By Invoice O’Grady & Patrick Fearon-Hernandez, CFA

(As a result of Independence Day vacation and a brief summer season hiatus, the subsequent report can be revealed July 12.)

As is our customized, we replace our geopolitical outlook for the rest of the yr as the primary half involves an in depth. This report is much less a collection of predictions as it’s a checklist of potential geopolitical points that we imagine will dominate the worldwide panorama for the remainder of the yr. It isn’t designed to be exhaustive; as a substitute, it focuses on the “huge image” circumstances that we imagine will have an effect on coverage and markets going ahead. They’re listed so as of significance.

Situation #1: A New Hegemonic Mannequin

Certainly one of our persistent themes has been that the Chilly Warfare mannequin of American hegemony has outlived its usefulness. When the Soviet Union collapsed, a brand new mannequin ought to have emerged. Nonetheless, it by no means did. As a substitute, the American international coverage institution eliminated its deal with containing the Soviets and shifted to a Wilsonian mannequin of international coverage. This mannequin argues the U.S. ought to interact in insurance policies to rid the world of human rights violations and dangerous habits. The Wilsonian mindset, adopted by the neoconservatives on the correct and the liberal order supporters on the left, framed the successful of the Chilly Warfare as a victory of values. And so, persevering with and escalating the usage of that mannequin would develop liberal democracy, thus implementing American values and making the world a greater place.

[wce_code id=192]

The coverage has not panned out both within the international coverage enviornment or find help from the American home scenario. Incursions within the Balkans, Afghanistan, Iraq, and Libya have both led to unclear outcomes or prolonged army operations. The incidence of this coverage has fallen exhausting on army households who’ve seen their troopers engaged in a number of deployments, most of which had no apparent exit technique.

In the course of the Chilly Warfare, there have been conditions the U.S. didn’t become involved in as a result of they have been seen as both inside the usS.R.’s sphere of affect or not in an space of concern for both superpower. However after the Chilly Warfare ended and the priorities shifted, the U.S. was drawn into international issues that didn’t have a strategic rationale.

A second issue within the Chilly Warfare mannequin of American hegemony was that the U.S. grew to become the supplier of financial safety to the world. The U.S. Navy protected the world’s sea lanes and assisted in stopping historic flash factors[1] from devolving into scorching wars, which prevented long-term enemies from fearing one another and fostered international commerce. As well as, the U.S. offered the reserve forex, accepting massive present account deficits to offer an ample provide of {dollars} to the world. This mannequin inspired international nations to construct their economies on export promotion, utilizing the American client as a supply of dependable demand.

The issue with the present mannequin of hegemony is that the incidence of the coverage falls on the much less prosperous who have a tendency to affix the army and whose jobs are in danger from international commerce. The prosperous are typically supportive of sustaining the established order; they profit from globalization and customarily don’t bear the price of army actions.

General, we don’t assume the present mannequin is politically sustainable. The voters who elected Barack Obama needed a distinct end result; when he proved typical in his insurance policies, they opted for Donald Trump. Though the election of Joseph Biden indicators help for the Chilly Warfare mannequin of hegemony, his victory was slender and even amongst his supporters there’s a common dissatisfaction with the mannequin.

If the Chilly Warfare mannequin can’t be sustained, what replaces it? There are typically two choices. The primary is the U.S. abandonment of hegemony, which results in international regionalization, the breakdown of globalization, and certain extra frequent and expanded regional conflicts, till, as historical past reveals, one other hegemon emerges. Though we regularly present the historic parade of hegemons as seamless, in actuality, it isn’t. Durations the place a reigning hegemon is fading and a brand new one hasn’t emerged are fraught with misery. For instance, the hole between hegemons within the late 1700s led to the American and French Revolutions and the rise of Napoleon. When the British have been fading however the U.S. refused to just accept the superpower mantle, we had two world wars and the Nice Melancholy. We’ve got feared an analogous scenario within the coming years as a brand new hegemon isn’t apparent. Though China is presumed to take that function, its demographics will make that tough.[2] Thus, if the U.S. does take away itself from the function, it might be a decade or two earlier than a substitute emerges.

