the inflation threat if Biden is one way or the other in a position to get extra excessive left-wing laws handed. Trendy financial idea (MMT) is an actual menace I’ve written about earlier than. Final week, when it was reported that Massachusetts senator Elizabeth Warren could also be occupied with a Cupboard place as Treasury secretary. Vermont senator Bernie Sanders, a self-proclaimed “Democratic Socialist,” might also find yourself with a task in Biden’s Cupboard, as Labor secretary.

Among the many inflation hedges CLSA analysts highlighted final week are gold and bitcoin. Certainly, final week was extremely constructive for each property, with gold advancing practically 4% to commerce above $1,950 an oz. Bitcoin was buying and selling above $16,000 immediately for the primary time since January 2018.

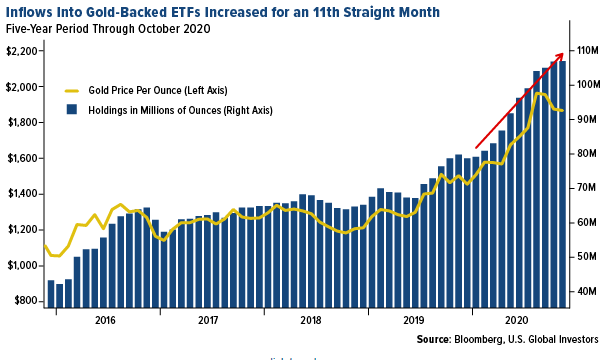

Holdings in gold-backed ETFs have had an unbelievable run this 12 months as buyers search a protected haven. Such merchandise noticed their 11th straight month of constructive inflows in October, bringing complete world holdings to over 110.eight million ounces, in keeping with Bloomberg information.

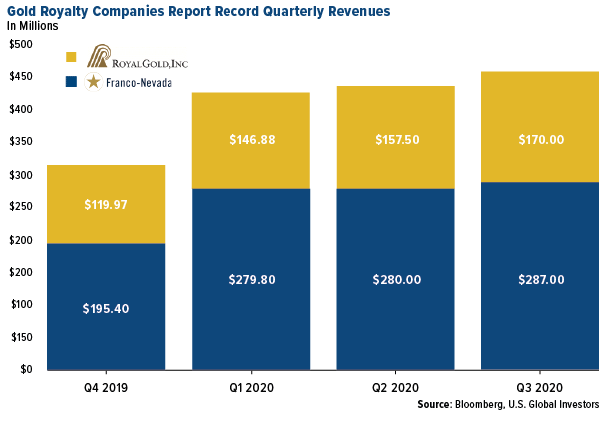

Because of larger steel costs and investor curiosity, gold mining equities have recently been money circulate machines. Gold royalty corporations, together with Franco-Nevada and Royal Gold, reported document revenues within the third quarter. Franco reported near $280 million in revenues, up 43% quarter-over-quarter (qoq) and roughly 19% year-over-year (yoy). Royal Gold reported $147 million, up 22% qoq and 27% yoy.

I’ve excessive expectations for Wheaton Valuable Metals, which is scheduled to report after the shut immediately.

Buffett’s Midas Contact Is Again

One other firm that had a blowout quarter was senior producer Barrick Gold. The corporate reported document free money circulate of greater than $1.Three billion. On a per-share foundation, free money circulate progress was up 155% from each the earlier quarter and the identical time final 12 months. Shares of Barrick closed up practically 7% yesterday on the information.

Should you recall, Warren Buffett purchased shares of Barrick within the second quarter, after he bashed gold for years as a result of it doesn’t pay a dividend. (And but neither does Berkshire Hathaway.) Maybe Buffett’s Midas contact is again?

Kirkland Lake additionally launched stellar monetary information on larger gold costs. Free money circulate got here in at 273%, with per-share progress up an unbelievable 200% yoy and 15% qoq.

321gold.com founder Bob Moriarty and I mentioned each corporations in better element throughout our webcast final week. In case you missed it, you possibly can watch the replay by clicking right here. I do know you’ll love the slides!

Biden’s $400 Billion Manufacturing Plan

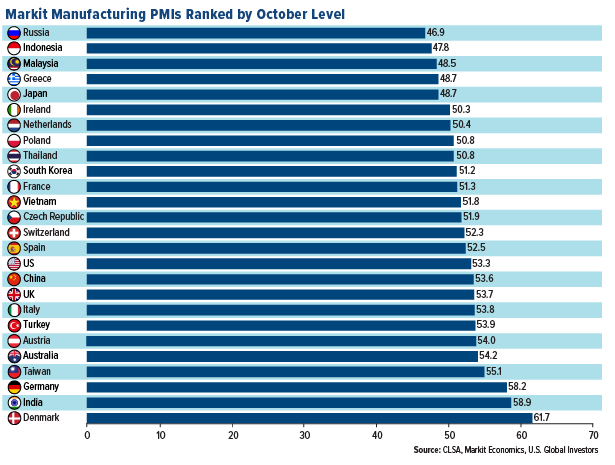

Underneath President Trump, the manufacturing sector has been very sturdy, even post-COVID. Final month, the U.S. buying supervisor’s index (PMI) got here in at 53.3, which is on the upper finish of nations ranked by PMI.

I don’t anticipate this altering or weakening below a President Biden. In July, the previous vp unveiled a four-year, $400 billion bundle to spur manufacturing and $300 billion for analysis and improvement. The purpose is that the plan would create as many as 5 million jobs, a lot of them to switch these misplaced as a result of pandemic.

Passing such a bundle could also be tough with Republicans in command of the Senate, however ought to it grow to be legislation, I anticipate demand for commodities and uncooked supplies to profit.

Register for the Digital Junior Mining Expo, That includes My Prime 10 Firms

Talking of commodities… Be sure to’re registered to affix us this week on Thursday, November 12, for the first-ever Digital Junior Mining Expo. To get the complete particulars, watch the video under, then register for FREE by clicking right here.

Initially revealed by U.S. Funds, 11/9/20

All opinions expressed and information offered are topic to vary with out discover. A few of these opinions might not be applicable to each investor. By clicking the hyperlink(s) above, you can be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all data equipped by this/these web site(s) and isn’t answerable for its/their content material.

The S&P 500 is extensively considered one of the best single gauge of large-cap U.S. equities and serves as the inspiration for a variety of funding merchandise. The NASDAQ-100 Index is a modified capitalization-weighted index of the 100 largest and most energetic non-financial home and worldwide points listed on the NASDAQ.

The Buying Managers’ Index (PMI) is an index of the prevailing route of financial developments within the manufacturing and repair sectors.

Money circulate is the overall amount of cash being transferred into an out of a enterprise, particularly as affecting liquidity.

Holdings could change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. International Buyers as of (09/30/2020): Barrick Gold Corp., Kirkland Lake Gold Ltd., Franco-Nevada Corp., Royal Gold Inc., Wheaton Valuable Metals Corp.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.