The current determination by the Federal Reserve to maintain charges regular did little to quell inflation fears, warranting the assistance of belongings just like the Invesco PureBeta 0-5 Yr US TIPS ETF (PBTP).

Whereas the economic system continues the therapeutic course of, the recurring sentiment is that costs for shopper items and companies will push greater.

As talked about, the Fed determined to maintain charges at close to zero final week, however the capital markets seem like trying previous the near-term and eyeing greater charges for the long-term. The Fed is eyeing an inflation charge of two%, however buyers aren’t so eager on that quantity.

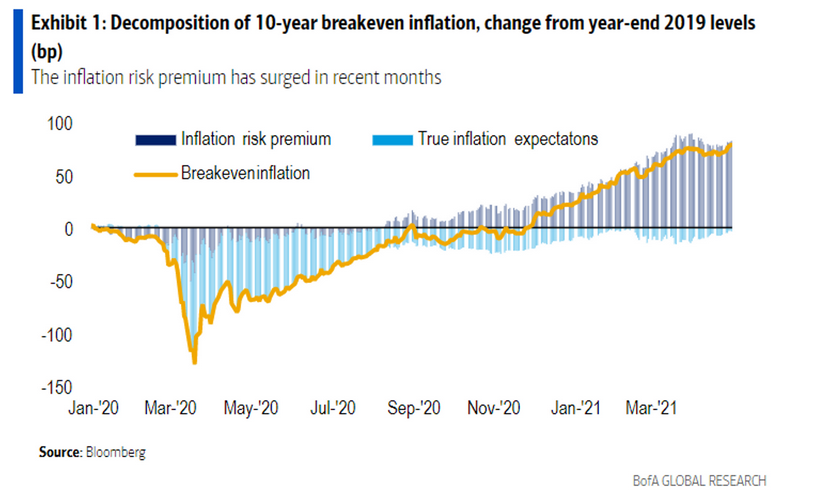

“Buyers are pricing in dangers of a ‘vital overshoot’ of the Federal Reserve’s 2% inflation goal for the primary time in a number of years, in line with economists at Financial institution of America Corp,” a MarketWatch article stated.

“Buyers are paying shut consideration to inflation on concern that an excessive amount of may immediate the Fed to lift rates of interest or start tapering its asset purchases ahead of anticipated, probably hurting their portfolios,” the article added. “Whereas making an attempt to discern whether or not any spike in inflation shall be merely transitory within the financial restoration, some buyers are weighing shifts to their holdings to organize for the chance that it will likely be persistent.”

Within the meantime, the U.S. economic system is buzzing alongside amid a vaccine deployment.

“Financial development is kicking into greater gear, however with 6% unemployment, an uneven family restoration and greater than 2 million fewer People within the labor power than previous to the outbreak, the Fed is maintaining the throttle broad open,” stated Greg McBride, chief monetary analyst at Bankrate.com.

A Dynamic ETF with Inflation Safety

Treasury-inflation protected securities (TIPS) may also help stem the tide of rising inflation. The principal steadiness of TIPS will increase as inflation rises, and buyers are paid the unique steadiness or the inflation-adjusted steadiness, whichever is bigger.

PBTP seeks to trace the funding outcomes the ICE BofA 0-5 12 months US Inflation-Linked Treasury Index. The fund typically will make investments at the least 80% of its whole belongings within the securities that comprise the underlying index.

The index is designed to measure the efficiency of the shorter maturity subset of the U.S. TIPS market, represented by TIPS with a remaining maturity of at the least one month and fewer than 5 years. Much less years means buyers are much less uncovered to period threat.

For extra information and knowledge, go to the Progressive ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.