Nonetheless, there may be one other risk. The U.S. might behave in a trend just like earlier hegemons. In different phrases, America might transfer from being a benevolent hegemon towards a malevolent one.[3] On this mannequin, known as “offshore rebalancing,” the U.S. would not assure safety within the Far East, Center East, or Europe. As a substitute, it will act as a balancing energy, tipping the scales to stop Germany or Russia from dominating Europe, Iran or Turkey from dominating the Center East, or China or Japan from dominating the Far East. It is a tough coverage to make use of. First, it requires exceptional international coverage expertise, requiring the practitioner to know precisely when to intervene. Second, it’s tough to “promote” to the voters in a democracy. The best that nations haven’t any everlasting associates, solely pursuits, is a little more Machiavellian than most voters would tolerate. In apply, this may imply setting Iran in opposition to Israel and the Arab states and guaranteeing that neither facet dominates. It will imply signaling to Japan and China that they may not depend on the U.S. to select sides in a battle. U.S. policymakers may also prohibit entry to the U.S. client, both by commerce obstacles or by a deliberate try to drive down the greenback’s worth.

For sure, the thought of offshore rebalancing hasn’t been in style among the many international coverage institution. However, if the choices are both withdrawal or malevolence, the latter could also be a greater possibility than the previous. In our opinion, the present mannequin of benevolence is not sustainable inside the American political system, so it most likely is not an possibility.

Situation #2: China More and more Dominating the Hong Kong Inventory Market

It’s now been a yr since Beijing imposed its new nationwide safety legislation on Hong Kong, and it’s clear that the laws has helped deliver the city-state below the mainland’s political management. Extra broadly, tendencies over the past yr make it clear that Hong Kong is shedding its earlier distinctive, autonomous character and is being extra intently built-in with mainland China politically, economically, financially, and socially.

Chinese language authorities haven’t been shy about making use of the safety legislation’s draconian punishments to clamp down on civil liberties in Hong Kong. As arrests have risen, many residents and corporations have fled. Certainly, indicators starting from softening property rents to falling retail employment counsel the town has been shedding its luster as a gorgeous place to stay ever since its political disaster actually took off in mid-2019, though it’s tough to tease out the affect of the coronavirus pandemic.

On the similar time, regardless that Hong Kong has misplaced some employees and companies, its key monetary providers sector is holding its personal because it turns into more and more built-in into the Chinese language economic system and monetary markets. Most significantly, the figures counsel Hong Kong’s inventory market is turning into increasingly dominated by Chinese language shares. Mainland shares now make up greater than 80% of Hong Kong’s inventory market capitalization versus 57% a decade in the past (see Determine 1). Mainland companies now account for nearly 90% of all new fairness funds raised in Hong Kong, counting each preliminary public choices and follow-on offers. Mainland firms are additionally turning into ever extra dominant by way of the variety of listed companies, new listings, and each day turnover on Hong Kong’s alternate.

Determine 1.

Within the coming months and years, we expect traders will more and more see Hong Kong as “simply one other Chinese language monetary heart,” like Shanghai and Shenzhen. In the interim, Hong Kong’s inventory market will proceed to have distinctive, enticing options in contrast with these two mainland exchanges, together with its deeper liquidity and time-tested regulatory regime. That ought to quickly protect Hong Kong’s function as a gorgeous funding gateway into China (northbound trades from Hong Kong to Shanghai and Shenzhen now make up greater than 81% of the “Inventory Join” program linking the inventory markets). All the identical, it will likely be more and more clear that China is molding Hong Kong into its personal likeness throughout a number of dimensions, which might finally make Hong Kong look much less enticing as an funding vacation spot.

Situation #3: China and Inflation

Cash offers three capabilities—it acts as a medium of alternate, a retailer of worth, and a unit of account. The primary two capabilities, by way of coverage, are in opposition. As a medium of alternate, we are likely to need extra money provide. The higher the extent of cash equipped, all else held equal, the extra one should purchase. Nonetheless, as a retailer of worth, one would favor the worth of cash to extend over time. These with authority over cash must handle this inside contradiction. If they permit the provision of cash to exceed the provision of products and providers, it might erode the shop of worth of the forex. However, fixing the provision of cash can result in deflation if items and providers enhance.

There isn’t any proper or unsuitable reply to this situation; the truth is, the choice is political in nature. Favoring the medium of alternate perform helps debtors and business, whereas favoring the shop of worth perform helps collectors and finance. After all, the problem is difficult by the function of credibility; if the financial authority is taken into account a protector of the worth of the forex, it will possibly get away with supporting increased cash provide ranges with out triggering inflation. In truth, financial stimulus with credible financial authorities can result in a growth in monetary property if households imagine that worth will increase received’t be allowed to fester.

Since cash is finally a social assemble, the coverage choice on inflation is political. China, given its lengthy historical past, has seen episodes of inflation. Inflation was rampant below the Nationalists throughout WWII. For instance, in June 1937, the CNY/USD alternate fee was 3.41. When the U.S. entered the conflict in opposition to Imperial Japan, the alternate fee weakened to 18.9 per greenback. By the top of 1945, it fell to 1,222 per greenback. By Could 1949, it had fallen to 23,280,000 per greenback. Though inflation wasn’t wholly liable for the Nationalist loss to the Chinese language Communist Social gathering within the Chinese language Civil Warfare, it weakened the recognition of the Nationalists and clearly didn’t assist their trigger.

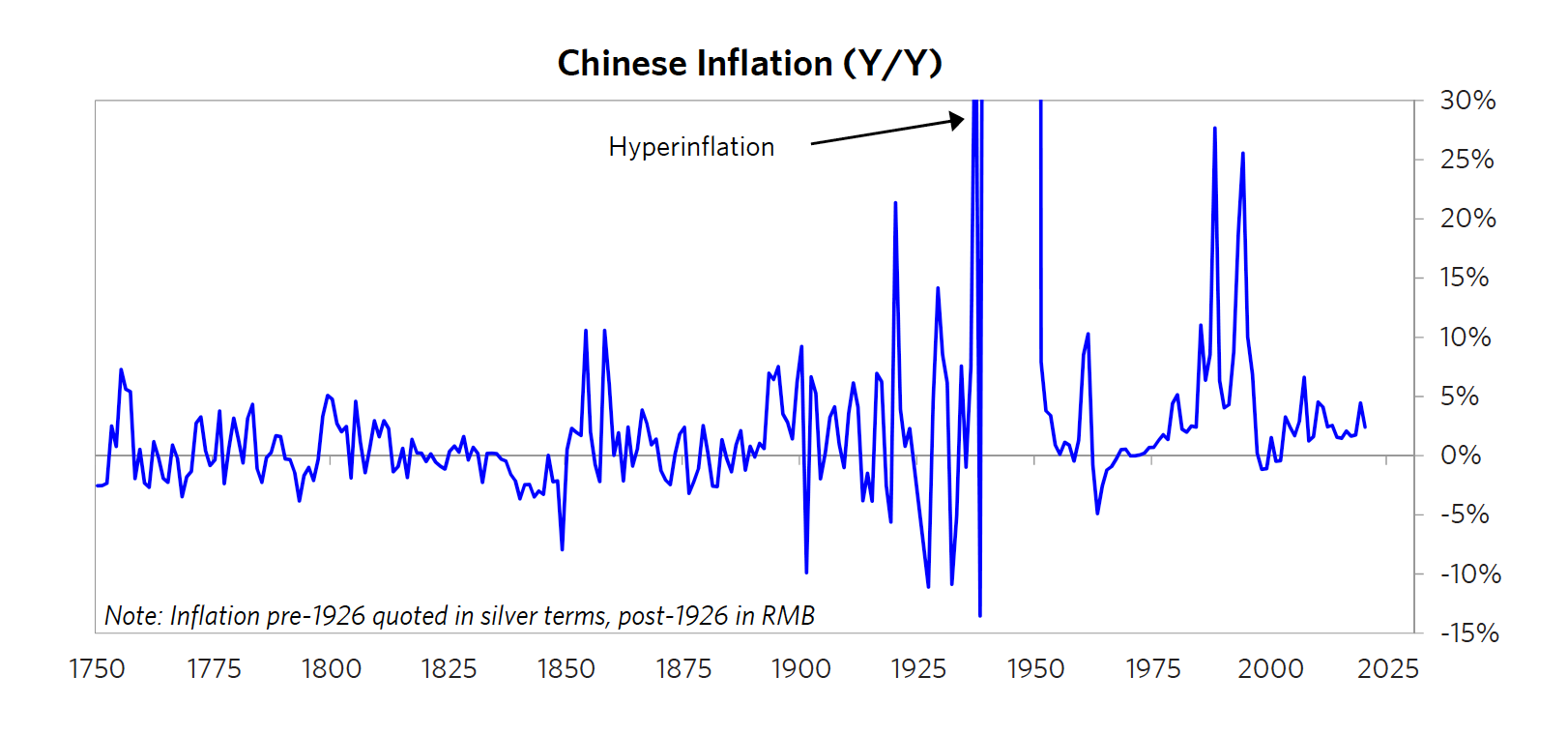

Determine 2.

(Supply: Ray Dalio)

This chart (Determine 2) reveals the hyperinflation throughout the conflict years. Inflation declined after Mao took management, except the Nice Leap Ahead within the late 1950s/early 1960s.

Determine 3.

Determine Three reveals Chinese language inflation because the mid-1980s. The three spikes from 1985 by means of 1995 have been largely because of the conversion from a Marxist command and management economic system, which had widespread worth controls. The spike within the late 1980s occurred previous to Tiananmen Sq. and is regarded as partly in charge for the protests. Since then, market reforms, particularly to the state-owned sector (SOE), have largely stored inflation at bay.

Inflation is a coverage selection. Inflation tends to learn debtors and might act to spur financial progress so long as it doesn’t speed up excessively. Deflation, however, advantages collectors. Societies are likely to attempt to discover a steadiness between the 2, which often leads to modest inflation; the present consensus is about 2% per yr. On the similar time, narratives from nationwide expertise have an effect on the diploma of inflation tolerance. Germany’s expertise of hyperinflation within the 1920s and the rise of Nazism within the 1930s led to a well known anti-inflation bias. What could also be much less appreciated is that China possible harbors an analogous place. For the CPC, the Nationalists’ incapacity to manage worth ranges coupled with the inflation that preceded the Tiananmen Sq. occasion are a warning that inflation should be contained to carry energy and comprise social unrest. Which means that China might find yourself resembling Germany in its inflation place; as China opens up its monetary markets to foreigners, we might see China taking the function that Germany performed within the late 1970s, particularly if the U.S. opts for increased inflation.

Fast Hits

This part is a roundup of geopolitical points we’re watching that haven’t risen to the extent of concern described above however ought to be monitored. A few of these points could also be subjects of future WGRs.

- Biafra, Nigeria, social media, and rising civil strife.

- The continued tensions between Spain, Morocco, and Western Sahara.

- Drought, meals costs, and geopolitical instability.

- The U.Okay.’s post-Brexit effort to recast itself as a world buying and selling powerhouse by signing new free-trade offers

- Italy’s essential take a look at of whether or not it will possibly make good use of the EU’s pandemic reduction funding to remodel its economic system, which in flip might assist revitalize the EU.

- Rising efforts by the non-public sector and governments to make the most of huge knowledge.

Ramifications

Regarding Situation #1, the potential ramifications are broad. If the U.S. practices hegemony as earlier hegemons did, America would possibly put commerce obstacles in place that may enhance the price to foreigners of buying {dollars}. This situation might result in tariffs and quotas, restrictive commerce preparations (bilateral as a substitute of multilateral), and maybe forex manipulation. It’s conceivable that the U.S. would power down the worth of the greenback to cut back the worth of international reserves or power international companies to both minimize their revenue margins to take care of market share or face the lack of competitiveness. If the U.S. performs a geopolitical balancing function, international nations might want to construct their militaries, which might help protection contractors.

With Situation #2, the relentless integration of Hong Kong into the Chinese language mainland monetary system is particularly vital for traders. Ever since China entered the World Commerce Group in 2001, Hong Kong has misplaced a lot of its standing as a significant producer and gateway for traded items flowing into and out of China. Leveraging its distinctive monetary providers infrastructure, mild regulatory regime, free capital account, and robust rule of legislation, Hong Kong has as a substitute turn into the gateway for worldwide capital flows into and out of the mainland. As Beijing continues to clamp down on Hong Kong’s political and social life, it turns into increasingly logical that it would finally prohibit its business and monetary construction as nicely. That’s very true contemplating Beijing’s current crackdown on mainland “fintech” companies over their rising affect and the dangers they current to the mainland’s monetary stability. For now, Hong Kong continues to supply a gorgeous venue for international traders to realize publicity to the Chinese language economic system, and for Chinese language traders to realize entry to international capital. Nonetheless, Beijing might finally need to deliver Hong Kong according to the mainland’s financial and monetary infrastructure, and that might possible make Hong Kong property a lot much less enticing.

Regarding Situation #3, China is more likely to tackle inflation in a fashion totally different than the usual orthodoxy. Often, inflation is addressed within the brief run by elevating rates of interest and maybe fiscal austerity. Beijing struggles with these strategies as a result of they threaten financial progress. As a substitute, regulators have a tendency to make use of “administrative steerage,” which suggests they power companies to restrain worth will increase (and see decrease margins), interact in lending regulation, alternate fee manipulation, and the usage of buffer shares. Western traders should do not forget that China received’t all the time depend on market indicators, particularly once they battle with political objectives. Though counting on markets tends to be environment friendly, it will possibly result in outcomes which may be thought-about insupportable to the CPC. For instance, within the face of rising commodity costs, the CPC is extra possible to make use of forex appreciation and buffer inventory gross sales to comprise worth will increase. Such habits could also be extra bullish than regular for commodity producers as a result of shoppers received’t be seeing increased costs, the standard results of shortage. And that motion would preserve demand. On the similar time, assuming excessive debt will “all the time” result in disaster might not apply in the identical technique to China. The nation can’t keep away from coping with the debt, however, in a totalitarian society, it has extra energy to assign the losses than in a democracy. If China is intent on preserving inflation at bay for social and political stability, its strategies might shock Western traders anticipating a distinct end result.

Nonetheless, if China decides it desires to internationalize the CNY and it takes on a story of strict inflation management, Beijing might discover itself able just like Switzerland and Germany within the 1970s. The currencies of those two nations got here to be seen because the world’s “hardest” currencies and appreciated quickly. In truth, Switzerland utilized a unfavorable nominal rate of interest to international accounts by the late 1970s to discourage additional CHF appreciation. If an analogous scenario develops to this historic analog, it might imply the CNY can be poised to understand considerably within the coming years.

[1] Europe, the Far East, and the Center East all have historic underlying conflicts. Particularly, Europe has by no means adjusted to the institution of Germany as a state, and within the Far East, China and Japan have fought periodic wars for hundreds of years. Within the Center East, colonial powers created pseudo-states that fulfilled their colonial aspirations however didn’t create workable nations. The present issues in that area are extra about checking out extra pure states.

[2] For this reason Normal Secretary Xi seems to be a person in a rush.

[3] For a deeper view, see our WGR collection from 2018, “The Malevolent Hegemon: Elements I, II, and III.”

This report was ready by Invoice O’Grady and Patrick Fearon-Hernandez, CFA, of Confluence Funding Administration LLC and displays the present opinion of the authors. It’s based mostly upon sources and knowledge believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to vary with out discover. This data doesn’t represent a solicitation or a suggestion to purchase or promote any safety.

Confluence Funding Administration LLC

Confluence Funding Administration LLC is an impartial Registered Funding Advisor situated in St. Louis, Missouri. The agency offers skilled portfolio administration and advisory providers to institutional and particular person shoppers. Confluence’s funding philosophy is predicated upon impartial, basic analysis that integrates the agency’s analysis of market cycles, macroeconomics, and geopolitical evaluation with a value-driven, company-specific method. The agency’s portfolio administration philosophy begins by assessing danger and follows by means of by positioning shopper portfolios to realize said revenue and progress targets. The Confluence crew is comprised of skilled funding professionals who’re devoted to an distinctive stage of shopper service and communication.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.